Thanks to the and the for hosting this mornings Apartment market outlook.

Category: NM Real Estate

NMREC mandatory course findings and update

Cantera Consultants and Advisors has just finished its analysis of the NM Real Estate Commissions mandatory course and E&O programs.

The findings and recommendations can be found here –

2-CCA2NMREC-UpdateandFindings-v9-

07202014

Thanks to the NMREC

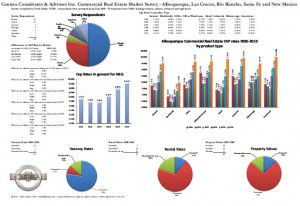

ULI NM – 2013 Commercial Real Estate Value Survey

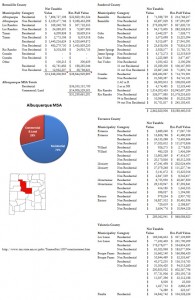

The NM Chapter of the Urban Land Institute released its 2013 Commercial Real Estate and Value survey last week at the joint Apartment Association of NM and Urban Land Institute Market forum luncheon.

Previous value and cap rate surveys performed by Cantera Consultants & Advisors Inc. can be found here for 2011 and here for 2010.

Read the full article from the ABQ Journal here

Read the full article from the ABQ Journal here

The complete 11 x 17 version of the survey can be found by clicking here.

Todd Clarke named as commissioner to Albuquerque Housing Authority

Property Tax update 2012 – should you protest?

I have had a number of clients ask me if we are still doing property tax protests, as they had received a handful of pieces in the mail from our competitors encouraging them to protest your property taxes, but not one from our firm.

2011 Status

Our office has only recently resolved our property taxes cases for 2011. The conclusion of these cases makes for the first time in 3 years that one year was complete before the next year started. During those 3 years we have protested over $745,000,000 in values, so from our perspective it certainly feels like most of the commercial and apartment buildings that could be protested have been done.

2012 protests

Although I am always glad to review your properties, for the most part I am recommending to my clients that they not protest their values this year. WHY you might ask? It’s simple, according to our value survey (attached), the market has started to turn the corner, and after 3 solid years of being able to lower our client’s property’s values, we think that window of time is drawing to a close.

Is there a downside to protest your property taxes every year?

Yes, when you file a protest, you open the door to an increase in value. If in reviewing your property’s info the assessor find cause to believe your property is under assessed, the can request an increase in value, and although I’ve never had it happen to me, I’ve had many assessors threaten to raise values, particularly when they feel a property owner filed a frivolous protest.

Material change in property in 2010 or 2011

I think the exception to this would be if your property has experienced a substantial physical or occupancy change in 2010 or 2011.

2013 is a reappraisal year

Although state law requires each county to reappraise its portfolio of properties every two years, many counties have gone for long periods of time with minimal increases in value.

Santa Fe County has announced that it has expanded its budget to bring all of the commercial properties to current and correct. My understanding is that Sandoval county is staffing up with the intent of revaluing all commercial properties, and Bernalillo County has indicated a similar effort.

Property Tax Lightning

As you may recall, the property tax lightning battle that is entering its fourth year, has been previously won a formal board level as well as district court, but those decisions have been appealed to the appellate court, which has not provided a ruling.

Apartment Tax Lightning

The back story for apartment tax lightning is a bit convoluted and long – so rather than bore you with the details, I can tell you that apartment owners continue to prevail in these cases – a summary of our 2011 cases can be found here – http://www.toddclarke.net/?p=1464 as well as the 2010 cases here- http://www.toddclarke.net/?p=969.

Class

If you would like to learn how our property tax system works, how to protest your own properties, or just need CE credit – our next course will be May 24th, 2012 – registration at www.canteraconsultants.com/registration

Textbook

If you don’t have time for the class, but would like the knowledge, we offer a 365 page textbook in both physical ($59 ) and digital form ($49 ). You can order your book online at www.canteraconsultants.com/bookk

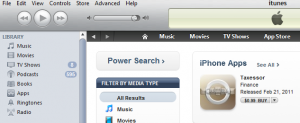

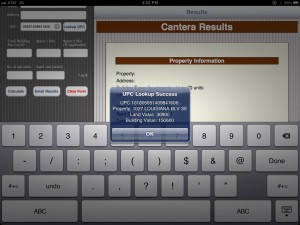

App

If you are curious as to your property’s value or if you ever need to look up your property taxes from your iPhone or iPad – consider our $0.99 app – which can be found online at http://itunes.apple.com/us/app/taxessor/id419811562?mt=8 . The Taxessor App takes the values from resolved cases and matches them up to your property to give you an indication of whether it might be possible to obtain a reduction.

Resource to look up your property’s historical values

Finally, If you need to look up more than years history at a time and you are tired of multiple

“clicks” and screens on bernco.gov – try out website – www.nmapartment.com – (scroll down and look in the left hand margin for the “Lookup your property taxes” – once you enter your UPC # and go – it will pull up a 10 year history of notices of values, and tax bills all on one screen.

As always, if you need anything related to property taxes in New Mexico, don’t hesitate to email or call me

Thanks,

Todd Clarke CCIM

CEO

Cantera Consultants & Advisors Inc.

Rent vs. Own

Homelessness in ABQ update

The Albuquerque Journal has an update on the homeless survey that was performed earlier this year.

The Albuquerque Journal has an update on the homeless survey that was performed earlier this year.

As you may remember, I participated in the survey earlier this year, and was dumbstruck by the stories the individuals I met shared.

Although the focus on the article is about one individual who has made it into housing, then fallen out, and is working to get back in, the part of the story that left me the saddest was the number of people who have died since we surveyed them.

Those of us who own housing, who work in the housing industry must to more to help initiatives like the City of Albuquerque’s Albuquerque Heading Home as well as non-profits like Metropolitan Homelessness Project and Joy Junction to eliminate homelessness.

(BTW, I should mention that Mayor Berry received the Humanitarian award for his dedication on this issue. Having been on his team, I can tell you his desire to eliminate homelessness involved a lot more than the camera time many people might have seen and the survey of the homeless quickly turned into an emergency plan that the Mayor and City Councilors funded to get people out of the sub freezing temperatures and in shelter).

Valuation survey for NM Commercial Real estate released.

Cantera Consultants & Advisors has just released its 2011 value survey for NM Commercial Real Estate. The survey reflects the collective wisdom of industry professionals in NM.

Although Cantera uses the survey primarily for the benefit of it’s during property tax protest hearings, the survey has become staple in the commercial real estate market and is widely used and quoted by many of the brokerage, appraisal firms and county assessors in NM.

The most interesting trend reported in this year’s survey is the indication that most of the commercial property types have turned the corner on decreasing values as CAP rates have started to decrease (slightly).

Tomorrow’s edition of the Business Outlook in the Albuquerque Journal will highlight information from the report.

Last year’s survey results can be found here.

The 2011 value survey can be found CCA-Survey-10012011-v10.

Apartments become more expensive

Thanks to Melissa Montoya for covering the latest in apartment trends on KOAT TV 7.

First responses from 2011 Census of homeless – in ABQ they are finding housing.

An update from our from the Albuquerque Heading Home homeless survey we helped with earlier this year.

An update from our from the Albuquerque Heading Home homeless survey we helped with earlier this year.

This article at 100k homes indicates that the first 15 homeless people from that survey have found housing – kudos to the Mayor and the folks at Albuquerque Heading Home for making this happen!

Property tax presentation for NM IREM Chapter

can be found here:

IREM-PropertyTaxUpdate-05052011-v2

thanks again to the IREM chapter for allowing me to provide them an update and overview of NM’s property tax system.

Update to Taxessor app now v2.1

iTunes had just pushed our latest update on the Taxessor app – it will now load your 2010 property tax values allowing you to compare your potential value with your current property tax value.

It is property tax season

Notices of value are in the mail, or will soon be in the mail. If you need assitance this year with your property taxes – we offer a number of services for you, your firm and your client including:

We have an “app” for that

If you are trying to determining if your value is “fair”, consider downloading our 99 cent app from the iTunes store – http://itunes.apple.com/us/app/taxessor/id419811562?mt=8

Version 1 of the app takes the Bernalillo county resolved cases from 2010 and applies it to your property to help you determine what your value could have been. Because 2010 is a revaluation year, hopefully these values will go down. Version 2 of the app, which is awaiting approval of will automatically lookup your info from the county website and compare it to the potential value.

If you need some light reading, how about our 320 page textbook?

Now in its 5th edition, the text walks you through the property tax process including calculating your bill, determining if you should protest, and provides case studies of formal hearings and claim of refunds. Available in PDF format for $39 or printed for $49 at http://www.canteraconsultants.com/books

Property Tax Class – is on May 19th, 2011

This NMREC approved course is good for 8 CE credit hours and includes the above mentioned app and textbook and provides hands on training on how to handle your protest and covers our everything you need to “understand NM’s Property Tax System” – course registration for the 5/19/2011 course can be made at – http://www.canteraconsultants.com/registration

Representation

Finally, if that all sounds like a lot of work, you can hire our firm to represent you. We will analyze your property for free, and we charge you a small percentage of the savings only in the first year we obtain a reduction. Over the last 22 years, we’ve won 97% of our cases, representing over a billion dollars of commercial real estate with an average reduction of 23%. We charge 1/3 of what we save the client (i.e if we reduce their property tax bill by $10,000 then we charge $3,333) and we pay a 25% referral fee (on what we collect) to licensed agents, property managers or Realtors. If they choose to waive the referral fee, we can reduce our fee to 25% of the savings, and let the client know why they received a special discount.

If you have a property tax problem, look to us to be your solution.

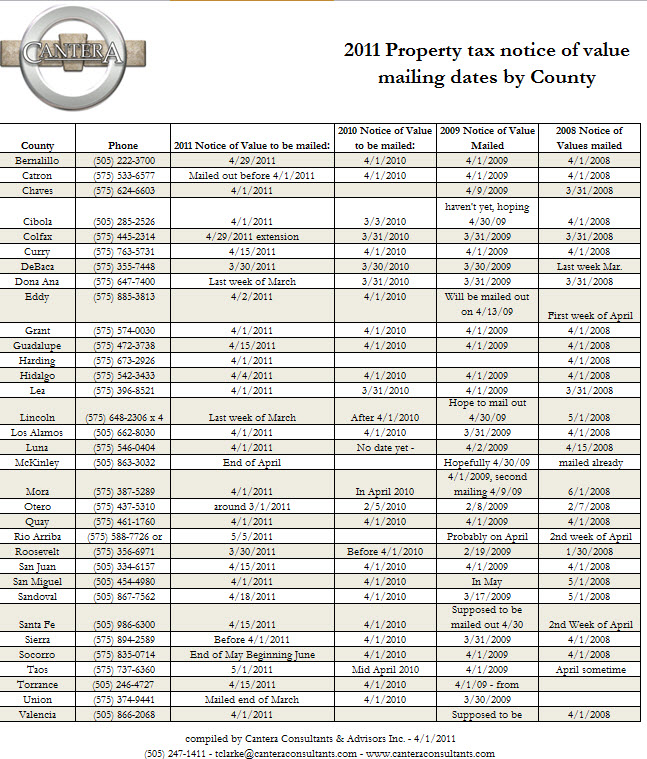

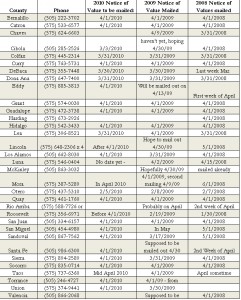

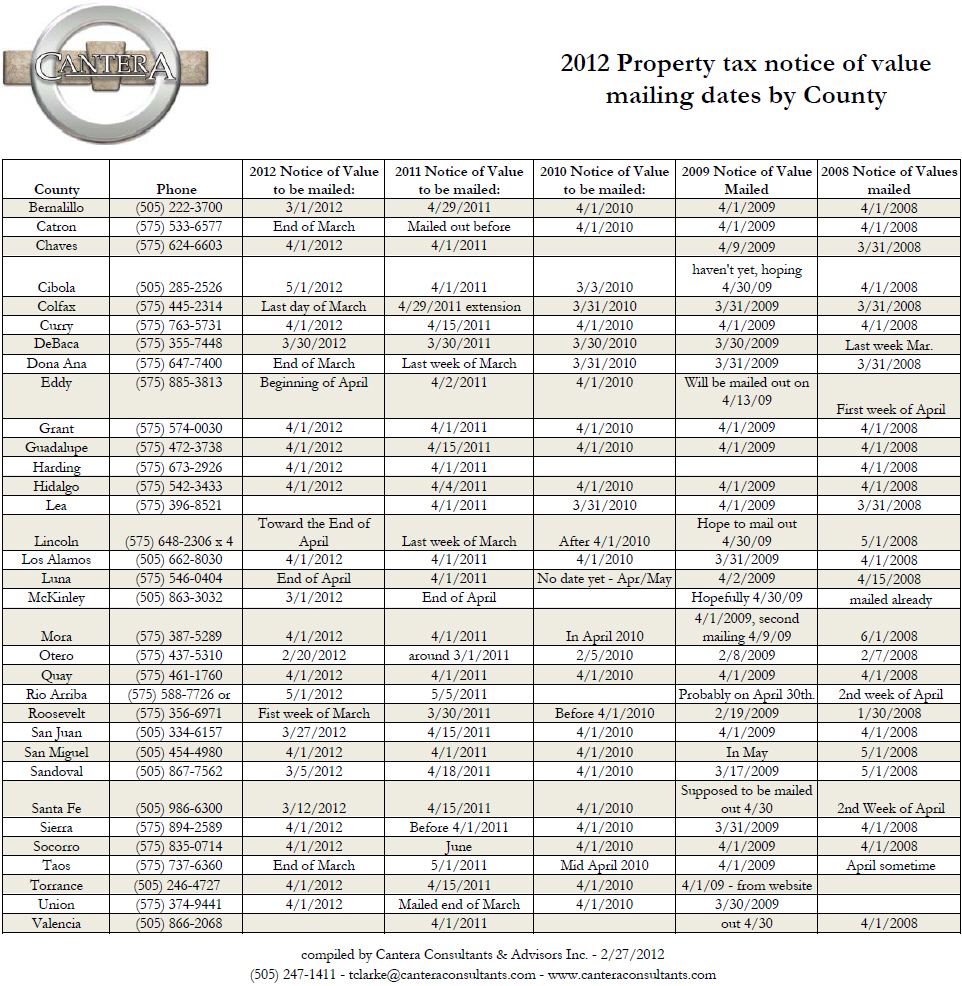

Notice of value dates for property tax bills

A new form of advertising – your house

Thanks to Gizmodo.com for sharing from Adzookie.com which is a UK based company that is offering to pay homeowners mortgages if they let them paint their house with advertisements.

Although the Gizmodo posting indicates the advertisement is only in UK, when I went to their website it looks like they are up and running in the USA as well!

my first iPhone app help client’s calculate their property taxes

Very excited – as of 5 minutes ago, our iPhone app to help client’s calculate their property taxes for commercial properties in Bernalillo County went “live” in the iTunes store! It is only 99 cents, and if you provide us feedback to improve version 2 and leave feedback, I’ll gladly send you a buck!

If you own a commercial property in Bernalillo County and you would like to compare your property’s value against the resolved cases from 2010, click here – http://itunes.apple.com/us/app/taxessor/id419811562?mt=8 to try it out.

The App is only $.99 and if you leave us a review and email me feedback at tclarke@nmapartment.com so we can improve version 2, I’ll gladly refund you a buck.

Thanks to Mark and Jamii at SWCP for making this happen.

Support for the app can be found here – http://www.taxessor.com .

More bricks and mortar fall to clicks

In a Wall Street Journal article dated today, Borders Group has indicated that they are making preperations to file bankruptcy in the forthcoming days.

Similar to the fallout of music stores after iTunes, Amazon website and digital readers has encouraged many readers to abandon physical stores. Companies that have figured out how to the digital frontier continue to thrive, while those that haven’t die. Interestingly , the same articles mentions that Borders tried going dot com a while back, threw in the towel and sold their initiative to Amazon.

“I think that there will be a 50% reduction in bricks-and-mortar shelf space for books within five years, and 90% within 10 years,” says Mike Shatzkin, chief executive of Idea Logical Co., a New York consulting firm. “Book stores are going away.””

—wsj.com 2/12/2011

Borders Group currently has over 600 locations, less than 1/2 of what it had in its peak at 2005.

In our market, Borders has a prominent location in the ABQ Uptown lifestyle center. I will be curious to see what the new highest and best use of that store will be.

Apartment update/forecast – ULI Dec. 2010

The New Mexico ULI chapter December meeting was a commercial real estate update that included Steve Maestas from NAI Maestas/Ward, John Ransom from Grubb & Ellis NM, Jim Folkman from the Home Builders of Central NM, and myself, Todd Clarke from NM Apartment Advisors Inc.

Our presentation can be viewed here.

CCIM Success Profiles – one of my mentors, John Henderson III CCIM

As you may know, the NM CCIM chapter #10 is collecting a series of stories about some of their most successful members – a task called “profiles in success”.

Many of us have had people in our lives who we are grateful for – persons who show up at the right time and point us in a new direction, or people that provide invaluable insight that changes our course for the better.

I am a 4th generation Commercial Realtor, and both of my parents were in the business and provided that role for me.

In addition to that, I’ve been fortunate enough to grow up in a business and community of individuals that lean towards sharing, supporting, who focus on growing the pie instead of figuring out how to make their own piece larger.

In turns out that isn’t by accident, but was by design. Over 30 years ago, a handful of commercial brokers assembled at one of the earliest meetings of the Leasing Information Network (now known as LIN). Like our country’s founding fathers, these brokers set down their ideals of how people in our business would interact. Cooperation was the key word of the day, with the idea that fees and information would be pulled out of individual silos and shared by all.

One of those leaders, John Henderson III CCIM, was an early mentor for me. I remember when I was a teenager John tactfully informed me that my personality could be improved by attending a Dale Carnegie course (he was right). When I started commercial real estate in 1989, John encouraged me to take a CCIM intro course as soon as possible, and like him, once I had the knowledge, I couldn’t stop. John went on to write a letter of support that helped me secure a CCIM 101 scholarship, and for me, the rest is history as CCIM has done more for my business than any other aspect of my life.

With that thought in mind, it is my pleasure to share this video about John’s start in the business – some 40 years ago, John Henderson was a successfully residential Realtor, whose own life would be changed by a mentor to him.

More on John’s beginning in commercial real estate can be found here at his video – http://www.nmcomreal.com/ccimintro2 .

If after hearing these stories, you believe you might benefit from taking a CCIM course – the local chapter has an intro course this on February 7th and 8th – for $245, a 43% discount over the national rate. You can register for the course at www.nmcomreal.com/ccim .

Thanks,

Todd

Are you an owner occupant in a Bernalillo County apartment building?

If so – you might be able to get your 2010 property taxes reduced (for free).

According to the Bernalillo County Assessor, Karen Montoya, if you owner occupy an apartment (you will need proof in the form of a drivers license or utility bill), you can call the assessor’s office at 222-3700 to seek a reduction in your 2010 property tax bill.

The assessor’s office will “correct this error through an administrative change”.

Filing a claim of refund for 2010 property taxes

After many months of strategizing, negotiating, researching, and putting together our cases for our client’s, Cantera Consultants & Advisors Inc. recently settled all of its cases on the controversial apartment property tax lightning cases for 2010 (click here to read the summary).

In a recent (and copyrighted) Albuquerque Journal article, The Bernalillo County Assessor has indicated that she intends to roll back the 2010 values on all apartments that were raised more than 3% over their 2009 values.

If you own an apartment that experienced an increased of more than 3% in value (over 2009), and you did not file a protest by May 20th of 2010, there is one additional option available to reduce your property taxes for 2010 – you can file a claim of refund.

While this is a normal a service we offer our clients for contingency fee, in this unique situation, I believe the work we (and others) have done for our client’s this year has laid the foundation for the remaining apartment owners who haven’t filed to seek a refund.

If you meet the following criteria, you might be able to handle this case yourself:

– If you are the owner of a property not held in a partnership or corporation, you can represent yourself at district court to seek a refund of your property taxes.

– If you have already paid your property taxes, the full amount (not the first half installment)

– If you fill out a claim of refund (again, its more than a form, it is a lawsuit)

– If you file, in person, and pay the filing fee

In New Mexico, a claim of refund is lawsuit against the county, in which you, as the property owner, claim that you have overpaid the county in property taxes.

While I am not an attorney, and cannot offer any legal advice, I have been involved in a handful of claim of refunds and I can tell you that you can go to the district court website at www.nmcourts.gov and search the cases for the name “Karen Montoya” (our current assessor) and request a copy of a claim of refund from the court (you must do so in person, and they will charge you a copy fee) and use it as a model for your claim of refund.

You can also download Chapter 11 of our book “Understanding NM’s Property Tax System -2010 edition” that includes a blank form that we’ve used before. The deadline to file the lawsuit is 60 days after the property tax bills were sent out.

When filling out the form – be sure and look up your property’s property tax bill information at Bernalillo County’s website. Part of the form requires that you calculate what your property tax bill should be (based on 2009 values + 3%) vs. what it was on the actual tax bill.

Most tax consultants, such as our selves, are also working with attorneys and can provide assistance, but this maybe one of the rare situations, where everything has already been resolved (thanks to those owners who filed protest, and there consultants/attorneys who worked through the cases in 2010), that an owner maybe able to simply handle this themselves.

****disclaimer – in case I haven’t made it totally clear – this information is provided as a public service, and it not intended to offer legal or real estate advice. Going to court without legal representation is not a wise idea.

Property Tax protests update for 2010

2010 Bernalillo County Multi-family Property tax rollback – the rest of the story.

The following is a summary of an email sent to clients after our December 15th, 2010 hearing:

As I was working through a review and update of the apartment property tax lightning cases of 2010, I was reminded of the ancient Chinese blessing (or curse depending on your viewpoint):

“May you live in interesting times”

Many people are not aware that this blessing has two follow-up lines:

“May you come to the attention of the authorities” and

“May you come to find what you are looking for”

Unfortunately, 2010 was a year where all three of these came true for many of us. With that in mind, The following is an update on the property tax protests for your property.

The short version of this update is simple: we were able to get your property the lowest value we believe was possible in 2010, that value is final, and is not subject to any further litigation or appeals.

The long version as follows:

In my 22 years of handling property tax protests, 2010 was a unique year. State statutes indicate that the “value” year was 2007, which represent the tail end of the peak in the real estate market, and yet here in 2010, values in many cases had plummeted. We can add to that mix a county assessor who had recently been told by two different judges in district court that parts of a law passed by the legislature in 2002, and enforced by 33 county assessors was unconstitutional. As these recent changes in the law have had a big impact on how properties are valued, and it would be a safe to say this was a “perfect storm” that could wipe many property owners out.

Why we believe our client’s hire us at Cantera Consultants & Advisors Inc.

As it relates to handling property tax protests for our clients, we have found that successful protests involve more than knowing valuation technique and state statutes, it is also about knowing the people and having a strategy.

Our strategy this year was as follows:

– To use time to the advantage of our clients

– To research, develop, or create market information for the foundation of value negotiations

– To provide our clients with the risk/return analysis of the values that were negotiated with the assessor’s appraisers

– To meet with our local politicians, keep abreast of the recent changes in law, and provide an continual education on our property tax system

– To keep our clients and the public informed as to the changes in the property tax arena

– To align ourselves with other professionals who have experience in the property tax protest arena and litigation (i.e. find a good attorney)

Market information

For the first time ever, our firm, Cantera Consultants and Advisor Inc., compiled a 5 year survey of occupancy, rental rates, CAP rates and value changes. This market information was published in the Albuquerque Journal earlier this year and was used to help our client’s in obtaining lower property tax values.

A bit of history about recent changes in the law

The law, known as the “property tax lighting” or “3% maximum increase” or “3% Cap on values” law limited the increase in values for residential properties by no more than 3%. What many people forget is that the law had other components, such as requiring all assessor’s to bring their entire portfolio to “current and correct values, which are to be no lower than 85% of market value” prior to implementing the cap.

The intention of this law was to minimize the impact of a property tax bill increase on the little old lady in Santa Fe whose neighborhood was being overrun by Hollywood types that were paying outlandish in prices for housing. The value of the little old lady’s house would rise to the recent sales, which would lead to an increase in her property tax bill to an amount she might not be able to afford.

While the intention of the law might have been noble, the thought process about how to implement it was poorly executed. If we as citizens of New Mexico have decided that the little old lady deserved protection, then the legislature could have granted her an exemption on her actual property tax bill. Instead, the law limited the increase of her assessed value by no more than 3% a year, or 6.1% every 2 years.

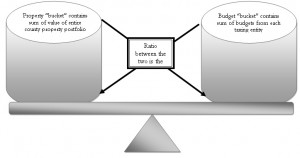

Anyone who has analyzed our property tax system knows that there are three variables that impact your final property tax bill. Your assessed value, the percentage of your property that is assessed, and the mill levy. In New Mexico, your assessed value should be close to “market value”, most properties are assessed at 1/3 of their market value, and the mill levy floats as a ratio between the county’s total property portfolio value and the budgets of those entities that tap into property taxes.

By limiting only the value of the property, the law did not limit the increases on the property tax bill. By requiring disclosure of all single family residential property sales, the law ensured the assessor had a ready pool of comparable sales, AND, many of us believed it opened the door for the legislature to consider a property transfer tax.

The law had some exemptions that allowed increases of more than 3%, including new construction, changes in zoning, and the sale of the property. If your property had experienced any of these, its value could be increased by more than 3%.

As property buyers came into title in their new property, they experienced a large increase in values, larger than the 3% of previous years, which led to the term of “property tax lightning” for the zapped feeling many of these owners experienced as their property tax bills shot through the roof.

From 2002 to 2009, residential property owners were repeatedly zapped with this unfair law. Typically, case law, or interpretation of laws in the court room allows our legal system to provide a balance against our legislature. Amazingly, it took a few years before a case was filed that impacted the interpretation of this law.

In 2009, a handful of property tax cases were brought against the Bernalillo County challenging the implementation of the exceptions to increasing values more than 3%. Two different judges ruled that the law was unconstitutional, and those cases have since been appealed, and now, on the eve of 2011, have still not been resolved.

Resolution or not, the message was clear – the legislature created a law that treated property tax owners differently based on the date of their purchase of a property.

At the end of 2009, and after these court rulings, the county assessor “rolled back” all single family home values that had been increased by more than 3% to their 3% limits.

As a side note – it is interesting to note that a legal opinion written about the same time as the law was being considered by the New Mexico Attorney general indicated that the while this new law may not be unconstitutional, “its application could be unconstitutional”.

Fast forward to spring of 2010, where the Bernalillo County assessor has two rulings that the 3% cap on increase law is unconstitutional. She decides to rolls back the value on some 45,000 single family homes that had experienced property tax lightning in former years.

As the overall value of the county’s portfolio is decreased by these roll backs, she also interprets that the law on limiting increase does not apply to apartment buildings based on their occupancy status and then she proceeds to raise the value on thousands of apartments across the county.

Although the decrease in single family values was not entirely offset by the increase in multifamily values, the timing of the two cannot be entirely coincidental.

Through out the summer, fall and winter of 2010, our office met with the county assessor’s appraisers and reviewed each of our client’s properties. In many cases, we were able to get a value reduction to the 2009 value plus 3%, or lower.

In some cases, we were able to get the value’s negotiated down close to the 2009 level +3%, and we signed off on those cases. Working with our client’s we performed a risk/return analysis that balanced an additional smaller decrease in value vs. the possibility of paying a property tax bill on the original assessed amount for many years as the cases worked their way through the property tax protest process and possible appeals into the legal system (keep in mind, those owners who prevailed in the 2009 single family property tax lightning cases are still paying higher property tax bills in 2009 and 2010 as their cases are still under appeal).

The balance of the property cases we had, totaling 30 in number, proceeded to formal hearings on December 15th, 2010. These were the most hard core cases, where none of the standard value techniques indicated a value remotely close to the 2009 plus 3%. In one particular case, while we able to reduce a property’s value by 50% from its 2010 assessment, the 2009 value plus 3% was another 50% lower. Each of these owner’s (including myself) indicated an ability to pay the higher property tax bill and a desire to continue their protest based solely on the legality of the removal of the 3% increase in values.

Assessor’s deposition

On November 19th, 2010, the Bernalillo County assessor was deposed by a handful of attorneys, including ours. I attended a majority of the deposition and I can tell you my summary at the time was that the most repeated answer in the 167 pages of the deposition, was “I don’t know”. Part of that consistent answer relates to the questions that some of the other attorneys asked – questions that showed a limited understanding of the assessor’s job duties, but the balance of the questions related to the assessor’s execution of the changes in values to apartments as it related to the removal of the 3% increase cap on values.

As you may know, there is a state statute that gives any county assessor a large advantage in formal hearings:

7-38-6. PRESUMPTION OF CORRECTNESS

Values of property for property taxation purposes determined by the department or the county assessor are presumed to be correct. Determinations of tax rates, classification, allocations of net taxable values of property to governmental units and the computation and determination of property taxes made by the officer or agency responsible there for under the Property Tax Code are presumed to be correct.Our belief was that the assessor’s deposition demonstrated that this presumption of correctness should not be applied by the formal tax board in these apartment cases.

Timing

Based on last year’s single family property tax lightning cases, and our experience from previous years, we believe the longer we can wait to resolve our cases, the more our client’s benefit. For example, last year, some of our clients benefitted from recent court rulings that came late in the year. Said succinctly, each year the aggregate protests carry with them a body of knowledge, and by being last or close to last in the protest process, we benefit from that knowledge base.

The unfortunate side effect of waiting until the end is that the assessor was successful in getting an extension of their cases until after the December 10, 2010 property tax bills were due, so many of our clients received a bill for full value.

Our formal hearings for unresolved cases were scheduled for December 15th, 2010.

Ostrowski Decision

On November 30th of 2010, the formal property tax board found in favor of a property owner who owned a single family residential property that was rented out. The property in this case had sold in 2004, and had been hit with tax lighting, but its value was not rolled back as it was believed to be a “non-owner occupant” property. The board ruled that irrespective of the property’s occupancy status, it was not being treated uniformly with other similar properties. The board ruled that the value be rolled back.

Owings Star decision

On December 3rd, 2010, the formal property tax board found in favor of the county assessor in a case where an apartment owner believed that their property had been discriminated against based on its increase value of 25%. Unfortunately, the owner presented little in evidence to demonstrate said discrimination, and the formal property tax board, citing the case Hahn, Inc. vs. County Assessor that “the bar is set very high for a property owner claiming discrimination. What must be proven is an intentional scheme of discrimination, for which there is no evidence here”, and the formal board found in favor of the assessor.

Unresolved Decision

On December 9th, 2010, the formal tax board convened to hear the 40+ cases of another tax consultant and his attorney. Although the assessor had been subpoenaed to appear, the county attorney informed the board that she would not be appearing, and that the consultant, and their respective property tax owners, did not have the authority to subpoena an assessor to appear. Both sides tendered their briefs and this case should be ruled on by January 8th, 2011.

Clarke Stipulation

About a week before the hearing, our attorney, Stephanie Dzur (who prevailed in the single family residential property tax lightning cases in 2009), extended an offer to the county attorney’s office. The offer was an agreement that indicated we understood that the county assessor has been making decisions based on the information available at the time, and while we respected the difficult position she was in, we believed we would prevail at formal hearings, and as such, the county should agree to rolling back all of our pending protests to the 2009 values plus a 3% increase. As part of this offer, Mrs. Dzur shared with the county assessor our case, which we believed to be very strong.

Wednesday, December 15th, was our formal hearing for all remaining property tax protests for Bernalillo County. By Tuesday afternoon, we had been able to negotiate all of our pending cases down to the lowest values, subject only to the apartment cases that has experienced “tax lightning” or an increase of more than 3%.

Wednesday morning, I received a call from the assessor and she indicated that she wanted to meet with myself, the county attorney, and our attorney, Stephanie Dzur. The assessor indicated that based on how the formal board was ruling, she believed that apartments should not be treated differently, and although she intended to appeal some of the formal rulings, she was willing to resolve and sign off on the balance of cases if we could come to terms on a stipulated agreement.

Over the course of the morning, we modified the language of our original stipulation presented in our offer the week before.

Although we had an intellectual interest in pursuing the case through formal boards and a passion to put on our case, foremost in our minds was the issue of an appeal. The assessor had indicated that she was going to appeal the decision of the formal tax board, and similar to the property tax lighting cases of 2009, we were concerned that our client’s would be exposed to many years of property tax bills based on much higher amounts, until the legal system could provide a final and complete ruling.

By working through the stipulated agreement, you and our other clients would benefit from a lower property tax bill and a final decision that was not appealable. For each property that was subject to this agreement, I have already forwarded to you the stipulated agreement. The gist of it is that we agreed that the assessor interpreted the law based on the best information she had at the time, that the information was changing over time, and that we wanted our clients to benefit from that updated information by being treated the same as other the residential properties in 2010.

In the end, we believe we had the better hand, the better case, and that it led to the best possible outcome.

2011 and beyond

Many of our client have asked us what 2011 will hold, and to be candid, while I have many ideas as to what might come about with a new governor, a “refreshed” legislature, and an reelected assessor, I remain hopeful that they will have the courage to deal with this pressing issue head-on.

My largest concern for future years is the creeping of politics in the property tax system. In his autobiography, Former Governor King indicated that one of the many reasons he wanted the state constitution rewritten in the 1970’s was to push politics out of the property tax system. The laws that came out of that constitutional congress served our state well for over three decades, but all of that effort has been undone by recent laws. Until we repeal those laws, or modify our property tax system I remain concerned that politics and politicians will continue to provide uncertainty in our property tax system. That uncertainty translates to an opaque property tax system that will have an impact on all of our property values.

Fortunately, organizations like the Apartment Association of New Mexico and NAIOP are staying on top of these issues by meeting with our elected leaders to provide a better outcome. If you are not currently a member of both of these organizations, I would highly recommend signing up in 2011.

My apologies for the lengthy update, but I thought you might have an interest in the rest of the story. If you have an interest in copies of any of the above mentioned documents, don’t hesitate to let me know.

Thanks,

Todd

————————-

Todd Clarke CCIM

Cantera Consultants & Advisors Inc.

715 8th NW Albuquerque NM 87102

O 505-247-1411

M 505-440-TODD

F 800-791-4047

tclarke@nmapartment.com

www.nmapartment.com

Read Confessions of a Commercial Real Estate Consultant – www.toddclarke.com

————————-

770 KKOB Radio update – 11/29/2010 – Forecasting real estate in 2011

Bob: what do you have for us today Todd

Todd: Good morning Bob! It’s hard to believe the holidays are already upon us and before you know it the end of the year will be here. As that time approaches, many of our customers wonder what 2011 will hold for the real estate industry and whether NM’s real estate market will lead, follow or diverge from national trends.

Bob: Todd, do you have a forecasting resource to help answer these question?

Todd: We sure do Bob, our firm has followed a publication called “the Emerging Trends in Real Estate” which is published by the Urban Land Institute and Price/Waterhouse/Coopers. For 32 years the authors of this publication have called upon the leading experts in the real estate industry to ask them what they see in their business in the coming year. This report provides an outlook on U.S. investment and development trends, real estate finance and capital markets, with a focus on key property sectors. The report draws on formal and informal surveys of real estate executives, investors, developers, and market experts around the U.S., including survey responses from over 500 real estate executives and personal interviews with over 125 industry leaders.

Bob: Sounds very comprehensive Todd, where can our listeners get a copy?

Todd: Bob there are two ways to get a copy – you can join the Urban Land Institute at www.uli.org, OR, you can attend their “Outlook NM” event to be held on the evening of December 9th, 2010

Bob: Can you tell me a bit more about this event?

Todd: I sure can – the national speaker is Chuck DiRocco from Price/Waterhouse/Cooper and he will be followed by our local panelists, Steve Maestas at Maestas Ward who will talk about retail, John Ranson of Grubb & Ellis who will address Office and Industrial, Jim Folkman of the HomeBuilders of Central NM who will discuss the single family residential market, and I will be covering the apartment industry.

Bob: Sounds like a full event – how can our listeners participate?

Todd: The cost of the event, which includes the publication is $60 – to RSVP – call the local Urban Land Institute office 505-269-7695 or call me anytime at 440-TODD.

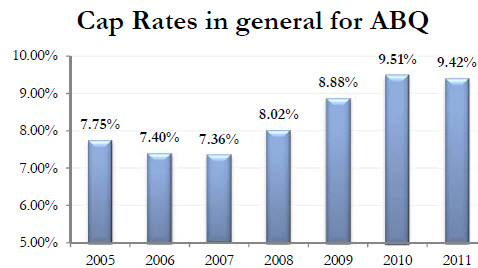

NM Commercial Real Estate Value Survey

Cantera Consultants & Advisors has just released the results from our latest valuation survey. This survey was performed over the summer of 2010 with real estate owners, investors, lenders, brokers and appraisers.

The attached document demonstrates the changes in CAP rates and values from 2005 to 2010.

Click here for the survey results and a related newspaper article CCA-Survey-07092010-v8plusJournalArticle

NM Notices of property tax value are being mailed out

Bernalillo County is mailng out notices of value on April 1st, 2010 and the deadline to file a protest of value will be 30 days after that.

The remaining 32 counties have indicated that this is there mailing schedule:

Our firm offers three options to assist you in property tax protests:

1. buy our 250+ page, fourth edition text book – click here to order for $49.

2. attend our “Understanding NM’s Property Tax System” course on April 15th, 2010 – you can register by clicking here.

3. hire our firm to represent you on a contigency basis – email tclarke@nmapartment.com or call 440-TODD (8633) for more info.

The potential impact of upcoming legislative and legal changes on NM’s Property Tax System

I think of our property tax system as a bit of a prisoner’s dilemma (that is the game theory where two suspects are picked up by the police – if they both refuse to cooperate they walk, if either turns on the other suspect, then other suspect goes to jail, and if they both turn in the other, they both go to jail). Applying that to our property tax system, I believe that most property owners want a fair system, but so long as there are loopholes or the perception of unfairness, than they too want that loop hole – the end game of which is a downward spiral in tax revenues.

Personally, I believe in supporting the person who has the right ideas over a party ideology– and former Governor King is just such a person – in the early 1970s he had the state constitution rewritten, in part to deal with the inequities in the property tax system (it was common for your political affiliation to dictate how high or low your property taxes are). So whenever I contemplate changes to the property tax law, I think, what would Gov. King look for that would create a fair equitable system.

Although our property tax system has a lot of “fairness” built into it, simple it isn’t. This flow chart shows how the property tax system works and who can influence it.

If I grossly simplify that process, there are four places to influence the final tax bill:

- The property value

- The % of that property value that is assessed (current 1/3)

- Deduction for any exemptions

- Mill levy (which is calculated by taking the total budget for taxing entities and dividing that by net taxable value for each county’s portfolio)

So simply said, our tax bill is calculated by taking:

Property value x % of assessment – allowed deductions = net taxable value x mill levy.

By having the law focus on only property value, it is possible to have no net change on the tax payers final properly tax bill. For example – if we had a law that said every property would double in value (say to reflect true market conditions) in 2010, then net impact on the tax bill would be no net change. (When you double the values, you halve the mill levy).

So in dealing with the two issues of tax lightning and fairness, my own personal belief is:

- At the time, (I was on a panel with him when he said this), the original intent of the Santa Fe assessor who wrote the some-what-disclosure & 3% cap law, he did so with the intent to protect the little old lady who has had the same house for 100+ years in Santa Fe – the idea was to keep her property taxes down even when the values were being pushed up by the Hollywood crowd moving into her neighborhood. This could have been handled through an exemption (like we do for Veterans and head of household, etc.), and we wouldn’t have the issues we do now. If the law was turned into the protecting the little old lady law through exemption, but it kept her property value

- I believe his true intent was to push through sales disclosure. The way the law was written, if an assessor disclosed information that had been disclosed to them, for every incident of disclosure, they were liable for a $1,000 fine, but the tax protest process requires the assessor to provide the protestant with complete copies of info (covered under part of the state statutes that deal with disclosure in court cases) – so I file a protest, the assessor uses 6 comparable sales that were disclosed to them by a property owner and that property owner could sue them for $6,000 – many of the 33 assessor’s were scared of this law and how to protect property info (I know of a county down south where you could “purchase” the assessor’s data set for a nominal amount of money).

- The 3% CAP was only supposed to protect the little old lady, not the average home owner, and certainly not the large apartment owner (22 counties consider apartments residential, 10 consider them commercial, and 1 just doesn’t know). BUT now that the law exists, I have been able to get my large apartment owners the same protection (no increase in value and a 3% CAP) – and as much as I love my industry, that just isn’t fair for our community.

- So looking at the law from every angle, there is no piece of the original legislation that provides transparency or disclosure.

- For residential, the law should be repealed entirely. The 3% CAP distorts everyone’s property taxes (when California passed proposition 13 (basically a limit on property tax increases), that state when from one of the best in schools and infrastructures to one of the worse.

- The commercial property owner and broker just isn’t paying attention – for example, let’s say you own a property in Rio Rancho – last year the residential property owners (who live in Sandoval County) voted to effectively double their mill rate by taxing themselves for a new college and hospital. The non-voting commercial property owner is now receiving a tax bill for $40,000 instead of $20,000 which has decreased their property value (in the short term at least) by $500,000 (8% CAP rate) or 20% of its original value of $2.5M.

- Furthermore, as the residential values decrease through the 3% CAP, the commercial property bears the burden of taxation. Although this next example is a different expense item, but it illustrates the unintended changes caused by new laws – in Florida, to reduce insurance costs, the legislature shifted more of the burden from residential to commercial – so much so that a 1,000 unit development project I worked on had a insurance bill as an apartment (commercial) that was 10 times higher ($2M) than if it was a condo (residential) which would have an insurance bill of $200,000. The Caps on increases of value for one property class will cause the same distortion.

- As it relates to newly developed properties – I have a client who tried to build a 300+ unit new construction apartment on Albuquerque’s Westside – its likely value was going to be lead to a tax bill that was 3.5 times higher than similar properties that had been built in previous years (which were subject to a CAP as well) – so the existing property owner had an unfair competitive advantage that caused this apartment not to be developed. To fix that, I think we would need a system where by new construction is phased in over 3 years to its full value AND we need a system that allows all property’s to be raised to their full value

- FAs it relates to bond issues, I believe when the voters vote, they need to understand that while their property taxes may (or may not) go up, by declining a bond issue, their property taxes could go down. Said another way if the ballot said “would you vote for a new library knowing that it would raise your property taxes by $40 a year for every $100,000 in value your house had (Y/N).” Then the tax payer/voter could consider the value the said public amenity (road, library, school, hospital, etc) adds to their community. Further consideration would have to be given to whether commercial benefits from every public service (fire/police= yes, library/school-no) and how we accommodate for that.

Finally, to have a fully fair and equitable process, any future laws need to model the impact on values based on the current mill levy, % of value, and property value and the outcome needs to be one where we can:

- Explain it to a new buyer or developer (for example – your property tax bill will likely be 1% of what you pay)

- Is transparent in operation (if I showed you the inequities in what we have now, and the loopholes that I as a tax consultant can use, you would be amazed at the lack of transparency)

- Is as fair as possible (i.e. you could look at your neighbor’s property tax bills and understand why they are similar (in value) or dissimilar (in exemption) as yours)

- Does it eliminate the abuse of unintended loophole as possible (when I was in China, they had a property tax that said you would only be taxed if your property was 100% complete – guess how many 40 story hi-rises I saw with an unfinished floor?)

Spaceport NM update

Thanks to Richard David for turning me on to this article about the spaceports status…

Thanks to Richard David for turning me on to this article about the spaceports status…

Albuquerque is #2!

Based on employment, quality of jobs, and the ability of cities to retain jobs in a down economy, Albuquerque came in #2 on Kiplingers Best Cities list.

Many of us know that good jobs are the drivers of demand for commercial real estate – and it is good affirmation for those investors who own and continue to buy in Albuquerque.

An update on property tax legislation

From the RANM newsletter dated 3/10/2009

FROM THE NEW MEXICO LEGISLATURE

Property Tax Disclosure Bills

Another property tax disclosure bill has moved in the Senate the last ten days. SB 564 (Duran), originally introduced in the Senate at the request of RANM, would require the property owner to provide the written declaration obtained from the county assessor stating the estimated taxes after sale of the house and valuation at the new price. The bill passed the Senate yesterday and now goes to the House.

HB 261 (Sandoval), introduced in the House, requires the seller or seller’s broker to obtain the future tax declaration from the county assessor. This is the bill we have worked to amend so that brokers are protected from liability. It passed the House and now goes to the Senate. Each bill has sufficient protections for real estate brokers.

SB 181 and SB 333 Property Tax Bills

Thanks for the great response to the Call to Action last week. SB 181 (Boitano) passed the Senate Finance Committee March 3 after the Call to Action and is now on the floor of the Senate for action. The bill would protect residential property with the annual 3 percent cap even upon sale of the property.

SB 333 would lower the maximum percentage of an undeveloped property’s market value which can be taxed from 33 1/3 percent to 16 2/3 percent. It has been on the schedule of the Senate Finance Committee for five days, and may not move.

My own 2 cents…

Senate Bill 564 is a good idea except where it snags apartment buildings… (apartments are in a purgatory area, and the last thing a seller wants to do is disclose a sale that many counties don’t require be disclosed)

The remaining bills only add to the mess that was created with partial disclosure, and will eventually lead to much larger bills for all of us (they seem to forget, when you push down values, everyone’s values, the mill levy increases) – if the goal is to achieve equity in the system – this doesn’t do it.

NM Apartment Market Review 2008/ Forecast 2009

Albuquerque Apartment market update2008 in review, looking forward to 2010 by Todd Clarke CCIM

The saying “may you live in interesting times” certainly seems to fit in today’s environment. Although the author and origin of this phrase is unknown, it is believed that it was composed as a curse and included two more phrases:

– May you come to the attention of those in authority

– May you find what you are looking for

Certainly, I think we could agree that our country’s financial sector is currently living under all three auspices.

In the following update, I attempt to summarize what is going on in today’s apartment market analyzing each of the components that the apartment market depends on for success, including a national perspective, and drilling down to our own local market.

Demand driver for apartment units

One of the fundamentals of the apartment industry is the concept that the occupancy of apartments is driven by population growth which is driven by job growth. By following job growth, one can make reasonable projections of future apartment occupancy.

National Employment

Between December 2007 and December 2009, unemployment increased by 2.3% to 7.2%, which means there are an additional 3,000,000 people without jobs. Unemployment has not been this high since 1992, and forecasts indicate this trends will likely continue as more and more companies are announcing layoffs.

Demand driver for apartment investors

The ability for an apartment investor to convert the equity in their property into cash depends on the liquidity of the financial markets, so financing is a major driver of buyer demand for apartment investments. When financing dries up the audience of future buyers becomes limited and, the investors risk rate increases as the safety of their net equity becomes less certain.

How did we get here?

Late in 2007, a perfect storm of excess liquidity, irrational exuberance, dubious rating assignments and quirky quant modeling (http://en.wikipedia.org/wiki/Quantitative_analyst ) assaulted investment markets in our country, and one by one, major banks, insurance companies, corporations, and now real estate investors are falling victim to the ensuing outcome.

As the economic trends continue to spread gloom and doom, comparisons are often made to depression era. I recently read John Kenneth Galbraith’s “The Great Crash of 1929” book which provides a detailed overview of that era. Certainly, some parallels exist between the two – the similarity of the downward spiral. The fact that both downturns were accelerated due to the great deal of leverage used for investments, limited cases of fraud, and the belief that the would continue to increase. The depression also was an unregulated free-for-all where numerous companies existed solely to invest in other companies, many of whom had only an idea and marginal cash flow or assets. Investors had limited information and bench marks to measure an investments return, except for its stock value. Today’s investor suffers from an overload of information and analysis, making it harder to sort out what is important and relevant versus the insignificant.

The largest difference between the 1930’s depression and today is three fold: improved transparency in market trades/information, increased sophistication of the market and increased oversight by our government.

Globally

From a macro perspective, part of the current economic crisis can be traced back to America’s ongoing trade deficit with countries like China. China in turn has reinvested our trade deficit dollars in USA government backed securities and treasury bills, effectively binding together the two countries economically even tighter. The national debt currently exceeds $10 trillion dollars (http://www.brillig.com/debt_clock/) and continues to increase at the rate of $3.31 billion a day since September of 2007.

China’s choice to reinvest those funds back into the United States, has increased the monetary supply, which has increased the access to capital for most investors. It created excess liquidity as there were more investors chasing few deals. As the market continued to climb to new heights, many investors started to believe in a “new methodology” for property values which only increased the disconnect between prices and the elementary market fundamentals. Said another way, as long as the market was increasing in value, more and more investors were willing to place their equity in any investment, with the hope of increasing prices, often ignoring the fact that the market was overdue for a correction, which historically purges the excesses of the market of equity and restore balance between the number of sellers and buyers of investments.

WTF? (where is the financing?)

On a Federal level, the government continues to encourage lenders to fund loans in the marketplace with carrots (bailouts), and sticks (threats of government takeover). Unfortunately the lack of liquidity in the marketplace will not be easily remedied with carrots or sticks, but only with trust.

The mortgage market has been cast as this decade’s financial villain, but the reality is that even though liar (no documentation) and ninja (no income, no job) loans did nothing to improve the industry’s reputation, only a small percentage of the market has actually defaulted on their loan.

The silent villain in this financial meltdown is also public policy or federal legislation. Although this legislation was intended to create more home ownership opportunities it did so by creating a new class of mortgages – subprime, named for the borrowers, who had less than ideal credit.

While the percentages of foreclosures for these mortgage products is higher than historical averages, there is something more toxic underlying these mortgages – known as CDO’s or collateralised-debt obligations. A recent article in the Economist does a fabulous job of describing these instruments and their undoing:

“Muddling the Mortgage

Yet the idea behind modeling got garbled when pools of mortgages were bundled up into collateralised-debt obligations (CDOs). The principle is simple enough. Imagine a waterfall of mortgage payments: the AAA investors at the top catch their share, the next in line take their share from what remains, and so on. At the bottom are the “equity investors” who get nothing if people default on their mortgage payments and the money runs out.Despite the theory, CDOs were hopeless, at least with hindsight (doesn’t that phrase come easily?). The cash flowing from mortgage payments into a single CDO had to filter up through several layers. Assets were bundled into a pool, securitised, stuffed into a CDO, bits of that plugged into the next CDO and so on and on. Each source of a CDO had interminable pages of its own documentation and conditions, and a typical CDO might receive income from several hundred sources. It was a lawyer’s paradise.

This baffling complexity could hardly be more different from an equity or an interest rate. It made CDOs impossible to model in anything but the most rudimentary way—all the more so because each one contained a unique combination of underlying assets. Each CDO would be sold on the basis of its own scenario, using central assumptions about the future of interest rates and defaults to “demonstrate” the payouts over, say, the next 30 years. This central scenario would then be “stress-tested” to show that the CDO was robust—though oddly the tests did not include a 20% fall in house prices.

This was modeling at its most feeble. Derivatives model an unknown price from today’s known market prices. By contrast, modeling from history is dangerous. There was no guarantee that the future would be like the past, if only because the American housing market had never before been buoyed up by a frenzy of CDOs. In any case, there are not enough past housing data to form a rich statistical picture of the market—especially if you decide not to include the 1930s nationwide fall in house prices in your sample.”

-the Economist, “In Plato’s Cave”, January 22nd, 2009

Essentially, the Wall Street gurus packaged together a large bundle of mortgages, which then they split into a various pieces, obtaining a rating for each piece, obtaining insurance for those pieces with ratings, then selling those insured/rated portions of the mortgage pool as low risk assets.

Although there are a multitude of problems that have emerged, the largest is the total disconnect between the property owner and the property loan. As you pay the loan on your house today, the interest portion may go to one CDO, the principal portion to another, and the payoff of the loan to yet another. That all may work so long as you can make your loan payments. But if you lose your job and you can’t make loan payments, then which CDO do you negotiate with to buy more time?

Let’s say you’re an institutional investor, pension fund, or bank who owns a lot of these CDO’s and you see an uptick in foreclosures – in fact a doubling from the historical average of 3.5% to 7%. You would like to work with the property owners, but you don’t actually own their mortgage, just a piece of it. To work with the owner would require several other institutions to agree to work with the owner, which is unlikely, so the property goes into foreclosure.

With more foreclosures than the quant modeling indicated would ever be likely, the market for more collateralized mortgages evaporates, and now there aren’t any buyers for the good or bad parts of your portfolio.

Meanwhile, back in the neighborhood, home buyers are waiting to see if they can get a better deal from a future foreclosure than an existing seller, so the housing market starts to see a large decrease in the volume of sales. Pretty soon, buyers of home are waiting on the fence to see if better deals are around the corner, and the market activity goes from cool to freezing.

Without sufficient market comparable sales of homes or mortgage pools, it becomes harder for sellers of homes or sellers of mortgage backed securities to value their existing portfolios.

The nail in the coffin for a complete downward spiral: poorly defined account regulations

The lending log jam is further hampered by auditors in the accounting industry who feel the obligation to hold corporations to a series of accounting standards like the “FAS-157-Mark to Market” (http://www.toddclarke.net/?p=318). This standard impacts how corporations “value” their holdings. The auditors biggest complaint is the portions of this standard that leave it to the auditor to determine a discount rate. To an auditor, interpretation equates to increased auditor liability which further encourages the auditor to use a more aggressive discount rate than the market would typically experience.

The CCIM Institute is working with our nation’s leaders to provide clarity on these regulations. To quote CCIM’s national president, Mac McClure:

“Under the rules, the accountant must use three levels to mark to market: level 1 active trading market, level 2 observable market data, and level 3 auditor discretion or discounted cash flow. Just like the commercial real estate appraisal business, level 1 would imply the auditor must find comparables which, in a market like today, are really non-existent. Level 2 represents observable market data which, in today’s market, we have very little or no trading of Commercial Mortgage Backed Securities. Level 3 is the use of Discounted Cash Flow Analysis which is what we taught the RTC, FDIC, GAO, and all the other government agencies in 1987-1990 to use. In practice, accountants want to be told which one of these to use or they want to be given the flexibility to use the one that fits the situation clearly. Under the current rules, accountants are having a real problem getting to level 3 because of the wording “auditor discretion.” In my discussion with the head of one of the largest accounting and audit firms in the United States today, he said the word “auditor discretion” is the kiss of death for discounted cash flow because no auditor will jump that hurdle. Instead, they would rather deeply discount the value of the asset because there are no comparables or market data that subject themselves to the potential scrutiny of an Enron-type investigation. However, if those two words were eliminated, they would be free to use any of the three methods to underwrite value.”

As an analogy, let’s say you own a 100 unit apartment in a good location, that possesses minimal deferred maintenance, with a solid history of stable cash flows, that you recently purchased for $5M. In the last year, only one other apartment in that size range has sold and it was a a beater, down and out, crime infested in the worst neighborhood in the city. Since many sellers don’t have to sell, they wait to do so, which deprives the market place of good comparable sales, leaving only the desperate to sell.

According to an auditor/accountant, the lack of market comparables would make the Level 1 standard of an “active market” ineligible, and as this sale was the only “observer able market data” Level 2 doesn’t apply, so that leaves Level 3, the discount rate as the only available value option. Remembering the fate of Arthur/Anderson, the auditor picks a large discount rate (say 20%). All of a sudden the “value” of your property is far less than what you paid, than what you would sell it for today (or any day), and far less than the property’s loan, so your lender triggers a clause in your loan that allows them to call the entire balance if a particular loan to value ratio is not maintained. Foreclosure ensues, followed by a fire sale of the property, and if enough of these properties sell in distress, they will establish a new lower market value, which then starts the whole downward spiral over again.

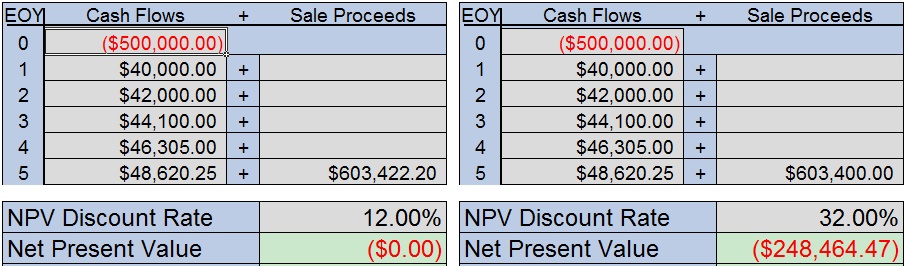

This example illustrates the difference of using an average and aggressive discount rate on the same fictional property’s cash flows:

Net value of the property at 12% IRR Net value of the property at 32% IRR

The table on the left indicates the return an investor would receive for a $500,000 down payment on a series of future cash flows and a disposition in year 5. This return is a reasonable 12%.

Lacking comparable sales, auditors might use a much higher discount rate, say 32%. On paper, the net value of the property has decreased by $248,464 or 50%.

This example demonstrates that even though the property’s cash flow remained unchanged, its dynamics where still in balance, and it was performing quite well, but a few misguided words of legislation put the property, and the investor’s equity into jeopardy.

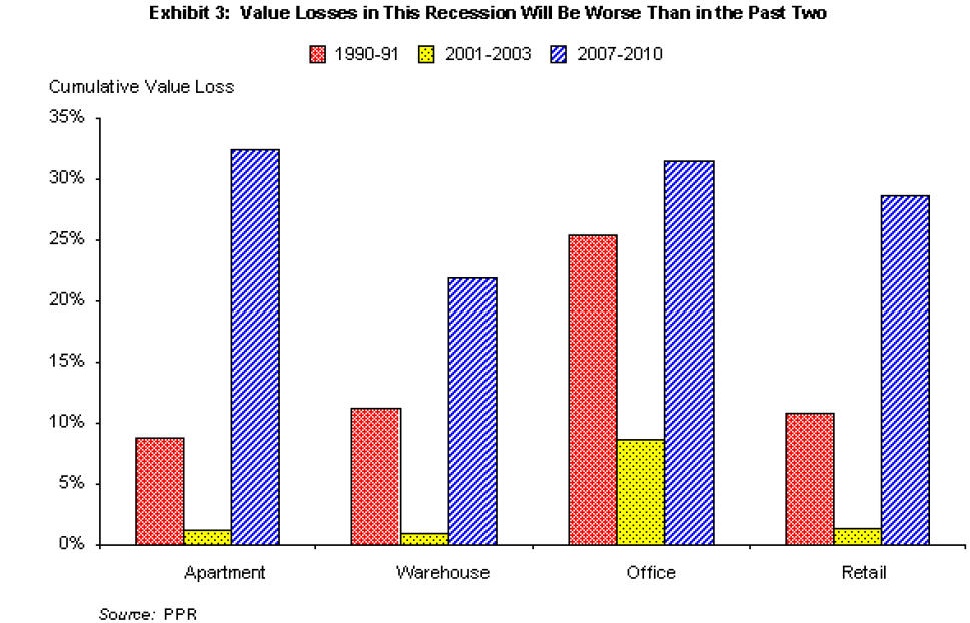

While this is a dire prediction, it seems many economists, like Susan Hudson-Wilson of Property Portfolio & Research (www.toddclarke.com/press/PPR_National_Employment-012009) are forecasting scenarios that include 32% decreases in national apartment values between 2007-2010.

Trust and transparency is at the heart of all these issues

So what happens if you are a financial institution holding a pool of mortgages or a portion of mortgages that are “highly” rated and the cash flow is less than what you thought? How do you value the balance of your portfolio if the accounting standards are not clear? How do you make sane business decisions when the rest of the market is extremely volatile?

You don’t – instead you end up losing trust. You can’t trust the valuations for your own portfolios and investments. If you can no longer assign value to your own portfolio then how can you trust that other companies and banks can?

Trust is the lubrication that keeps market gears turning.

Most of our financial system is built on trust. Banks that used to loan each other money short term, often overnight, no longer do so because they aren’t sure what kind of financial condition the lender, or the borrower is in. So they start holding on to cash. They start hunkering down.

Our Federal Government realized this for a brief time last fall when they offered to let financial institutions sell their toxic debt to the taxpayers, to get a clean start. But the fallacy in doing so was that the government assumed every institutions knew bad debt from good debt – and as we’ve already discussed, once the auditors apply a steep discount rate to all of your investments, bad and good start to look alike.

Transparency follows trust or as President Reagan was once quoted saying “Trust but verify”. During 2008, financial intuitions wrote down large portions of their portfolios value, but they couldn’t explain to their stock holders how they arrived at those write downs, and quarter after quarter, more and more write downs followed, to the point that stock holders no longer understood what they owned either.

To stop a run on the banks, the Federal Government created the Troubled Assets Relief Program (TARP). An impressive amount of federal money was set aside to become a safety net for the banks and their toxic debts. It has been more than three months since TARP was passed, and I think many people are starting to realize that what the banks truly needed is a safety net. A tarp covers your assets during a storm but this TARP has become an opportunity for the government to intrude into the day to day operations of a company on issues like the executive compensation and company sales junkets. It’s a bit like reshuffling the chairs on the Titanic right after it hit the iceberg.

It has been recently reported that there are a number of local and regional banks that opted out of the ability to tap into the TARP funds due to the uncertainty associated with the strings that the government is imposing on TARP recipients.

Keep in mind, part of this mess was created by social tinkering by our government and the thought that more tinkering, or taking on more debt will solve this problem appears counter intuitive to the solutions the market and this country need.

So what can the Federal Government do?

One economist indicated the best thing the government could do to expedite a cleanup of this financial mess would be to mandate all federally insured institutions replace their top management by a certain date, or risk losing FDIC insurance. As the new officers came on board, they would be extremely diligent in finding all of their toxic debt, and shedding it as part of their turn around process.

Lacking that, a second financial market could be created without the regulatory shortcomings of the current market. This new market should have clear accounting rules and more importantly, one regulator to report to.

In short, until transparency in the bank holdings is created, ideally with sound valuation methodologies, trust will not exist between the players which will only prolong the capital market crisis.

Translating the residential real estate market to the commercial real estate market

If residential mortgages provided the fuel for the CDO’s spark that led to the fire of the current meltdown, how has this spread to other markets?

For the most part, commercial real estate and apartments continue to have sound fundamentals, but many of these properties have loans that are payable in full in the next couple of years. One of the world’s largest industrial investors, ProLogis, has billions of dollars of loans that renew on stabilized, class A, industrial properties in the next couple of years.

The shift from excess liquidity to scarcity of finance has put these investors in a tenuous position leaving them with the options of waiting it out, hoping liquidity is restored, or wholesaling their assets to use pent up equity to retire existing debt.

This has recently been evidenced by the thrashing of stock values experienced by Real Estate Investment Trusts like ProLogis, AIMCO, UDR, and General Growth. Most of which have started liquidating parts of their portfolio (http://www.toddclarke.net/?p=211).

And now, your local perspective

During 2008, Albuquerque felt like it lived in a parallel universe that was disconnected from the national economy – jobs continued to roll in, foreclosures were some of the lowest in the country, single family housing held on to most of its values, apartment occupancies continued to increase, as so did rental rates.

Albuquerque Employment Overview

The ongoing gloom and doom on a national level is starting to permeate the Albuquerque economy as the capital crunch continues to starve many businesses of the funding they need for day to day operations.

As you may know, Albuquerque was recently rated one of the top 5 cities in the country to build wealth in. Although the ups and downs of Eclipse Aviation’s bankruptcy have garnered major headlines, the labor department’s (http://www.dws.state.nm.us/dws-Mnews.html) latest release of employment data indicates that unemployment has been creeping up slowly since last summer’s announcement that it was at a 30 year low.

Albuquerque Sales last year

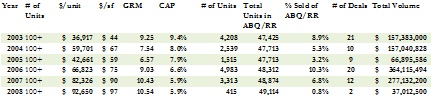

2008 was not a banner year for apartment sales in Albuquerque. The volume of sales decreased by 75% from $336M to $82M, with the 100+ unit apartments leading the way decreasing in sales from $277M to $37M. In fact, further analysis of the 100+ unit sales indicates that both sales that occurred in 2008, were actually put under contract in 2007. While the overall volume of sales decreased, valuation benchmarks showed only marginal decreases ranging from 10% to 15%.

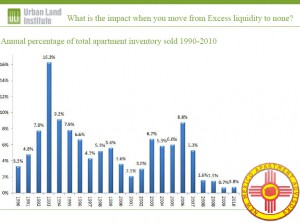

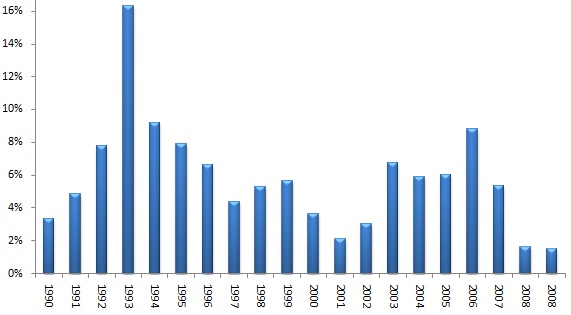

This graph shows the percentage of the total apartment inventory that sold year by year.

Break down by segment

Albuquerque is unique in that it has such an abundant supply of small and medium sized units allowing the small property investors to work their way up the investment ladder over time – conceivably making it possible today’s fourplexes investor to own a 100+ unit property in twenty years. As that investor moves up the apartment investment ladder to larger properties, they are able to support on-site management staff, 3rd party management, and increasing sophistication in property operations.

NM Apartment Advisors has broken down the classification of apartment investments into physical category descriptions that reflect the typical investor for that size range. Each of these investors has a different approach to value and desired yield.

Distressed Sales

For the first time in a long time, distressed sales are starting to have an impact in the average value of New Mexico apartment sales. NM Apartment Advisors classifies a sale that is listed as “short”, “foreclosure”, “fire” or “handyman special” as a distressed sale. In typical years, the number of distressed sales has a marginal impact on the overall marketplace, but in 2008, some 18.4% of the sales that occurred were sales under distress, which skewed market values even more than expected. For that reason, for those segments of the marketplace that experienced distressed sales (mostly apartments containing 8 units or less), two categories of the 2008 summary have been provided, one has all sales, and the other that only reflects the non-distressed sales.

The following is a summary of each of these segments of the marketplace:

100+ units: in total, the 100+ unit apartments makes up over 60% of the total number of units, but only 4% of the total number of apartment communities. During 2005-2007 buyers binged by buying up some 20% of the marketplace. Although two sales in this size range occurred in 2008, both were marketed and under contract in 2007, effectively making 2008 a year with no sales in this catergory.

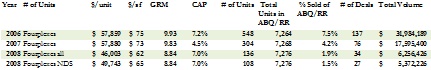

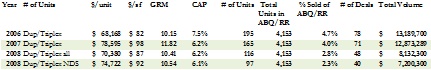

*the “% sold of ABQ/RR” heading above represents the market churn, or the percentage of the marketplace that sold that year

NM Apartment Advisors Inc. took a property to market in this category in 2008, and was able to secure 18 offers from qualified buyers, but increasing volatility in the capital markets made securing financing all but impossible.

In summary, while buyer interest remains strong, buyers are limited today by lack of financing choices. In 2009, the deals most likely to close will be delivered to a purchaser with attractive assumable financing, or seller financing.

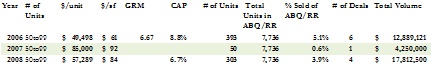

50to99 units: This segment of the marketplace makes up a small portion of the total inventory, and it is common to see very few transactions annually in this size range. For example, the only sale in 2007 was a 50 unit property that was sold to a condo converter. If we consider that sale to be an anomaly, then between 2006 to 2008, values on a price per unit increased 16%.

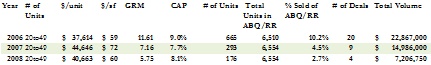

20to49 units: Like the 50 to 99 unit category, this portion of the marketplace is relatively small, but even it experienced a decrease in the total dollar volume of sales by 52%. CAP rates rose from 7.7% to 8.1% and the price per unit decreased 9% from its high in 2007.

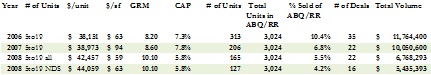

5to19 units: While the overall volume of sales in this category decreased, the price per unit increased by 13%.

Fourplexes: although the fourplex marketplace only contains 9% of the marketplace in total number of units, they contain 35% of the total number of apartment communities. From 2007 to 2008, fourplexes experienced a decrease in sales volume of 64%, and a decrease in price per unit of 21%. 18% of all fourplex sales in 2008 were distressed sales, and even if those sales are excluded, the price per unit still decreased 14%.

Duplexes/Triplexes: Typically the units in this category often sell to owner/occupants who are more interested in the ability to live in the property than in its investment potential. Like the housing market, value decreases in this category are minimal. Adjusting for the 80% of the sales that were not distressed, the price per unit decreased by only 5%.

The impact of competitive investments in other markets

Although our office continues to receive phone calls from investors looking to expand their existing Albuquerque portfolio, many of them are chasing deals in markets that suffer from higher volatility like Phoenix, Las Vegas, the inland empire, and the Bay area which offer higher returns.

Local Financing