Come listen to the latest trends in recruiting millennials with housing to our market.

Guest Speakers: Todd Clarke CCIM and Dale Dekker

http://www.techfiestaabq.com/

Confessions of a Commercial Real Estate Consultant

View Cantera Consultants & Advisors Inc. recent consulting assignments

Come listen to the latest trends in recruiting millennials with housing to our market.

Guest Speakers: Todd Clarke CCIM and Dale Dekker

http://www.techfiestaabq.com/

The following are links and documents from todays presentation.

Complete the 2014 ULI Value / CAP rate survey here

Prezi from today – Ethical use of social networking Prezi-CCA-EthicalUseofSocialMedia-072014

List of iOS apps – click here

Today’s powerpoint presentation can be found by clicking here- SantaFe-Tech-SocialNetworkingWebinar-07182014-v5

CCIM 2013 annual seminar – 97 apps in 90 minutes

Click here for the technology blog

The NM Chapter of the Urban Land Institute released its 2013 Commercial Real Estate and Value survey last week at the joint Apartment Association of NM and Urban Land Institute Market forum luncheon.

Previous value and cap rate surveys performed by Cantera Consultants & Advisors Inc. can be found here for 2011 and here for 2010.

Read the full article from the ABQ Journal here

Read the full article from the ABQ Journal here

The complete 11 x 17 version of the survey can be found by clicking here.

Thanks to the Oregon Association of Realtors for hosting Views from the future of commercial real estate.””

PDFs of the presentations can be found here

Introduction – Todd Clarke CCIM – OAR-Intro-ViewsfromtheFrontier-10222012-v4

Office – Patricia Lynn CCIM NotesfromtheEdge Office-PatriciaLynn6c

Industrial – Sam Foster CCIM ViewsFromTheEdge-Industrial-SamFoster-v04302012-v2dtc

Residential/Multifamily – Todd Clarke CCIM – ViewsFromTheEdge-Residential-ToddClarke-v10252012-v6dtc

Latest and greatest apps – can be found here.

Confessions of a Commercial Real Estate consultant can be found here.

OAR-CCA-ConfessionsofaConsultant-10242012

This day long course covers the ins/outs of navigating the social networking minefield as well as the latest in technology and how to use it to make you more efficient in your daily work.

Learn how to:

– Develop a social networking policy for you and your agents

– Determine which social networking tools will work best with your customers

– How to tap in to the Gen Y market and what they are looking for in terms of information and content

– What software and tools you can use to manage social networking

– How to engage clients using social networking

– What tools you need to take your office paperless

– The latest in market trends and how they impact your business

– The latest tech to separate the time wasters from those tools that can make you more efficient

– How to make your iPad or Droid tablet an effective marketing/presentation and business tools (including top apps)

(You can see Todd Clarke and Todd Kuhlman present over 100 mobile apps in 90 minutes at the national CCIM conference in Denver, CO – click here – https://www.youtube.com/watch?v=Wjj3bhxHS44)

One of my former students kindly offered this testimonial:

“Todd’s got his eye on the ball when it comes to technology. He knows what works and perhaps more importantly knows what doesn’t work and can help you steer away from traps.” – Richard E. Juge, CCIM, SIOR (National CCIM president 2010)

Register for this or any other course at www.canteraconsultants.com/cca2015 .

Additional information about your international award winning instructor can be found at www.toddclarke.com

CCIM has just released the video interview with Greg Lindsay, author of Aerotropolis: The way we will live next from the CCIM Live 2011 conference held in Phoenix last month.

Earlier this year I wrote my review of this fabulous book which can be read here.

Greg’s powerpoint webinar from August 2011 is available at the CCIM website.

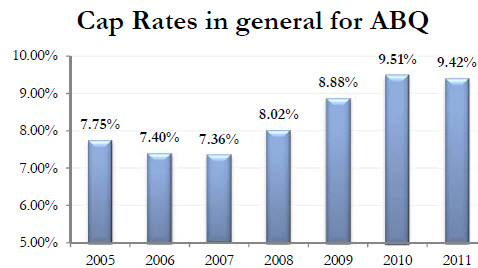

Cantera Consultants & Advisors has just released its 2011 value survey for NM Commercial Real Estate. The survey reflects the collective wisdom of industry professionals in NM.

Although Cantera uses the survey primarily for the benefit of it’s during property tax protest hearings, the survey has become staple in the commercial real estate market and is widely used and quoted by many of the brokerage, appraisal firms and county assessors in NM.

The most interesting trend reported in this year’s survey is the indication that most of the commercial property types have turned the corner on decreasing values as CAP rates have started to decrease (slightly).

Tomorrow’s edition of the Business Outlook in the Albuquerque Journal will highlight information from the report.

Last year’s survey results can be found here.

The 2011 value survey can be found CCA-Survey-10012011-v10.

Last week I had the pleasure of introducing and interviewing Greg Lindsay, author of Aerotropolis. CCIM has just posted his webinar live.

Aerotropolis, the way we’ll live next

Authors: Greg Lindsay & John D. Kasarda,

Publishing Info: Farrar, Straus and Giroux, Nonfiction, First edition published March 1st, 2011

As an international instructor for the CCIM institute I discovered that the book, Aerotropolis: the way we’ll live next dovetails nicely with what the just-in-time delivery model as a primary driver of demand for industrial space that we teach in the CCIM 102 course, I would highly recommend it to anyone in commercial real estate.

As a rabid book consumer, I will easily digest about 100+ books a year, and without a doubt, Aerotroplis: the way we’ll live next has become not only my favorite book of this year, but one of my all time favorite business books. It is one of those rare books that I thoroughly enjoyed reading that I found myself moderating how much I could read daily so I can push the ending of the book out as long as possible.

My favorite magazine, The Economist recently offered a glowing review of Aereotroplis, stating “In Aerotropolis, John Kasarda of the University of North Carolina and his co-author, Greg Lindsay, convincingly put the airport at the centre of modern urban life.”

The theme of the book is that successful cities of the future will be wrapped around successful airports and those cities that can’t adapt may be passed by. Its authors state the books hypothesis as an equation related to time “The aerotropolis is a time machine. Time is the ultimately finite commodity setting the exchange rates for all the choices we make.”

Author and reporter, Greg Lindsay, expands and expounds on the John Kasarda’s original idea that airports are the highways of the future. As a former Fast Company and Wired magazine reporter, Mr. Lindsay racks up the frequent flyer miles talking with civic leaders, CEO’s and company logicians as he interviews them on their home turf about the importance of air transit to their communities, companies or supply chains future.

As a fellow traveler, I reminisced about Mr. Lindsay’s travels to well-known airports like Chicago’s O’Hare, Atlanta’s Hartsfield, Amsterdam’s Schiphol, or even Hong Kong’s International, but I was green with envy over his trips to Dubai’s Al Maktoum International Airport or South Korea’s Incheon airport and adjoining master planned Songdo International Business District. One story of Mr. Lindsay tracking his gift of flowers from the Aalsmeer flower auction in Amsterdam to his mother’s front porch will endear Mr. Lindsay to the reader as an extremely diligent reporter and respectful son. Even more surprising than his few thousand mile journey for flowers was his mother’s reaction.

Some of the books concepts in the book are eye opening such as “The world’s urban population is poised to nearly double by 2050, adding another three billion people to places like Chongqing. We will build more cities (and slums) in the next forty years than we did in the first nine thousand years of civilized existence. The United Nations predicts the vast majority will flood cities in Africa and Asia, especially China.”

Or this quote about South Korea “South Korea’s capital is the archetypal twentieth-century megacity, doubling in size every decade or so since 1950 to twenty-four million inhabitants—the second most populous on earth after greater Tokyo.”

Or my favorite quote about a Chinese based manufacturer: “We had barely crossed the border before he opened his laptop and began walking me through the true costs of those shipments. He’d built a widget calculating every conceivable variable: the weight, volume, value, and quantity of the products in question; the lead times for sourcing and building them; time spent in transit; their shelf life; the spread between paying his vendors and being paid himself; the cost of money in the meantime; and the cost of returns. An entire calculus, in other words, underlies the pivotal question of our era: What is the price of speed? The widget’s answer: slow is more expensive. The only thing faster than a FedEx 777 Freighter out of Hong Kong is the velocity of money, and the last thing Casey wants to pay for are the days his parcels are stuck on a boat. Obsolescence sets in the moment they leave the factory. “Revenue evaporation,” he calls it. “Air freight is key,” he muttered while running the numbers. “We like to work with products that can go by air. We build them in Shenzhen, and they’re in New York two days later. Time is often our number one currency, and the dollar is second.” ”

And this quote summarized the breath taking feelings I experienced in my many visits to China for CCIM’s education program: “China is placing the single biggest bet on aviation of any country, ever. Even before the crisis and China’s subsequent stimulus, the central government announced as part of its Eleventh Five-Year Plan that it would build a hundred new airports by 2020, at a cost of $62 billion. The first forty were ready last year. The vast majority lie inland, hugging provincial capitals and secondary cities bigger than any in the States. Full-scale aerotropoli are planned for China’s western hubs, Chongqing and Chengdu, and its ancient capital. Besides airports, China laid as many miles of high-speed railroad track in the last five years as Europe did in the last two decades. The trains, in turn, are meant to keep people off the highways, to which China’s adding thirty thousand miles—enough to eclipse the American interstate highway system. China’s planners have internalized the lessons of America’s Eisenhower-era infrastructure boom, designing a world-class system for moving people and goods quickly, cheaply, and reliably across any distance, whether locally by highway, regionally by rail, or globally by air. The plan is to pick up and move large swaths of the Delta hundreds or even thousands of miles inland. There is nothing to stop them.

And this quote on where the future global cities will be “Finding another five hundred million passengers 7should be easy. China has anywhere between 125 and 150 cities with populations greater than a million. The United States has nine; Europe, thirty-six. When the first phase of China’s airport-building boom is complete, the number of hubs handling thirty million passengers annually—more than Boston’s Logan or Washington’s Dulles—will have risen from three to thirteen, all of which will be the host of aerotropoli. By the time they’re finished in 2020, 82 percent of the population—1.5 billion people—will live within a ninety-minute drive of an airport, nearly twice the number today.”

The book dovetails nicely with some of my other favorite business reads like Marc Levinson’s “The Box: How the Shipping Container Made the World Smaller and the World Economy Bigger” and Sasha Issenberg’s “The Sushi Economy: Globalization and the Making of a Modern Delicacy” both of which deal with just in time delivery and creating new markets.

Additional topics addressed in Aerotroplis include Peak Oil vs. Peak Food, globalization as a tool to pull the poor into the middle class vs. the carbon footprint of globalization via air travel, and the true cost of air travel in both economic and environmental terms.

If you enjoy Aerotroplis as much as I did, you might also read the June edition of Southwest Airline’s Spirit magazine as Mr. Lindsay has recently penned an article titled “Corporate Latter”. In this article he builds on the concepts discussed in Aerotroplis and discusses how technology has allowed us to shift away from being tied to an office, setting up shop at any location (http://www.spiritmag.com/click_this/article/the_corporate_latter/) . One economic development guru and author, Mark Lautman, is pushing this idea as the next evolution of cutting edge business recruitment – to scale down the benefits big corporations receive so communities can chase the highly mobile, quality of life comes first businessperson/consultant who eventually expands their business and hires staff. According to “When the Boomers Bail: A Community Economic Survival Guide”, this segment of our economic businesses is one of the fastest growing.

Not only would I highly recommend you read Aerotroplis, I would encourage you to purchase copies to share with your family, friends and clients as the conversations started from the concepts in the book are engaging, enlightening and very relevant to anyone with commercial real estate.

Todd Clarke CCIM

Aerotropolis can be purchased at: http://www.amazon.com/Aerotropolis-Way-Well-Live-Next/dp/0374100195/ref=sr_1_1?ie=UTF8&qid=1306590616&sr=8-1

Thanks to Melissa Montoya for covering the latest in apartment trends on KOAT TV 7.

In a Wall Street Journal article dated today, Borders Group has indicated that they are making preperations to file bankruptcy in the forthcoming days.

Similar to the fallout of music stores after iTunes, Amazon website and digital readers has encouraged many readers to abandon physical stores. Companies that have figured out how to the digital frontier continue to thrive, while those that haven’t die. Interestingly , the same articles mentions that Borders tried going dot com a while back, threw in the towel and sold their initiative to Amazon.

“I think that there will be a 50% reduction in bricks-and-mortar shelf space for books within five years, and 90% within 10 years,” says Mike Shatzkin, chief executive of Idea Logical Co., a New York consulting firm. “Book stores are going away.””

—wsj.com 2/12/2011

Borders Group currently has over 600 locations, less than 1/2 of what it had in its peak at 2005.

In our market, Borders has a prominent location in the ABQ Uptown lifestyle center. I will be curious to see what the new highest and best use of that store will be.

Bob: what do you have for us today Todd

Todd: Good morning Bob! It’s hard to believe the holidays are already upon us and before you know it the end of the year will be here. As that time approaches, many of our customers wonder what 2011 will hold for the real estate industry and whether NM’s real estate market will lead, follow or diverge from national trends.

Bob: Todd, do you have a forecasting resource to help answer these question?

Todd: We sure do Bob, our firm has followed a publication called “the Emerging Trends in Real Estate” which is published by the Urban Land Institute and Price/Waterhouse/Coopers. For 32 years the authors of this publication have called upon the leading experts in the real estate industry to ask them what they see in their business in the coming year. This report provides an outlook on U.S. investment and development trends, real estate finance and capital markets, with a focus on key property sectors. The report draws on formal and informal surveys of real estate executives, investors, developers, and market experts around the U.S., including survey responses from over 500 real estate executives and personal interviews with over 125 industry leaders.

Bob: Sounds very comprehensive Todd, where can our listeners get a copy?

Todd: Bob there are two ways to get a copy – you can join the Urban Land Institute at www.uli.org, OR, you can attend their “Outlook NM” event to be held on the evening of December 9th, 2010

Bob: Can you tell me a bit more about this event?

Todd: I sure can – the national speaker is Chuck DiRocco from Price/Waterhouse/Cooper and he will be followed by our local panelists, Steve Maestas at Maestas Ward who will talk about retail, John Ranson of Grubb & Ellis who will address Office and Industrial, Jim Folkman of the HomeBuilders of Central NM who will discuss the single family residential market, and I will be covering the apartment industry.

Bob: Sounds like a full event – how can our listeners participate?

Todd: The cost of the event, which includes the publication is $60 – to RSVP – call the local Urban Land Institute office 505-269-7695 or call me anytime at 440-TODD.

Cantera Consultants & Advisors has just released the results from our latest valuation survey. This survey was performed over the summer of 2010 with real estate owners, investors, lenders, brokers and appraisers.

The attached document demonstrates the changes in CAP rates and values from 2005 to 2010.

Click here for the survey results and a related newspaper article CCA-Survey-07092010-v8plusJournalArticle

Reading this article at the Economist got me thinking…

What if borrowed and lenders had a prenegotiated arrangement that converted debt into equity a commercial real estate deal? I don’t mean like todays, expensive involuntary conversion that happens through foreclosure, but a more organized rational, prenegotiated, pre-nupital like document that said something like “in the event of a capital crisis, or the mid-term (a average of this property’s value over the last 24 months) value of this asset decreases below the loan limit, borrower shall have mortgage their interest converted into an equity interest, thus unemcumbering the asset of all debt, freeing up cash flow which shall be distributed as follows… (cash flow going to lender, tax benefit going to equity position)… until such time as…”

Certainly debt would cost more, but an equity player might be willing to go into a deal knowing the downside was much lower.

In less than 90 minutes, we covered technology and how to best make it work for the commercial Realtor.

Everything from making presentations using your iphone and a portable projector, how to find a $200 netbook, take your office into the digital era by going paperless to the best tech tools to travel with.

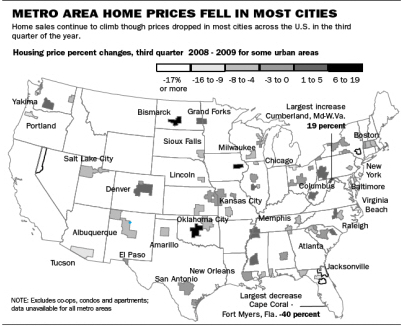

According to a story in today’s Albuquerque Journal, 80% of this country’s cities showed a decrease in home sales prices, but Albuquerque remained on an modest upward trend.

“Third-quarter data showed the median sale price in the Albuquerque metro area was $183,500 — up from the first and second quarters — but down about 5 percent off the sale price of $193,400 in the third quarter of 2008. “

The Greater Albuquerque Association of Realtors has also indicated that the volume of sales has increased by 40% over this time last year.

One of the things to take into account, is that this does not necessarily indicate that home prices have shifted that much, as local agents will tell you there has been a lot of activity in the under $250,000 price range, and little activity in the over $1,000,000 price range, which is more than enough to cause the median price to decline

Its unfortunate that GAAR and NAR don’t do a same house comparison for appreciation/depreciation.

from the Cool Hunter website comes a possible design for a new W hotel…

The website features several perspectives and layouts on this apartment, which looks like a cross between BladeRunner and Space 1999.

Hey – who is that in my shower?

As major retailers like CompUsa, Mervyn’s, Linens and Things, Circuit City, fold one after another, leaving vacant spaces in major malls across the country, occupancy rates continue a downward trend, which eventually leads to decreasing rents and values.

Real Estate investors with the most leverage (i.e. the least amount of their own money), will be the hardest hit, but even lower leverage institutions are taking a hammering in their overall valuations.

What’s going on?

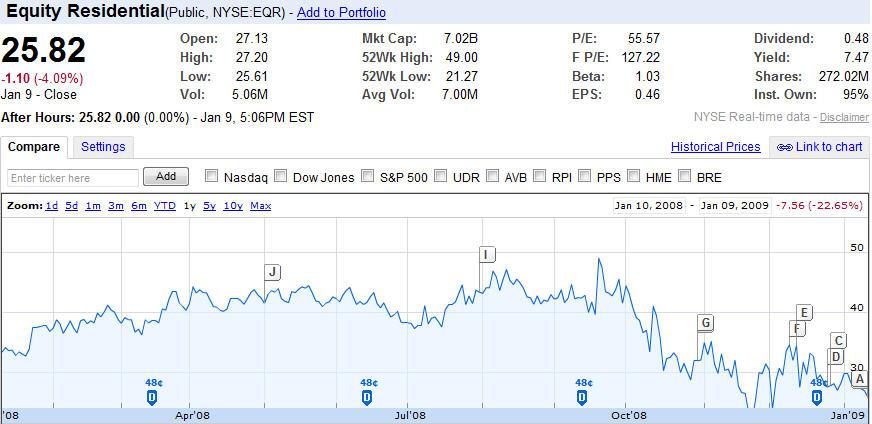

It has to do more with the capital markets than the dynamics of the real estate economy. According to a recent Wall Street Journal article, over $530 Billion dollars of loans are coming due in the next 3 years, including $160 Billion in 2009. Real Estate investors that counted on excess liquidity (or even some liquidity) in the marketplace, are now seeing their valuations hammered as the stock market’s perception is that many of these companies will be unwilling to renew their financing.

Some of this country’s largest owners, are

Real Estate Investment Trusts, or REIT’s are a special type of corporation (that is not double taxed) which allows passive investors to hedge their risk by investing in a large number of markets around the country (thus avoiding having all of their eggs stuck in one city).

As an indication of where Wall Street pessimism in the marketplace, take a look at the stock value of some of the largest and most well known REITS:

Equity Residential

A Co-Star article indicates that REIT’s values have seen decreases of more than 40% and that many of them are likely to run into a liquidity crisis.

It certainly is an interesting time to be in the business – the recent meltdown of the subprime crisis had led to a crisis of trust between lender’s – so much so that the SEC was recently quoted as saying

“The trust and confidence that counterparties require in one another in order to lend, trade, or engage in similar risk-based transactions evaporated to varying degrees for each firm very quickly. What would have been more than sufficient in previous stressful periods was insufficient in more extreme times.”

From a bystander’s viewpoint, it has been interesting to witness the country’s politicians mickey mouse with the free market, then run from the issues, then hold hearings to find blame, and now they believe they can solve it?

Unfortunately, they’ve avoided discussing the root causes of the capital crisis – public policy initiatives to get every American into a home (whether they could afford it or not), government interference in the free market by offering home ownership preferential tax treatment, and a lack of oversight when Wall Street started going bezerk creating complex financial instruments that neither them, the rating agencies, the buyers or the sellers understood.

The original plan for Troubled Assets Relief Program T.A.R.P was to allow lender’s to clear their slate clean of these bad debts, thus opening the market for future financing.

And guess what?

We still don’t understand them, and until we do, no one knows who has the hot potatoes (the bad debts), and until due-diligence is done to uncover those assets, those same lender’s don’t know what to convey to T.A.R.P. and their assets remain frozen as there isn’t market to buy and convey what you can’t quantify.

Unfortunately, the market doesn’t wait for solutions, it just keeps rolling, and its rolling off the precipice if the real estate investors and developers can’t renew their loans on existing, performing, assets.

Right now, solutions are most likely to come from the following arenas:

1. The capital markets start to thaw and we see financing return to the marketplace

2. a seperate financing vehicle is created, possibly under the T.A.R.P. program

3. Lender’s convert their debt positions into equity (which would require government approval).

4. The property owners start to liquidate other holdings (Prologis just announced a large sale of their Asian holdings

Until then? Look for continue decreases in real estate equity and the possibility that the canary may die, before one of these solutions are expedited.

Thanks to my good friend, Sam Foster for turning me on to this article in the WSJ. The OP-ED piece by Daniel Henninger highlight’s one of today’s biggest issues for an investor – how to sort through the overwhelming amount of data and capitalize on the fact, while others are swapping cocktail conversation about the fiction.

Daniel goes on to say

“I’m still mesmerized by the virtually uncountable number of intelligent individuals worldwide who were revealed as dumb in 2008. What happened to them? What if mass dumbing down is now the norm?”

The Economist recently ran an online debate about the same issue – is our society getting smarter or dumber over time?

What are you thoughts?

The Washington Post has an interesting article on how the pieces for put into play for today’s economic meltdown over two decades ago.

![]()

In the December 20th, 2008 issue, the Economist covers the latest trends in how Retailers are analyzing your shopping habits.

Would you believe?

– Camera’s that read your facial patterns?

– receiver’s that record your wherebouts based on your cell phone?

– reorganizing the store so the things you buy the most are in the back?

– video cameras hooked up to computers that “mine” your traffic patterns, expressions, and more?

It all reminds me of Paco Underhill’s Why We Buy: The Science of Shopping-Updated and Revised for the Internet, the Global Consumer, and Beyond a favorite read of mine.

There is often a fine line between real estate and personal property.

Manufactured homes are often considerd personal property, unless they are affixed to the ground, wheels removed, and the appear to be even more like real esate if a garage is added.

So what happens when you add a garage to a mobile home ?

Well the result isn’t inexpensive, but it sure is cool!

Thanks to the guys over at Gizmodo.com for the tip on the latest in mobile real estate.

The old adage about location, location, location certainly applies to Upham, NM.

Whats that you say? Where the H-E, double hockey sticks is Uphan? As a native NM who was born not too far from there, I’m afraid to tell you I didn’t know where Upham was until a couple of years ago when the Governor and Sir Richard Branson announced their plan to launch tourists, I mean paying astronauts, into space.

What is now a slab in the ground will soon look like this:

So how does location fit in? Upham, New Mexico is located just west of the WhiteSand Missile Range which is one of North America’s largest no-fly zones and as the FAA report mentions, there isn’t much out here to be impacted by a rocket launch…

Tampa Bay Fox News is reporting that NASA has issued a Request for Inquiries for potential uses for three soon to be retired space shuttles. Space shuttles Discovery, Atlantis, and Endeavour are slated to be mothballed and sold off for approx. $42M each. Shipping is likely to be $6M, and I’m guessing that since these are larger than 75lbs, they won’t be delivered by our friendly UPS driver, Tony.

Since New Mexico is part of the space shuttle program, it seems only fitting that we should have our own space shuttle. And what better use than installed a newly built Space/Air musuem?

What do you say Mayor? Can we add one of these to a new Space musuem?

(If you are curious, the Space Shuttle will most likely be delivered on the back of one of NASA;s 747’s – thanks to the guys at gizmodo.com for turning us on to this photo.

)

)