To be held at GAAR offices on Thursday, October 2nd, 2014

Spreadsheet tools:

DTC-IRR-Model-v15-comm-blank-Citadelapartments

Confessions of a Commercial Real Estate Consultant

View Cantera Consultants & Advisors Inc. recent consulting assignments

To be held at GAAR offices on Thursday, October 2nd, 2014

Spreadsheet tools:

DTC-IRR-Model-v15-comm-blank-Citadelapartments

Yesterday’s Wall Street Journal reported that Susan Combs, Treasurer for the State of Texas is pushing for new legislation that would require local governments to add up their total debt obligations and disclose it to their constituents, the tax payer.

GREAT IDEA SUSAN!

Her office has also signed the light on Texas with a “Texas its your money” website that shares a ton of financial information about the states budgets.

New Mexican’s shouldn’t we demand the same?

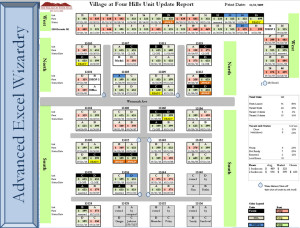

Whether you are a beginning or advanced Excel user, this course will demonstrate how you can be more efficient, productive and improve your presentations.

Topics covered in the course include:

– Formatting

– Making stunning custom graphs

– Key formulas

– Database normalization

– Using Pivot Tables

– Using Goal seek to find the solution

– Conditional formatting as a tool to make legible and cool looking spreadsheets

– Creating macros to make your spreadsheet work more efficiently

* bringing a laptop with any version of Microsoft Excel is highly recommended

An example of an apartment dashboard tool created in Excel:

Register for this or any other course at www.canteraconsultants.com/cca2015 .

Additional information about your international award winning instructor can be found at www.toddclarke.com

This day long course covers the ins/outs of navigating the social networking minefield as well as the latest in technology and how to use it to make you more efficient in your daily work.

Learn how to:

– Develop a social networking policy for you and your agents

– Determine which social networking tools will work best with your customers

– How to tap in to the Gen Y market and what they are looking for in terms of information and content

– What software and tools you can use to manage social networking

– How to engage clients using social networking

– What tools you need to take your office paperless

– The latest in market trends and how they impact your business

– The latest tech to separate the time wasters from those tools that can make you more efficient

– How to make your iPad or Droid tablet an effective marketing/presentation and business tools (including top apps)

(You can see Todd Clarke and Todd Kuhlman present over 100 mobile apps in 90 minutes at the national CCIM conference in Denver, CO – click here – https://www.youtube.com/watch?v=Wjj3bhxHS44)

One of my former students kindly offered this testimonial:

“Todd’s got his eye on the ball when it comes to technology. He knows what works and perhaps more importantly knows what doesn’t work and can help you steer away from traps.” – Richard E. Juge, CCIM, SIOR (National CCIM president 2010)

Register for this or any other course at www.canteraconsultants.com/cca2015 .

Additional information about your international award winning instructor can be found at www.toddclarke.com

CCIM has just released the video interview with Greg Lindsay, author of Aerotropolis: The way we will live next from the CCIM Live 2011 conference held in Phoenix last month.

Earlier this year I wrote my review of this fabulous book which can be read here.

Greg’s powerpoint webinar from August 2011 is available at the CCIM website.

Technology and Social Networking Tools for Today’s Real Estate Professional

This 1-day course, taught by Todd Clarke, CCIM, teaches how to implement the latest technology and social networking tools into a real estate professional’s day-to-day business and add value to clients. Participants will review the latest hardware available, including smart phones, iPads and netbooks, and find software and data storage solutions. In addition, develop a business strategy for using social networking sites such as Facebook, Twitter, and LinkedIn, through hands-on exercises.

Upon successful completion of this course, you will be able to:

Course location and pricing

Chicago, IL ~ April 5, 2011 ~ 8:30 am – 5:00 pm

Levine Learning Center

430 N. Michigan Ave Suite 800 ~ Chicago, IL 60611

Members $295 Non-members $395

Instructor: Todd Clarke, CCIM

After many months of strategizing, negotiating, researching, and putting together our cases for our client’s, Cantera Consultants & Advisors Inc. recently settled all of its cases on the controversial apartment property tax lightning cases for 2010 (click here to read the summary).

In a recent (and copyrighted) Albuquerque Journal article, The Bernalillo County Assessor has indicated that she intends to roll back the 2010 values on all apartments that were raised more than 3% over their 2009 values.

If you own an apartment that experienced an increased of more than 3% in value (over 2009), and you did not file a protest by May 20th of 2010, there is one additional option available to reduce your property taxes for 2010 – you can file a claim of refund.

While this is a normal a service we offer our clients for contingency fee, in this unique situation, I believe the work we (and others) have done for our client’s this year has laid the foundation for the remaining apartment owners who haven’t filed to seek a refund.

If you meet the following criteria, you might be able to handle this case yourself:

– If you are the owner of a property not held in a partnership or corporation, you can represent yourself at district court to seek a refund of your property taxes.

– If you have already paid your property taxes, the full amount (not the first half installment)

– If you fill out a claim of refund (again, its more than a form, it is a lawsuit)

– If you file, in person, and pay the filing fee

In New Mexico, a claim of refund is lawsuit against the county, in which you, as the property owner, claim that you have overpaid the county in property taxes.

While I am not an attorney, and cannot offer any legal advice, I have been involved in a handful of claim of refunds and I can tell you that you can go to the district court website at www.nmcourts.gov and search the cases for the name “Karen Montoya” (our current assessor) and request a copy of a claim of refund from the court (you must do so in person, and they will charge you a copy fee) and use it as a model for your claim of refund.

You can also download Chapter 11 of our book “Understanding NM’s Property Tax System -2010 edition” that includes a blank form that we’ve used before. The deadline to file the lawsuit is 60 days after the property tax bills were sent out.

When filling out the form – be sure and look up your property’s property tax bill information at Bernalillo County’s website. Part of the form requires that you calculate what your property tax bill should be (based on 2009 values + 3%) vs. what it was on the actual tax bill.

Most tax consultants, such as our selves, are also working with attorneys and can provide assistance, but this maybe one of the rare situations, where everything has already been resolved (thanks to those owners who filed protest, and there consultants/attorneys who worked through the cases in 2010), that an owner maybe able to simply handle this themselves.

****disclaimer – in case I haven’t made it totally clear – this information is provided as a public service, and it not intended to offer legal or real estate advice. Going to court without legal representation is not a wise idea.

Did you know at one time in NM’s history, your political affiliation impacted the amount of your property tax bill? Are you confused by Tax Lightening? Uncertain as to what surprises next year’s property tax bill will hold? Do you want to understand why it is “fair” for two similar properties to have different assessed values? Confused by the media news and the latest legislation? Need the straight scoop on the property tax law? Then plan to attend this course!

Learn how:

– To build a credible case for protesting your property’s tax value

– To calculate your property tax bill

– What you should provide and what you shouldn’t

– How the assessors in each county approach value

– The basis of the property tax law and how it impacts your tax bill

– How to conduct your negotiations at informal and formal hearings

– Includes a review of the latest legislative laws/updates

– Includes Fifth edition book “Understanding NM’s Property Tax system” a $50 value.

– Book includes case study and mock informal and formal hearings

– You will leave this course with the tools you need to file a protest

This course has been utilized by owners of property to lower their values as well as real estate professionals looking to understand the process and offer additional services to their clients. The course includes the 5th Edition, 360 page book titled “Understanding NM’s Property Tax System”, a $50 value, free of charge (PDF version is free, printed version is $50). This must-have text book includes sample case studies, and cites state statutes that are important to know for any settlement or formal hearing. (if you don’t need the CE and want the textbook – it can be ordered here: www.canteraconsultants.com/books)

Register for this or any other course at www.canteraconsultants.com/cca2015 .

Additional information about your international award winning instructor can be found at www.toddclarke.com