Thanks to my friends at the Polish Real Estate Federation for promoting myself and fellow CCIM instructors, Steve Price, Mark Cypert and Joe Fisher and our resumes:

Category: CCIM

A to Z of investment basics course

To be held at GAAR offices on Thursday, October 2nd, 2014

Spreadsheet tools:

DTC-IRR-Model-v15-comm-blank-Citadelapartments

Santa Fe Course – 7/18/2014

The following are links and documents from todays presentation.

Complete the 2014 ULI Value / CAP rate survey here

Prezi from today – Ethical use of social networking Prezi-CCA-EthicalUseofSocialMedia-072014

List of iOS apps – click here

Today’s powerpoint presentation can be found by clicking here- SantaFe-Tech-SocialNetworkingWebinar-07182014-v5

CCIM 2013 annual seminar – 97 apps in 90 minutes

Click here for the technology blog

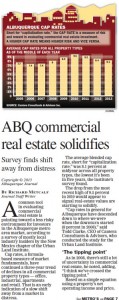

ULI NM – 2013 Commercial Real Estate Value Survey

The NM Chapter of the Urban Land Institute released its 2013 Commercial Real Estate and Value survey last week at the joint Apartment Association of NM and Urban Land Institute Market forum luncheon.

Previous value and cap rate surveys performed by Cantera Consultants & Advisors Inc. can be found here for 2011 and here for 2010.

Read the full article from the ABQ Journal here

Read the full article from the ABQ Journal here

The complete 11 x 17 version of the survey can be found by clicking here.

ABQ Biz 1st – Boomers, Millennials power apartment biz

At the annual Apartment Association market update last week, Todd Clarke discussed the latest generational drivers of apartment demand. View the complete article by clicking here.

DeJa Vu an update to multifamily in CCIM’s Journal

This month’s CCIM magazine has an update article on the multifamily industry.

“In some markets, demand is up and the existing multifamily properties are simply obsolete. “We need to replace our inventory,” says Todd D. Clarke, CCIM, chief operating officer of NM Apartment Advisors in Albuquerque, N.M. “The average apartment was built in 1965, is red brick, pitched roof, master metered, and built furnished — none of which is what the baby boomers and Generation Y are looking for.” Developers are expected to deliver 560 units in Albuquerque this year — up from 158 in 2012, according to Marcus & Millichap.

Generation Y, in particular, is expected to be key to multifamily leasing and development. A significant portion of this 87.3 million-strong population segment will form new households as they leave their parents’ homes during the next two years, Marcus & Millichap notes.”

Attend the next CCIM conference in Denver and see the 2 T’s of technology

Tech guru’s Todd Kuhlman and Todd Clarke will be hosting 60 apps in 60 minutes on 10/26/2013.

The video of the session can be found – here as Todd Kuhlman and I provided info on 97 apps in 90 minutes.

Albuquerque Realtor has connection to Japanese CCIM’s

The Albuquerque Business News covered Todd’s recent class and pinning ceremony for the newly minted CCIM’s in Japan:

Todd Clarke named as commissioner to Albuquerque Housing Authority

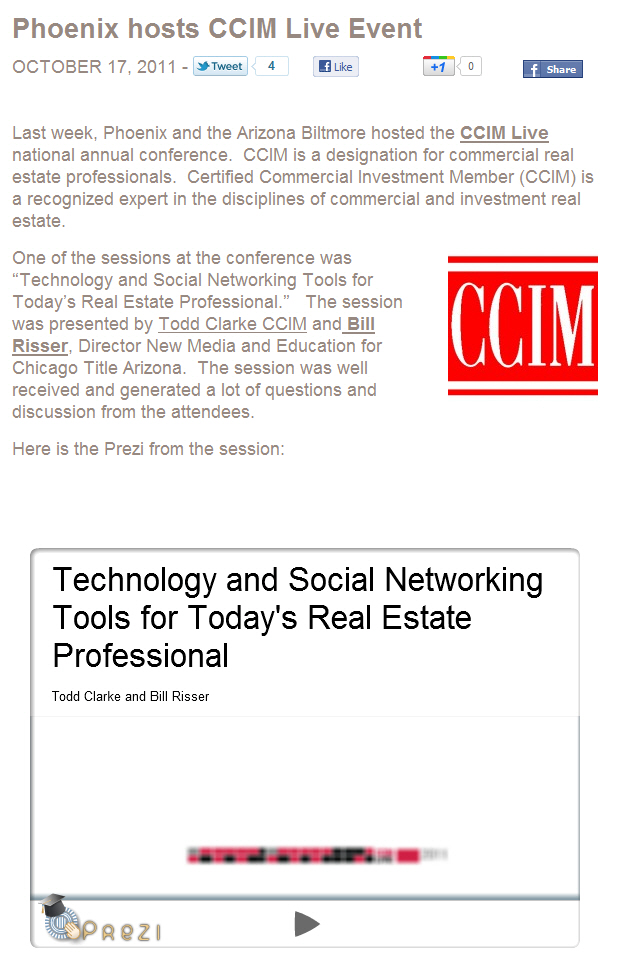

CCIM Live!

Session on using technology in marketing was well attended – thanks again to the CCIM Institute for doing such a great job!

Marketing using Social Networking recap

What did you miss last week at @ccim live? This session on how to develop a marketing strategy 4 social networking co-taught with Bill Risser

Click here to see the video overview and Prezi presentation.

A special thank you

to my CCIM CCR Study session students who obtained their designation in 2010 & 2011 – they gave me this photo – very kind and appreciated!

In this photo: Tom Jones, Sean McMullen, Rose Cabezut, Jerry Cass, Tuan Van Hyunh, Todd Clarke, Lia Armstrong, John Shepler, Tom Franchini, Rob Powell and Michael Contreras, all CCIMs!

CCIM 102 Tokyo – Kampai!

CCIM Live and Frank Lloyd Wright!

CCIM Live update – Aerotropolis webinar now online!

Last week I had the pleasure of introducing and interviewing Greg Lindsay, author of Aerotropolis. CCIM has just posted his webinar live.

CCIM LIVE! – only 65 days!

Only 65 days are left until the next CCIM annnual meeting and what looks to be an amazing program – the list of speakers can be found here – http://live.ccim.com .

Announcing our Social Networking scavenger hunt

Would you like to win a new iPad2 with red leather cover (notice the CCIM logo?)

Correctly answers the first 10 questions on our social networking quiz and give us some feedback on the next 4 questions at:

www.canteraconsultants.com/scavengerhunt

Good luck!

This marketing effort will be used to gauge the effectiveness of social networking in the marketing of the CCIM Technology and Social Networking course http://www.ccim.com/education/course/TSN/TSN0001 .

my first iPhone app help client’s calculate their property taxes

Very excited – as of 5 minutes ago, our iPhone app to help client’s calculate their property taxes for commercial properties in Bernalillo County went “live” in the iTunes store! It is only 99 cents, and if you provide us feedback to improve version 2 and leave feedback, I’ll gladly send you a buck!

If you own a commercial property in Bernalillo County and you would like to compare your property’s value against the resolved cases from 2010, click here – http://itunes.apple.com/us/app/taxessor/id419811562?mt=8 to try it out.

The App is only $.99 and if you leave us a review and email me feedback at tclarke@nmapartment.com so we can improve version 2, I’ll gladly refund you a buck.

Thanks to Mark and Jamii at SWCP for making this happen.

Support for the app can be found here – http://www.taxessor.com .

CCIM announces new technology and social networking course

Technology and Social Networking Tools for Today’s Real Estate Professional

This 1-day course, taught by Todd Clarke, CCIM, teaches how to implement the latest technology and social networking tools into a real estate professional’s day-to-day business and add value to clients. Participants will review the latest hardware available, including smart phones, iPads and netbooks, and find software and data storage solutions. In addition, develop a business strategy for using social networking sites such as Facebook, Twitter, and LinkedIn, through hands-on exercises.

Upon successful completion of this course, you will be able to:

Course location and pricing

Chicago, IL ~ April 5, 2011 ~ 8:30 am – 5:00 pm

Levine Learning Center

430 N. Michigan Ave Suite 800 ~ Chicago, IL 60611

Members $295 Non-members $395

Instructor: Todd Clarke, CCIM

CCIM Success Profiles – one of my mentors, John Henderson III CCIM

As you may know, the NM CCIM chapter #10 is collecting a series of stories about some of their most successful members – a task called “profiles in success”.

Many of us have had people in our lives who we are grateful for – persons who show up at the right time and point us in a new direction, or people that provide invaluable insight that changes our course for the better.

I am a 4th generation Commercial Realtor, and both of my parents were in the business and provided that role for me.

In addition to that, I’ve been fortunate enough to grow up in a business and community of individuals that lean towards sharing, supporting, who focus on growing the pie instead of figuring out how to make their own piece larger.

In turns out that isn’t by accident, but was by design. Over 30 years ago, a handful of commercial brokers assembled at one of the earliest meetings of the Leasing Information Network (now known as LIN). Like our country’s founding fathers, these brokers set down their ideals of how people in our business would interact. Cooperation was the key word of the day, with the idea that fees and information would be pulled out of individual silos and shared by all.

One of those leaders, John Henderson III CCIM, was an early mentor for me. I remember when I was a teenager John tactfully informed me that my personality could be improved by attending a Dale Carnegie course (he was right). When I started commercial real estate in 1989, John encouraged me to take a CCIM intro course as soon as possible, and like him, once I had the knowledge, I couldn’t stop. John went on to write a letter of support that helped me secure a CCIM 101 scholarship, and for me, the rest is history as CCIM has done more for my business than any other aspect of my life.

With that thought in mind, it is my pleasure to share this video about John’s start in the business – some 40 years ago, John Henderson was a successfully residential Realtor, whose own life would be changed by a mentor to him.

More on John’s beginning in commercial real estate can be found here at his video – http://www.nmcomreal.com/ccimintro2 .

If after hearing these stories, you believe you might benefit from taking a CCIM course – the local chapter has an intro course this on February 7th and 8th – for $245, a 43% discount over the national rate. You can register for the course at www.nmcomreal.com/ccim .

Thanks,

Todd

Interested in becoming a CCIM?

CARNM’s most recent award winning Realtor, Lia Armstrong CCIM, was kind enough to share what the CCIM program has meant for her- watch the YouTube Video.

Save your seat for the February 7-8, 2011 course by registering here.

CCIM 2010 – final exam dates

The CCIM instititute

posted today the dates for the Course Concepts Review and final exam for 2010:

Spring 2010 Program – New Orleans, LA

Portfolio Submission Deadline: January 12 CCR/Comp Exam Registration Deadline: March 23

CCR: April 18 – 19

Comp Exam: April 20

Fall 2010 Program – Orlando, FL

Portfolio Submission Deadline: July 13

CCR/Comp Exam Registration Deadline: September 21

CCR: October 19 – 20

Comp Exam: October 21

If all else fails…the Bob Ward response

CCIM’s take on Mark to Market accounting and its impact on the economy.

I received this earlier last week from our good friend, Mac Maclure with an update on the how the definition of a phrase could be having a large impact on the current liquidation crisis:

I received this earlier last week from our good friend, Mac Maclure with an update on the how the definition of a phrase could be having a large impact on the current liquidation crisis:

Dear Members of the Faculty:

During this historic week in America as we experience another peaceful transition of power in our nation’s Capitol, your CCIM Management Team is approaching 2009 with a new outlook, new resolutions, and a fair amount of cautious optimism. While we have watched Wall Street and auto industry executives go before the U.S. Congress asking for bailouts, the commercial real estate industry continues to suffer from its own crisis. A vital CCIM member benefit is the Institute’s role as a legislative advocate for the commercial real estate industry. Through our affiliation with NAR and our partnership with IREM, we are part of a team that constantly monitors legislative and regulatory developments to shape the direction of today’s policy issues. In that role, the Institute must offer not only opinions but solutions to the current economic environment. This email addresses our approach to solving a number of the economic issues. While I recognize it is lengthy, I feel it is important that each of you have detailed information.

Chief Executive Officer Jonathan Salk and I went to Washington, D.C., in December to attend the NAR economic stimulus work group, which included representatives from various commercial real estate organizations. Prior to this meeting, the CCIM and IREM legislative committees were asked what a second economic stimulus package should include to stabilize commercial real estate markets. Both of our organizations felt that based on our member’s input, our legislative staff should develop a list of eight solutions, which are attached, that supported our stimulus provisions recommendations. The full Financial Crisis Background Paper is also attached. As a result, the NAR economic work group adopted six of the solutions as its platform, which are summarized in the attached Economic Stimulus Proposal.

However, as we all know the real benefit of our organization is the ability of our members to interact with Congress one on one in the district that elects them. For years our strength has always been in our grass roots involvement on a day to day basis. Therefore, I would like to give you a personal briefing of one of the major issues in our solutions fact sheet that should be addressed with each Congressman on a one on one basis by our members. The issue is called “Mark to Market” rules that were enacted after Enron in an attempt to eliminate potential problems in the accounting industry. Many people are running around Washington talking about “Mark to Market”, but few of them actually understand what they are talking about. Therefore, as Paul Harvey used to say, here is the rest of the story.

The Financial Accounting Standards Board has enacted a rule forwarded to the Securities and Exchange Commission called “FAS157 – Mark to Market”, which is used to determine the fair value for all CMBS programs as well as commercial real estate properties that are held in publicly traded vehicles. Each year under Federal Guidelines, auditors have got to, by Federal law, mark all publicly traded vehicles to market. Under the rules that the auditors work with, “FAS 157” fair value says the auditor must mark to market the new value of the asset every year on the balance sheet of the companies. Under the rules, the accountant must use three levels to mark to market: level 1 active trading market, level 2 observable market data, and level 3 auditor discretion or discounted cash flow. Just like the commercial real estate appraisal business, level 1 would imply the auditor must find comparables which, in a market like today, are really non-existent. Level 2 represents observable market data which, in today’s market, we have very little or no trading of Commercial Mortgage Backed Securities. Level 3 is the use of Discounted Cash Flow Analysis which is what we taught the RTC, FDIC, GAO, and all the other government agencies in 1987-1900 to use. In practice, accountants want to be told which one of these to use or they want to be given the flexibility to use the one that fits the situation clearly. Under the current rules, accountants are having a real problem getting to level 3 because of the wording “auditor discretion.” In my discussion with the head of one of the largest accounting and audit firms in the United States today, he said the word “auditor discretion” is the kiss of death for discounted cash flow because no auditor will jump that hurdle. Instead, they would rather deeply discount the value of the asset because there are no comparables or market data that subject themselves to the potential scrutiny of an Enron-type investigation. However, if those two words were eliminated, they would be free to use any of the three methods to underwrite value.

On January 13, NAR President Charles McMillan delivered testimony before the House of Representatives’ Committee on Financial Services and communicated these positions. Also on the 13th, the CCIM Institute cosigned letters, which are attached, to Representative Barney Frank and Senator Chris Dodd, that support a commercial-focused lending facility. Congressman Frank, chair of the U.S. House Committee on Financial Services, has introduced H.R. 384, which supports stabilizing and providing liquidity to the credit markets, including mortgage-backed securities.

This is just the start of this issue in Congress and we will be pursuing other opportunities with NAR and other coalition partners. We will also be flexible to consider issues that may not be part of our stimulus proposal. These difficult times present an opportunity for CCIMs to make our collective voice heard in the new administration. Join us on April 22 in Washington, D.C. for our annual Capitol Hill Visit Day and meet with your members of Congress. Go to http://www.ccim.com/members/govaffairs/capitol_hill.html for details and to register. As always, the CCIM Institute is very focused on advocacy efforts on behalf of this industry, and we need and appreciate your help to reinforce these messages with your own elected representatives.

If you have any questions or would like additional information regarding these efforts, please contact CCIM’s legislative staff at legislative_affairs@ccim.com.

Mac

Charles A. McClure, CCIM, CRE

2009 President – CCIM Institute

Chairman – McClure Partners

P.O. Box 802047

Dallas, Texas 75380-2047

972-663-3738 Office

214-384-9862 Mobile

mmcclure@mcclureusa.com

Thanks to CIRE Magazine – an overview of how a commercial Realtor can position themselves in the downturns

One CCIM shares how starting a consulting business can help during an economic downturn

By Todd D. Clarke, CCIM

After a few years in the business and having completed more than 400 apartment transactions, I became focused on how to get paid for what I knew versus what I could do. Having been through the ups and downs of economic cycles, I didn’t want all of my income generated from a source that had variables I couldn’t control, such as an economic meltdown and fluctuations in interest rates. You can work for years on a client relationship, precisely price a property through analysis, execute the perfect marketing plan, find a buyer, and put a property under contract, only to have the whole deal blow up because of forces outside your control. The commercial real estate industry has experienced this nationally during the 1980 Resolution Trust Corp. days and most recently in the current credit crunch.