is made for the babyboomers…and their hoverarounds.

While big boxes are downsizing, Apple credits iPad sales to their physical stores

Within 24 hours of each other these two stories became headlines:

Apple announces their update to the iPad – the iPad2 and as part of Steve Job’s keynote speech and presentation he indicates that 2010 was the year of the iPad, that its sales have outpaced anything they thought possible, AND, were due in large part to its retail stores.

The Wall Street Journal indicated today that most big box retailers are downsizing, subleasing or vacating their big box locations in pursuit of a better retail model.

The article goes on to indicate that it may have less to do with the size of the store than the quality of the experience and, in fact, the article mentions the “customer experience” of an Apple store.

From a CCIM market analysis standpoint, if retail big boxes truly downsize, we can anticpate a glut of retail to hit market in the next couple of years. If you haven’t taken CCIM 102, and would like to be able to calculate the impact of this spatial change in your market, the course provides the tools and processes to help you calculate what this will do to occupancy, rents and values.

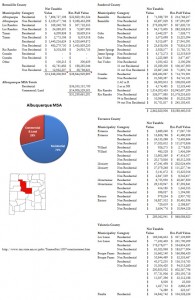

my first iPhone app help client’s calculate their property taxes

Very excited – as of 5 minutes ago, our iPhone app to help client’s calculate their property taxes for commercial properties in Bernalillo County went “live” in the iTunes store! It is only 99 cents, and if you provide us feedback to improve version 2 and leave feedback, I’ll gladly send you a buck!

If you own a commercial property in Bernalillo County and you would like to compare your property’s value against the resolved cases from 2010, click here – http://itunes.apple.com/us/app/taxessor/id419811562?mt=8 to try it out.

The App is only $.99 and if you leave us a review and email me feedback at tclarke@nmapartment.com so we can improve version 2, I’ll gladly refund you a buck.

Thanks to Mark and Jamii at SWCP for making this happen.

Support for the app can be found here – http://www.taxessor.com .

More bricks and mortar fall to clicks

In a Wall Street Journal article dated today, Borders Group has indicated that they are making preperations to file bankruptcy in the forthcoming days.

Similar to the fallout of music stores after iTunes, Amazon website and digital readers has encouraged many readers to abandon physical stores. Companies that have figured out how to the digital frontier continue to thrive, while those that haven’t die. Interestingly , the same articles mentions that Borders tried going dot com a while back, threw in the towel and sold their initiative to Amazon.

“I think that there will be a 50% reduction in bricks-and-mortar shelf space for books within five years, and 90% within 10 years,” says Mike Shatzkin, chief executive of Idea Logical Co., a New York consulting firm. “Book stores are going away.””

—wsj.com 2/12/2011

Borders Group currently has over 600 locations, less than 1/2 of what it had in its peak at 2005.

In our market, Borders has a prominent location in the ABQ Uptown lifestyle center. I will be curious to see what the new highest and best use of that store will be.

Homeless survey in Albuquerque – Day 1

This morning starting at 4am, hundreds of volunteers, including Mayor Barry and his wife, scoured the city looking to survey the homeless and put a face with the statistics of being without a home.

As part of the 100khomes project, Albuquerque has created ABQheadinghome or Twitter

KRQE ran a full story this morning which can be found here.

I surveyed one individual who has been living in a makeshift tent in an arroyo on the west mesa. He has been homeless 7 months, and was recently attacked by three individuals who wanted his possessions. The attack was so brutal he was hospitalized and ended up receiving titanium plates in his head.

There has to be a better way to take care of all people who live here…this group seems determined to find it.

Update: Day 2– below freezing temperatures, blanked of snow on the westside, I was fortunate to be put on good friend (and City Councilor) Trudy Jones team – we introduced “Mike” who spent the night tented in highway culdesac.

The people on our Day 2 team were simply amazing – they knew the people we interviewed on a first name basis and made the process very comfortable for everyone.

Update: Day 3– the Mayor has announced that this survey has turned into a rescue misssion and the city is workign with APS to open up high school gyms for shelter from the unsually cold winter. Councilor Jones is raising money to feed the homeless, and United Way (and others) have raised over $50,000 in less than 48 hours.

It is one of the few times I’ve been speechless by the giving of others and honored to be a small part of the process.

CCIM announces new technology and social networking course

Technology and Social Networking Tools for Today’s Real Estate Professional

This 1-day course, taught by Todd Clarke, CCIM, teaches how to implement the latest technology and social networking tools into a real estate professional’s day-to-day business and add value to clients. Participants will review the latest hardware available, including smart phones, iPads and netbooks, and find software and data storage solutions. In addition, develop a business strategy for using social networking sites such as Facebook, Twitter, and LinkedIn, through hands-on exercises.

Upon successful completion of this course, you will be able to:

Course location and pricing

Chicago, IL ~ April 5, 2011 ~ 8:30 am – 5:00 pm

Levine Learning Center

430 N. Michigan Ave Suite 800 ~ Chicago, IL 60611

Members $295 Non-members $395

Instructor: Todd Clarke, CCIM

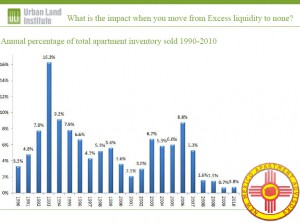

Apartment update/forecast – ULI Dec. 2010

The New Mexico ULI chapter December meeting was a commercial real estate update that included Steve Maestas from NAI Maestas/Ward, John Ransom from Grubb & Ellis NM, Jim Folkman from the Home Builders of Central NM, and myself, Todd Clarke from NM Apartment Advisors Inc.

Our presentation can be viewed here.

CCIM Success Profiles – one of my mentors, John Henderson III CCIM

As you may know, the NM CCIM chapter #10 is collecting a series of stories about some of their most successful members – a task called “profiles in success”.

Many of us have had people in our lives who we are grateful for – persons who show up at the right time and point us in a new direction, or people that provide invaluable insight that changes our course for the better.

I am a 4th generation Commercial Realtor, and both of my parents were in the business and provided that role for me.

In addition to that, I’ve been fortunate enough to grow up in a business and community of individuals that lean towards sharing, supporting, who focus on growing the pie instead of figuring out how to make their own piece larger.

In turns out that isn’t by accident, but was by design. Over 30 years ago, a handful of commercial brokers assembled at one of the earliest meetings of the Leasing Information Network (now known as LIN). Like our country’s founding fathers, these brokers set down their ideals of how people in our business would interact. Cooperation was the key word of the day, with the idea that fees and information would be pulled out of individual silos and shared by all.

One of those leaders, John Henderson III CCIM, was an early mentor for me. I remember when I was a teenager John tactfully informed me that my personality could be improved by attending a Dale Carnegie course (he was right). When I started commercial real estate in 1989, John encouraged me to take a CCIM intro course as soon as possible, and like him, once I had the knowledge, I couldn’t stop. John went on to write a letter of support that helped me secure a CCIM 101 scholarship, and for me, the rest is history as CCIM has done more for my business than any other aspect of my life.

With that thought in mind, it is my pleasure to share this video about John’s start in the business – some 40 years ago, John Henderson was a successfully residential Realtor, whose own life would be changed by a mentor to him.

More on John’s beginning in commercial real estate can be found here at his video – http://www.nmcomreal.com/ccimintro2 .

If after hearing these stories, you believe you might benefit from taking a CCIM course – the local chapter has an intro course this on February 7th and 8th – for $245, a 43% discount over the national rate. You can register for the course at www.nmcomreal.com/ccim .

Thanks,

Todd

Interested in becoming a CCIM?

CARNM’s most recent award winning Realtor, Lia Armstrong CCIM, was kind enough to share what the CCIM program has meant for her- watch the YouTube Video.

Save your seat for the February 7-8, 2011 course by registering here.

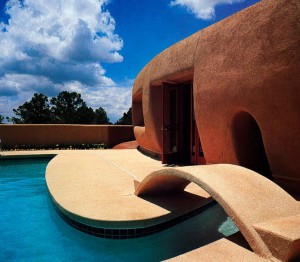

NM based Frank Lloyd Wright designed house for sale

Known as the “pottery house” and located in Santa Fe – this Frank Lloyd Wright designed house has recently come up for sale and is being offered by the original owner for $6,000,000.

Interested? More info can be found here.

Are you an owner occupant in a Bernalillo County apartment building?

If so – you might be able to get your 2010 property taxes reduced (for free).

According to the Bernalillo County Assessor, Karen Montoya, if you owner occupy an apartment (you will need proof in the form of a drivers license or utility bill), you can call the assessor’s office at 222-3700 to seek a reduction in your 2010 property tax bill.

The assessor’s office will “correct this error through an administrative change”.

Filing a claim of refund for 2010 property taxes

After many months of strategizing, negotiating, researching, and putting together our cases for our client’s, Cantera Consultants & Advisors Inc. recently settled all of its cases on the controversial apartment property tax lightning cases for 2010 (click here to read the summary).

In a recent (and copyrighted) Albuquerque Journal article, The Bernalillo County Assessor has indicated that she intends to roll back the 2010 values on all apartments that were raised more than 3% over their 2009 values.

If you own an apartment that experienced an increased of more than 3% in value (over 2009), and you did not file a protest by May 20th of 2010, there is one additional option available to reduce your property taxes for 2010 – you can file a claim of refund.

While this is a normal a service we offer our clients for contingency fee, in this unique situation, I believe the work we (and others) have done for our client’s this year has laid the foundation for the remaining apartment owners who haven’t filed to seek a refund.

If you meet the following criteria, you might be able to handle this case yourself:

– If you are the owner of a property not held in a partnership or corporation, you can represent yourself at district court to seek a refund of your property taxes.

– If you have already paid your property taxes, the full amount (not the first half installment)

– If you fill out a claim of refund (again, its more than a form, it is a lawsuit)

– If you file, in person, and pay the filing fee

In New Mexico, a claim of refund is lawsuit against the county, in which you, as the property owner, claim that you have overpaid the county in property taxes.

While I am not an attorney, and cannot offer any legal advice, I have been involved in a handful of claim of refunds and I can tell you that you can go to the district court website at www.nmcourts.gov and search the cases for the name “Karen Montoya” (our current assessor) and request a copy of a claim of refund from the court (you must do so in person, and they will charge you a copy fee) and use it as a model for your claim of refund.

You can also download Chapter 11 of our book “Understanding NM’s Property Tax System -2010 edition” that includes a blank form that we’ve used before. The deadline to file the lawsuit is 60 days after the property tax bills were sent out.

When filling out the form – be sure and look up your property’s property tax bill information at Bernalillo County’s website. Part of the form requires that you calculate what your property tax bill should be (based on 2009 values + 3%) vs. what it was on the actual tax bill.

Most tax consultants, such as our selves, are also working with attorneys and can provide assistance, but this maybe one of the rare situations, where everything has already been resolved (thanks to those owners who filed protest, and there consultants/attorneys who worked through the cases in 2010), that an owner maybe able to simply handle this themselves.

****disclaimer – in case I haven’t made it totally clear – this information is provided as a public service, and it not intended to offer legal or real estate advice. Going to court without legal representation is not a wise idea.

Property Tax protests update for 2010

2010 Bernalillo County Multi-family Property tax rollback – the rest of the story.

The following is a summary of an email sent to clients after our December 15th, 2010 hearing:

As I was working through a review and update of the apartment property tax lightning cases of 2010, I was reminded of the ancient Chinese blessing (or curse depending on your viewpoint):

“May you live in interesting times”

Many people are not aware that this blessing has two follow-up lines:

“May you come to the attention of the authorities” and

“May you come to find what you are looking for”

Unfortunately, 2010 was a year where all three of these came true for many of us. With that in mind, The following is an update on the property tax protests for your property.

The short version of this update is simple: we were able to get your property the lowest value we believe was possible in 2010, that value is final, and is not subject to any further litigation or appeals.

The long version as follows:

In my 22 years of handling property tax protests, 2010 was a unique year. State statutes indicate that the “value” year was 2007, which represent the tail end of the peak in the real estate market, and yet here in 2010, values in many cases had plummeted. We can add to that mix a county assessor who had recently been told by two different judges in district court that parts of a law passed by the legislature in 2002, and enforced by 33 county assessors was unconstitutional. As these recent changes in the law have had a big impact on how properties are valued, and it would be a safe to say this was a “perfect storm” that could wipe many property owners out.

Why we believe our client’s hire us at Cantera Consultants & Advisors Inc.

As it relates to handling property tax protests for our clients, we have found that successful protests involve more than knowing valuation technique and state statutes, it is also about knowing the people and having a strategy.

Our strategy this year was as follows:

– To use time to the advantage of our clients

– To research, develop, or create market information for the foundation of value negotiations

– To provide our clients with the risk/return analysis of the values that were negotiated with the assessor’s appraisers

– To meet with our local politicians, keep abreast of the recent changes in law, and provide an continual education on our property tax system

– To keep our clients and the public informed as to the changes in the property tax arena

– To align ourselves with other professionals who have experience in the property tax protest arena and litigation (i.e. find a good attorney)

Market information

For the first time ever, our firm, Cantera Consultants and Advisor Inc., compiled a 5 year survey of occupancy, rental rates, CAP rates and value changes. This market information was published in the Albuquerque Journal earlier this year and was used to help our client’s in obtaining lower property tax values.

A bit of history about recent changes in the law

The law, known as the “property tax lighting” or “3% maximum increase” or “3% Cap on values” law limited the increase in values for residential properties by no more than 3%. What many people forget is that the law had other components, such as requiring all assessor’s to bring their entire portfolio to “current and correct values, which are to be no lower than 85% of market value” prior to implementing the cap.

The intention of this law was to minimize the impact of a property tax bill increase on the little old lady in Santa Fe whose neighborhood was being overrun by Hollywood types that were paying outlandish in prices for housing. The value of the little old lady’s house would rise to the recent sales, which would lead to an increase in her property tax bill to an amount she might not be able to afford.

While the intention of the law might have been noble, the thought process about how to implement it was poorly executed. If we as citizens of New Mexico have decided that the little old lady deserved protection, then the legislature could have granted her an exemption on her actual property tax bill. Instead, the law limited the increase of her assessed value by no more than 3% a year, or 6.1% every 2 years.

Anyone who has analyzed our property tax system knows that there are three variables that impact your final property tax bill. Your assessed value, the percentage of your property that is assessed, and the mill levy. In New Mexico, your assessed value should be close to “market value”, most properties are assessed at 1/3 of their market value, and the mill levy floats as a ratio between the county’s total property portfolio value and the budgets of those entities that tap into property taxes.

By limiting only the value of the property, the law did not limit the increases on the property tax bill. By requiring disclosure of all single family residential property sales, the law ensured the assessor had a ready pool of comparable sales, AND, many of us believed it opened the door for the legislature to consider a property transfer tax.

The law had some exemptions that allowed increases of more than 3%, including new construction, changes in zoning, and the sale of the property. If your property had experienced any of these, its value could be increased by more than 3%.

As property buyers came into title in their new property, they experienced a large increase in values, larger than the 3% of previous years, which led to the term of “property tax lightning” for the zapped feeling many of these owners experienced as their property tax bills shot through the roof.

From 2002 to 2009, residential property owners were repeatedly zapped with this unfair law. Typically, case law, or interpretation of laws in the court room allows our legal system to provide a balance against our legislature. Amazingly, it took a few years before a case was filed that impacted the interpretation of this law.

In 2009, a handful of property tax cases were brought against the Bernalillo County challenging the implementation of the exceptions to increasing values more than 3%. Two different judges ruled that the law was unconstitutional, and those cases have since been appealed, and now, on the eve of 2011, have still not been resolved.

Resolution or not, the message was clear – the legislature created a law that treated property tax owners differently based on the date of their purchase of a property.

At the end of 2009, and after these court rulings, the county assessor “rolled back” all single family home values that had been increased by more than 3% to their 3% limits.

As a side note – it is interesting to note that a legal opinion written about the same time as the law was being considered by the New Mexico Attorney general indicated that the while this new law may not be unconstitutional, “its application could be unconstitutional”.

Fast forward to spring of 2010, where the Bernalillo County assessor has two rulings that the 3% cap on increase law is unconstitutional. She decides to rolls back the value on some 45,000 single family homes that had experienced property tax lightning in former years.

As the overall value of the county’s portfolio is decreased by these roll backs, she also interprets that the law on limiting increase does not apply to apartment buildings based on their occupancy status and then she proceeds to raise the value on thousands of apartments across the county.

Although the decrease in single family values was not entirely offset by the increase in multifamily values, the timing of the two cannot be entirely coincidental.

Through out the summer, fall and winter of 2010, our office met with the county assessor’s appraisers and reviewed each of our client’s properties. In many cases, we were able to get a value reduction to the 2009 value plus 3%, or lower.

In some cases, we were able to get the value’s negotiated down close to the 2009 level +3%, and we signed off on those cases. Working with our client’s we performed a risk/return analysis that balanced an additional smaller decrease in value vs. the possibility of paying a property tax bill on the original assessed amount for many years as the cases worked their way through the property tax protest process and possible appeals into the legal system (keep in mind, those owners who prevailed in the 2009 single family property tax lightning cases are still paying higher property tax bills in 2009 and 2010 as their cases are still under appeal).

The balance of the property cases we had, totaling 30 in number, proceeded to formal hearings on December 15th, 2010. These were the most hard core cases, where none of the standard value techniques indicated a value remotely close to the 2009 plus 3%. In one particular case, while we able to reduce a property’s value by 50% from its 2010 assessment, the 2009 value plus 3% was another 50% lower. Each of these owner’s (including myself) indicated an ability to pay the higher property tax bill and a desire to continue their protest based solely on the legality of the removal of the 3% increase in values.

Assessor’s deposition

On November 19th, 2010, the Bernalillo County assessor was deposed by a handful of attorneys, including ours. I attended a majority of the deposition and I can tell you my summary at the time was that the most repeated answer in the 167 pages of the deposition, was “I don’t know”. Part of that consistent answer relates to the questions that some of the other attorneys asked – questions that showed a limited understanding of the assessor’s job duties, but the balance of the questions related to the assessor’s execution of the changes in values to apartments as it related to the removal of the 3% increase cap on values.

As you may know, there is a state statute that gives any county assessor a large advantage in formal hearings:

7-38-6. PRESUMPTION OF CORRECTNESS

Values of property for property taxation purposes determined by the department or the county assessor are presumed to be correct. Determinations of tax rates, classification, allocations of net taxable values of property to governmental units and the computation and determination of property taxes made by the officer or agency responsible there for under the Property Tax Code are presumed to be correct.Our belief was that the assessor’s deposition demonstrated that this presumption of correctness should not be applied by the formal tax board in these apartment cases.

Timing

Based on last year’s single family property tax lightning cases, and our experience from previous years, we believe the longer we can wait to resolve our cases, the more our client’s benefit. For example, last year, some of our clients benefitted from recent court rulings that came late in the year. Said succinctly, each year the aggregate protests carry with them a body of knowledge, and by being last or close to last in the protest process, we benefit from that knowledge base.

The unfortunate side effect of waiting until the end is that the assessor was successful in getting an extension of their cases until after the December 10, 2010 property tax bills were due, so many of our clients received a bill for full value.

Our formal hearings for unresolved cases were scheduled for December 15th, 2010.

Ostrowski Decision

On November 30th of 2010, the formal property tax board found in favor of a property owner who owned a single family residential property that was rented out. The property in this case had sold in 2004, and had been hit with tax lighting, but its value was not rolled back as it was believed to be a “non-owner occupant” property. The board ruled that irrespective of the property’s occupancy status, it was not being treated uniformly with other similar properties. The board ruled that the value be rolled back.

Owings Star decision

On December 3rd, 2010, the formal property tax board found in favor of the county assessor in a case where an apartment owner believed that their property had been discriminated against based on its increase value of 25%. Unfortunately, the owner presented little in evidence to demonstrate said discrimination, and the formal property tax board, citing the case Hahn, Inc. vs. County Assessor that “the bar is set very high for a property owner claiming discrimination. What must be proven is an intentional scheme of discrimination, for which there is no evidence here”, and the formal board found in favor of the assessor.

Unresolved Decision

On December 9th, 2010, the formal tax board convened to hear the 40+ cases of another tax consultant and his attorney. Although the assessor had been subpoenaed to appear, the county attorney informed the board that she would not be appearing, and that the consultant, and their respective property tax owners, did not have the authority to subpoena an assessor to appear. Both sides tendered their briefs and this case should be ruled on by January 8th, 2011.

Clarke Stipulation

About a week before the hearing, our attorney, Stephanie Dzur (who prevailed in the single family residential property tax lightning cases in 2009), extended an offer to the county attorney’s office. The offer was an agreement that indicated we understood that the county assessor has been making decisions based on the information available at the time, and while we respected the difficult position she was in, we believed we would prevail at formal hearings, and as such, the county should agree to rolling back all of our pending protests to the 2009 values plus a 3% increase. As part of this offer, Mrs. Dzur shared with the county assessor our case, which we believed to be very strong.

Wednesday, December 15th, was our formal hearing for all remaining property tax protests for Bernalillo County. By Tuesday afternoon, we had been able to negotiate all of our pending cases down to the lowest values, subject only to the apartment cases that has experienced “tax lightning” or an increase of more than 3%.

Wednesday morning, I received a call from the assessor and she indicated that she wanted to meet with myself, the county attorney, and our attorney, Stephanie Dzur. The assessor indicated that based on how the formal board was ruling, she believed that apartments should not be treated differently, and although she intended to appeal some of the formal rulings, she was willing to resolve and sign off on the balance of cases if we could come to terms on a stipulated agreement.

Over the course of the morning, we modified the language of our original stipulation presented in our offer the week before.

Although we had an intellectual interest in pursuing the case through formal boards and a passion to put on our case, foremost in our minds was the issue of an appeal. The assessor had indicated that she was going to appeal the decision of the formal tax board, and similar to the property tax lighting cases of 2009, we were concerned that our client’s would be exposed to many years of property tax bills based on much higher amounts, until the legal system could provide a final and complete ruling.

By working through the stipulated agreement, you and our other clients would benefit from a lower property tax bill and a final decision that was not appealable. For each property that was subject to this agreement, I have already forwarded to you the stipulated agreement. The gist of it is that we agreed that the assessor interpreted the law based on the best information she had at the time, that the information was changing over time, and that we wanted our clients to benefit from that updated information by being treated the same as other the residential properties in 2010.

In the end, we believe we had the better hand, the better case, and that it led to the best possible outcome.

2011 and beyond

Many of our client have asked us what 2011 will hold, and to be candid, while I have many ideas as to what might come about with a new governor, a “refreshed” legislature, and an reelected assessor, I remain hopeful that they will have the courage to deal with this pressing issue head-on.

My largest concern for future years is the creeping of politics in the property tax system. In his autobiography, Former Governor King indicated that one of the many reasons he wanted the state constitution rewritten in the 1970’s was to push politics out of the property tax system. The laws that came out of that constitutional congress served our state well for over three decades, but all of that effort has been undone by recent laws. Until we repeal those laws, or modify our property tax system I remain concerned that politics and politicians will continue to provide uncertainty in our property tax system. That uncertainty translates to an opaque property tax system that will have an impact on all of our property values.

Fortunately, organizations like the Apartment Association of New Mexico and NAIOP are staying on top of these issues by meeting with our elected leaders to provide a better outcome. If you are not currently a member of both of these organizations, I would highly recommend signing up in 2011.

My apologies for the lengthy update, but I thought you might have an interest in the rest of the story. If you have an interest in copies of any of the above mentioned documents, don’t hesitate to let me know.

Thanks,

Todd

————————-

Todd Clarke CCIM

Cantera Consultants & Advisors Inc.

715 8th NW Albuquerque NM 87102

O 505-247-1411

M 505-440-TODD

F 800-791-4047

tclarke@nmapartment.com

www.nmapartment.com

Read Confessions of a Commercial Real Estate Consultant – www.toddclarke.com

————————-

This decade’s population growth is the slowest in the USA since the depression

According to CNN.com – which is covering the release of the Census data sets today. There is just under 309 million Americans today.

770 KKOB Radio update – 11/29/2010 – Forecasting real estate in 2011

Bob: what do you have for us today Todd

Todd: Good morning Bob! It’s hard to believe the holidays are already upon us and before you know it the end of the year will be here. As that time approaches, many of our customers wonder what 2011 will hold for the real estate industry and whether NM’s real estate market will lead, follow or diverge from national trends.

Bob: Todd, do you have a forecasting resource to help answer these question?

Todd: We sure do Bob, our firm has followed a publication called “the Emerging Trends in Real Estate” which is published by the Urban Land Institute and Price/Waterhouse/Coopers. For 32 years the authors of this publication have called upon the leading experts in the real estate industry to ask them what they see in their business in the coming year. This report provides an outlook on U.S. investment and development trends, real estate finance and capital markets, with a focus on key property sectors. The report draws on formal and informal surveys of real estate executives, investors, developers, and market experts around the U.S., including survey responses from over 500 real estate executives and personal interviews with over 125 industry leaders.

Bob: Sounds very comprehensive Todd, where can our listeners get a copy?

Todd: Bob there are two ways to get a copy – you can join the Urban Land Institute at www.uli.org, OR, you can attend their “Outlook NM” event to be held on the evening of December 9th, 2010

Bob: Can you tell me a bit more about this event?

Todd: I sure can – the national speaker is Chuck DiRocco from Price/Waterhouse/Cooper and he will be followed by our local panelists, Steve Maestas at Maestas Ward who will talk about retail, John Ranson of Grubb & Ellis who will address Office and Industrial, Jim Folkman of the HomeBuilders of Central NM who will discuss the single family residential market, and I will be covering the apartment industry.

Bob: Sounds like a full event – how can our listeners participate?

Todd: The cost of the event, which includes the publication is $60 – to RSVP – call the local Urban Land Institute office 505-269-7695 or call me anytime at 440-TODD.

Candid advertising

In case you can’t read it – it says “your art might suck, but your studio doesn’t have to”.

Advertising live/work/walk studios adjacent to the main square in Taos, the Central Station Taos wins our award this month for being brutally frank.

10 years of tenants, toilets and trash

Imagine being the landlord of this multinational facility – and while its only some 286 miles away, the average round trip cost to service it is $750,000,000.

Today, the International Space Station (ISS) celebrates its 10th anniversary as an occupied structure.

To date, ISS has been visited by 200 visitors on some 36 space shuttle launches and/or 9 Russian Launches. The ISS represents the largest manmade structure outside of Earth, contains 29,561 cubic feet and is estimated to have cost $150,000,000,000 to design, launch, assemble, maintain and service. That works out to be about $5,074,253 per cubic foot.

Regardless of how you feel about the space station, it is amazing to think that over 100,000 people from 15 different nations have been able to work well enough together to allow this project to continue.

Other interesting facts: as of today, the International Space Station has made over 46,000 orbits around the earth – along a path that is visible to over 90% of the world’s population.

Thanks to Gizmodo for the 10th anniversary alert!

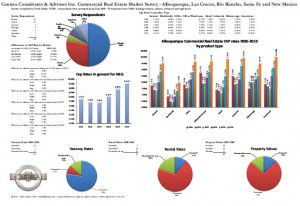

NM Commercial Real Estate Value Survey

Cantera Consultants & Advisors has just released the results from our latest valuation survey. This survey was performed over the summer of 2010 with real estate owners, investors, lenders, brokers and appraisers.

The attached document demonstrates the changes in CAP rates and values from 2005 to 2010.

Click here for the survey results and a related newspaper article CCA-Survey-07092010-v8plusJournalArticle

Another Albuquerque historic landmark gone…

Almost a year ago, I wrote about the devastating fire at the Castle apartments. Located on Central Avenue at about 15th street, the apartments were incredibly well built, had an appealing interior design and finish and were well loved by anyone who has ever lived there.

Although several local developers looked at ways to save the structure and renovate the building, it was demolished this week. The following photos are pictures I took when I toured the property with the owners a few years ago and/or recent photos of the demolition.

KRQE website has coverage of the fire and the demolition.-

All that remains today are the original carriage houses, now car garages to the south of the original structures.

As one of Albuquerque’s finest apartment structures, you will be missed.

Course: Understanding NM’s Property Tax System

Did you know at one time in NM’s history, your political affiliation impacted the amount of your property tax bill? Are you confused by Tax Lightening? Uncertain as to what surprises next year’s property tax bill will hold? Do you want to understand why it is “fair” for two similar properties to have different assessed values? Confused by the media news and the latest legislation? Need the straight scoop on the property tax law? Then plan to attend this course!

Learn how:

– To build a credible case for protesting your property’s tax value

– To calculate your property tax bill

– What you should provide and what you shouldn’t

– How the assessors in each county approach value

– The basis of the property tax law and how it impacts your tax bill

– How to conduct your negotiations at informal and formal hearings

– Includes a review of the latest legislative laws/updates

– Includes Fifth edition book “Understanding NM’s Property Tax system” a $50 value.

– Book includes case study and mock informal and formal hearings

– You will leave this course with the tools you need to file a protest

This course has been utilized by owners of property to lower their values as well as real estate professionals looking to understand the process and offer additional services to their clients. The course includes the 5th Edition, 360 page book titled “Understanding NM’s Property Tax System”, a $50 value, free of charge (PDF version is free, printed version is $50). This must-have text book includes sample case studies, and cites state statutes that are important to know for any settlement or formal hearing. (if you don’t need the CE and want the textbook – it can be ordered here: www.canteraconsultants.com/books)

Register for this or any other course at www.canteraconsultants.com/cca2015 .

Additional information about your international award winning instructor can be found at www.toddclarke.com

Honey, where did we park the house?

I could have sworn we left it right here on the corner of Sinkhole Avenue and Dropoff Blvd…

This first appeared on one of my favorite gadget blogs, Gizmodo, and then was followed by a posting with more photos on the National Geographic website.

Before my friends in Albuquerque chuckle too much about those crazy places (like California) that seem to suffer from too many of these natural disasters, a few years ago, an Albuquerque sink hole swallowed up a Albuquerque Fire Department truck.

Latest update – we now have video.

Too my friends in the development business, how would you value a site like this?

Property Tax update on 770 KKOB AM

![]()

Thanks to Bob Clark and 770 KKOB for hosting Stephanie Dzur and I last week.

We fielded dozens of calls about the property tax lightning and other property tax issues.

If you aren’t familiar with Stephanie’s name you should be. Stephanie is a local attorney won the case last year against the Bernalillo County assessor’s office that ended with the district court ruling that the law was unconstitutional.

In additional to winning the case, Stephanie was a home owner impacted by tax lightning. She maintains a blog on the issues that can be found here.

Later this week, a complete podcast of this radioshow wil be available on this website.

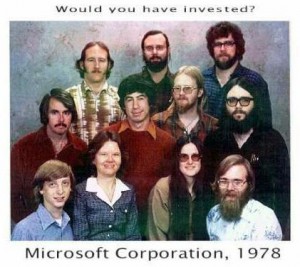

The passing of an era

Posted in our sister blog, Todd Clarke’s Technology Corner, is an obituary of the man who developed the hardware for the first personal computer.

His fulltime job was as a scientist at Sandia National Labratories, but his interests were in developing computers that the public could use.

His company, MITS, developed the hardware, but he needed a software operating system to make the machine more accesible, and he and heard of a bright young programmer in the Seattle Area, Bill Gates, who might be able to write what he needed. Bill and his partner, Paul Allen worked around the clock from some down and out Route 66 motels to write the first operating system under their new corpoorate name, Microsoft.

This corporate photo, taken in 1978, shows the original Microsoft staff.

Thank you Dr. Edwards for cementing Albuquerque’s role in computer history.

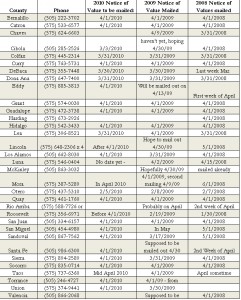

NM Notices of property tax value are being mailed out

Bernalillo County is mailng out notices of value on April 1st, 2010 and the deadline to file a protest of value will be 30 days after that.

The remaining 32 counties have indicated that this is there mailing schedule:

Our firm offers three options to assist you in property tax protests:

1. buy our 250+ page, fourth edition text book – click here to order for $49.

2. attend our “Understanding NM’s Property Tax System” course on April 15th, 2010 – you can register by clicking here.

3. hire our firm to represent you on a contigency basis – email tclarke@nmapartment.com or call 440-TODD (8633) for more info.

What to look for in a property tax consultant.

I recently assisted a client with finding a property tax consultant in Kansas. After using the CCIM network to identify candidates, we issued a brief RFP and identified the top contenders in a short time.

Experience

Experience should include not only how many protests have they successfully completed, but also the kind training and background in analysis and or appraisal for the given property type. Additionally, they should have other experience in your property classification/type. For instance, if they were involved in selling apartments and had access to all of the comparable sales, because many of were sales they had been involved in, then the power of their testimony in informal or formal hearings carries substantial more weight that someone who collected the sales info third-hand.

Approach

There are many approaches as to how a consultant works the protest, for example, some consultants use their political skills while others use their skills of analysis.

Results

Ask the consultant the following:

What are their results?

What was their toughest case?

What was their easiest case? (and did they charge for it?)

Who is their competition?

Have they had success getting a reduction after following competition?

As you interview property tax agents you should:

Ask to see copies of their most recent reports – a protestor who doesn’t file a report, is not likely to get you the lowest possible valuation.

Fully understand how their pricing for their services work – some have little incentive to do a thorough job to protest your taxes because they charge you a low monthly or annual fee to monitor your values.

Ask for a copy of their contract – make sure you understand how you pay them and when. For example, some tax consultants charge just for the first years savings while other charge you for every year that value remains in place (it would be better to pay a 35% contingency fee on only the first year savings, than pay a 25% contingency fee on two years savings which would effectively cost you 50% of the savings).

Ask for a summary report of their average track record for clients. Some tax consultant’s average as little as 8% average reductions, and others that are in the double digits. Don’t fall into the trap of being “sold” on their services when they tell you about their “best” case. For example, our firm lowered a valuation from $9M to $1M last year, an 89% reduction, which hardly represents our average of 24%.

Discuss with them the process and how hands on they are

Ask them what documentation they will need from you as owner. While it may be a chore to dig up old paperwork, if they don’t ask you for copies of old appraisals, surveys, and phase I environmental audits, then they are not likely to be extremely diligent in obtaining the lowest value.

Ask what experience the consultant has in your particular property niche – don’t for example, hire someone who specializes in office buildings and has never done a ministorage protest.

Ask for testimonial letters from former clients and request their contact info to follow-up.

If the tax consultant demands an upfront fee to analyze your property, move on! There are many other tax consultants who are glad to review your property and tell you if they think you have a case or not.

Beware of consultants who imply they have a political “in” with an assessor. The state of New Mexico Tax and Revenue department has an auditing process to smoke out cases that were settled without merit.

Ask for their resume and look for their additional experience in the market – a tax consultant who has been an active in the real estate community is likely to command more respect at a formal hearing, than an tax consultant who is a virtually an unknown entity in the market.

Remember – the person you hire is your advocate, if you don’t have warm fuzzy feelings with them, move on to the next tax consultant.

Fee models

Annual flat fee

Some firms, particularly national ones, charge a flat fee to review their client’s valuations and, when they deem necessary, protest them. They generally have no built-in incentive to protest and their compensation is not tied to the degree to which they prevail.

This model works well in states where the property tax owner and assessor often agree on the accurate value for the property.

Contingency fee

This arrangement gives the owner’s agent an incentive to protest, if they believe that they can win, and it makes their compensation proportionate to the reduction in value they achieve.

1. Analysis skill set

2. Additional services offered

3. Methodologies used

4. Since they get paid if the reduce the tax bill, will the consultant be willing to pay if they get the taxes raised?

As always, if you ever need assitance in finding a tax consultant, don’t hesitate to email or call me at (505) 440-TODD or tclarke@nmapartment.com

Is there such a thing as too much retail?

from Bricks and Mortar to clicks and flips

Ever wonder why there are more and more Walgreen’s and less and less clothing stores?

It is a reflection of our shopping patterns as more and more of us choose to order online or from catalogues vs. visiting a physical a store – a long tend trend known as bricks/mortar to clicks/flips.

Long term, this indicates a higher demand for industrial/distribution properties, and declining demand for retail.

Thank you Lifehacker.com for the article.

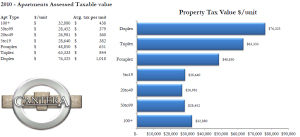

Apartments and Property tax lighting

Cantera Consultants & Advisors Inc. recently completed a thorough analysis of all apartments in Bernalillo County.

The following graph is a summary of that analysis.

The graph illustrates that duplexes, triplexes and fourplexes are assessed at a much higher rate than their bigger peers.

If you feel this is counter intuitive, you would be correct – generally, the newest nicest apartments with swimming pools, clubhouses and movie theaters are the larger apartments.

So whats going on in the details?

Simple – our property tax code is too complicated, and skewed towards the larger owner who can afford to higher a property tax consultant such as Cantera and the smaller owners are less likely to pay attention when their notice of values come out.

What can you do about this? Join advocacy groups like the Apartment Association of NM and work with there government affairs committee to help our legislature change our laws.

The potential impact of upcoming legislative and legal changes on NM’s Property Tax System

I think of our property tax system as a bit of a prisoner’s dilemma (that is the game theory where two suspects are picked up by the police – if they both refuse to cooperate they walk, if either turns on the other suspect, then other suspect goes to jail, and if they both turn in the other, they both go to jail). Applying that to our property tax system, I believe that most property owners want a fair system, but so long as there are loopholes or the perception of unfairness, than they too want that loop hole – the end game of which is a downward spiral in tax revenues.

Personally, I believe in supporting the person who has the right ideas over a party ideology– and former Governor King is just such a person – in the early 1970s he had the state constitution rewritten, in part to deal with the inequities in the property tax system (it was common for your political affiliation to dictate how high or low your property taxes are). So whenever I contemplate changes to the property tax law, I think, what would Gov. King look for that would create a fair equitable system.

Although our property tax system has a lot of “fairness” built into it, simple it isn’t. This flow chart shows how the property tax system works and who can influence it.

If I grossly simplify that process, there are four places to influence the final tax bill:

- The property value

- The % of that property value that is assessed (current 1/3)

- Deduction for any exemptions

- Mill levy (which is calculated by taking the total budget for taxing entities and dividing that by net taxable value for each county’s portfolio)

So simply said, our tax bill is calculated by taking:

Property value x % of assessment – allowed deductions = net taxable value x mill levy.

By having the law focus on only property value, it is possible to have no net change on the tax payers final properly tax bill. For example – if we had a law that said every property would double in value (say to reflect true market conditions) in 2010, then net impact on the tax bill would be no net change. (When you double the values, you halve the mill levy).

So in dealing with the two issues of tax lightning and fairness, my own personal belief is:

- At the time, (I was on a panel with him when he said this), the original intent of the Santa Fe assessor who wrote the some-what-disclosure & 3% cap law, he did so with the intent to protect the little old lady who has had the same house for 100+ years in Santa Fe – the idea was to keep her property taxes down even when the values were being pushed up by the Hollywood crowd moving into her neighborhood. This could have been handled through an exemption (like we do for Veterans and head of household, etc.), and we wouldn’t have the issues we do now. If the law was turned into the protecting the little old lady law through exemption, but it kept her property value

- I believe his true intent was to push through sales disclosure. The way the law was written, if an assessor disclosed information that had been disclosed to them, for every incident of disclosure, they were liable for a $1,000 fine, but the tax protest process requires the assessor to provide the protestant with complete copies of info (covered under part of the state statutes that deal with disclosure in court cases) – so I file a protest, the assessor uses 6 comparable sales that were disclosed to them by a property owner and that property owner could sue them for $6,000 – many of the 33 assessor’s were scared of this law and how to protect property info (I know of a county down south where you could “purchase” the assessor’s data set for a nominal amount of money).

- The 3% CAP was only supposed to protect the little old lady, not the average home owner, and certainly not the large apartment owner (22 counties consider apartments residential, 10 consider them commercial, and 1 just doesn’t know). BUT now that the law exists, I have been able to get my large apartment owners the same protection (no increase in value and a 3% CAP) – and as much as I love my industry, that just isn’t fair for our community.

- So looking at the law from every angle, there is no piece of the original legislation that provides transparency or disclosure.

- For residential, the law should be repealed entirely. The 3% CAP distorts everyone’s property taxes (when California passed proposition 13 (basically a limit on property tax increases), that state when from one of the best in schools and infrastructures to one of the worse.

- The commercial property owner and broker just isn’t paying attention – for example, let’s say you own a property in Rio Rancho – last year the residential property owners (who live in Sandoval County) voted to effectively double their mill rate by taxing themselves for a new college and hospital. The non-voting commercial property owner is now receiving a tax bill for $40,000 instead of $20,000 which has decreased their property value (in the short term at least) by $500,000 (8% CAP rate) or 20% of its original value of $2.5M.

- Furthermore, as the residential values decrease through the 3% CAP, the commercial property bears the burden of taxation. Although this next example is a different expense item, but it illustrates the unintended changes caused by new laws – in Florida, to reduce insurance costs, the legislature shifted more of the burden from residential to commercial – so much so that a 1,000 unit development project I worked on had a insurance bill as an apartment (commercial) that was 10 times higher ($2M) than if it was a condo (residential) which would have an insurance bill of $200,000. The Caps on increases of value for one property class will cause the same distortion.

- As it relates to newly developed properties – I have a client who tried to build a 300+ unit new construction apartment on Albuquerque’s Westside – its likely value was going to be lead to a tax bill that was 3.5 times higher than similar properties that had been built in previous years (which were subject to a CAP as well) – so the existing property owner had an unfair competitive advantage that caused this apartment not to be developed. To fix that, I think we would need a system where by new construction is phased in over 3 years to its full value AND we need a system that allows all property’s to be raised to their full value

- FAs it relates to bond issues, I believe when the voters vote, they need to understand that while their property taxes may (or may not) go up, by declining a bond issue, their property taxes could go down. Said another way if the ballot said “would you vote for a new library knowing that it would raise your property taxes by $40 a year for every $100,000 in value your house had (Y/N).” Then the tax payer/voter could consider the value the said public amenity (road, library, school, hospital, etc) adds to their community. Further consideration would have to be given to whether commercial benefits from every public service (fire/police= yes, library/school-no) and how we accommodate for that.

Finally, to have a fully fair and equitable process, any future laws need to model the impact on values based on the current mill levy, % of value, and property value and the outcome needs to be one where we can:

- Explain it to a new buyer or developer (for example – your property tax bill will likely be 1% of what you pay)

- Is transparent in operation (if I showed you the inequities in what we have now, and the loopholes that I as a tax consultant can use, you would be amazed at the lack of transparency)

- Is as fair as possible (i.e. you could look at your neighbor’s property tax bills and understand why they are similar (in value) or dissimilar (in exemption) as yours)

- Does it eliminate the abuse of unintended loophole as possible (when I was in China, they had a property tax that said you would only be taxed if your property was 100% complete – guess how many 40 story hi-rises I saw with an unfinished floor?)

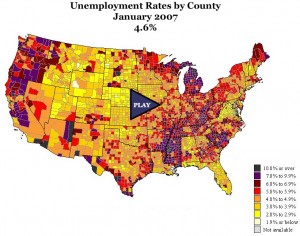

Unemployment trends across the country – good or bad for your area?

Click on this link for an animated video showing county by county unemployment levels and watch as most of the country turns purple in unemployment.

Now you really can have an office anywhere!

Possible solution for zoning issuess?

This make look like any ordinary residential area in California, but would you believe it if I told you it was actually a factory? Click here for more. I wonder why developer’s haven’t used this for industrial parks?

This make look like any ordinary residential area in California, but would you believe it if I told you it was actually a factory? Click here for more. I wonder why developer’s haven’t used this for industrial parks?

Mega development near Vegas…

The Hoover dam by-pass is under construction – Gizmodo (and my father-in-law) have forwarded some amazing photos of the construction of this bridge.

First CMBs in years – closes – $400M+, 1.44 DCR, 62.4% LTV

A possible solution for all the commercial real estate debt that is coming due?

Reading this article at the Economist got me thinking…

What if borrowed and lenders had a prenegotiated arrangement that converted debt into equity a commercial real estate deal? I don’t mean like todays, expensive involuntary conversion that happens through foreclosure, but a more organized rational, prenegotiated, pre-nupital like document that said something like “in the event of a capital crisis, or the mid-term (a average of this property’s value over the last 24 months) value of this asset decreases below the loan limit, borrower shall have mortgage their interest converted into an equity interest, thus unemcumbering the asset of all debt, freeing up cash flow which shall be distributed as follows… (cash flow going to lender, tax benefit going to equity position)… until such time as…”

Certainly debt would cost more, but an equity player might be willing to go into a deal knowing the downside was much lower.

The Economist has such a way with words

Take this example whereby they explain the inputs a home buyer needs to make a decision:

Most people face a future that comprises a combination of Donald Rumsfeld’s known and unknown unknowns. Choosing to buy a house, for example, involves a series of bets on land prices, interest rates, taxes, job prospects, future planning decisions in the area selected and the structural soundness of the property concerned. It is impossible for any buyer to be confident about so many variables. Any decision must be a guess.

Thanks to everyone who attended yesterday’s technology lunch and learn

In less than 90 minutes, we covered technology and how to best make it work for the commercial Realtor.

Everything from making presentations using your iphone and a portable projector, how to find a $200 netbook, take your office into the digital era by going paperless to the best tech tools to travel with.

The case for a national MLS

NAR announced their purchase of technology to construct the Realtors® Property Resource, a nationwide database of over 140,000,000 homes. Althoughthe press release denies the intent to make this anything more than a member benefit, it seems likely that a national MLS could follow.

Currently, local and regional MLS systems have a data sharing protocol to NAR’s national service – one that provides minimal info (for example, one of our fourplex apartment listings shows up as an 8 bedroom house), and some search abilities for buyers.

More and more buyers and agents are demanding the ability to get to information without having to worry about how to find the local MLS provider’s website first.

As you would expect with any large organization (NAR has about 1,000,000 members), they have had a hard time balancing the needs of the consumer, the agent, and the Realtor boards.

At the end of the day, a good friend, mentor and former Executive Officer of the first Commercial Association of Realtors (NM) in this country, once told me – “if you focus on your customers, customers, then your business will prosper”. (Thank you Nelson Janes!)

How about it NAR? Let’s focus soley on the real estate buyer and seller, and let the rest of the chips fall where they may.

If we don’t you can count on someone like Google to.

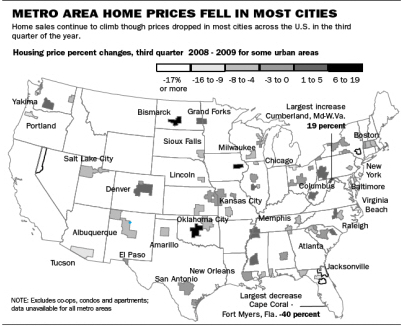

Albuquerque’s housing market continues to improve while USA shows decrease

According to a story in today’s Albuquerque Journal, 80% of this country’s cities showed a decrease in home sales prices, but Albuquerque remained on an modest upward trend.

“Third-quarter data showed the median sale price in the Albuquerque metro area was $183,500 — up from the first and second quarters — but down about 5 percent off the sale price of $193,400 in the third quarter of 2008. “

The Greater Albuquerque Association of Realtors has also indicated that the volume of sales has increased by 40% over this time last year.

One of the things to take into account, is that this does not necessarily indicate that home prices have shifted that much, as local agents will tell you there has been a lot of activity in the under $250,000 price range, and little activity in the over $1,000,000 price range, which is more than enough to cause the median price to decline

Its unfortunate that GAAR and NAR don’t do a same house comparison for appreciation/depreciation.

Spaceport NM update

Thanks to Richard David for turning me on to this article about the spaceports status…

Thanks to Richard David for turning me on to this article about the spaceports status…