Thanks to my friends at the Polish Real Estate Federation for promoting myself and fellow CCIM instructors, Steve Price, Mark Cypert and Joe Fisher and our resumes:

Category: Believe it or Not!

New Sim City coming

Although this might seem like a shameless plug for my brother Scott who is a programmer at Maxis working on the new Sim City game, I wanted to share that its an amazing piece of virtual real estate.

The Urban Land Institute recently featured the game in its magazine – the article can be found here.

My kiddos and I were fortunate enough to try a beta, and I’ve got to admit the realism is amazing and the game play is addictive.

Pre-orders are being taken for a March 2013 release date for $59 for Mac or PC.

Cool Shape Shifting Home – your next cabin retreat?

Thanks to Gizmodo.com for finding this amazing shape shifting home.

As the roof rises, your ceiling becomes the heavens!

Now this is the way to view the stars!

The full video can be found here:

This is the kind of person I want looking after my states finances…

Yesterday’s Wall Street Journal reported that Susan Combs, Treasurer for the State of Texas is pushing for new legislation that would require local governments to add up their total debt obligations and disclose it to their constituents, the tax payer.

GREAT IDEA SUSAN!

Her office has also signed the light on Texas with a “Texas its your money” website that shares a ton of financial information about the states budgets.

New Mexican’s shouldn’t we demand the same?

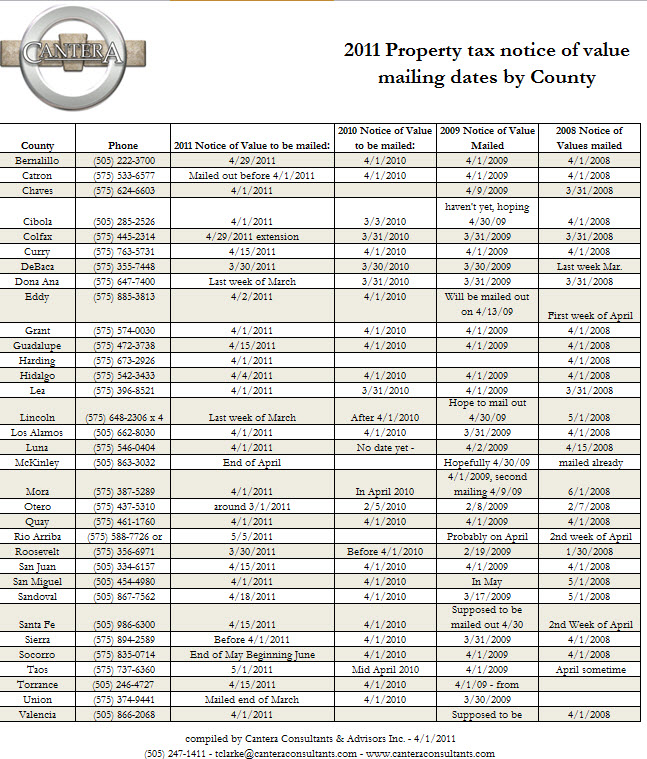

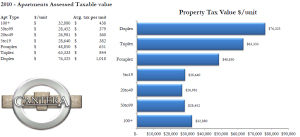

Apartment Property Tax Lightning update – 2011

On the 30th of January, 2012 our firm had a formal property tax protest hearing in front of the Bernalillo County property tax protest board.

The hearing took approximately 2 and 1/2 hours and the Bernalillo County assessor was represented by one commercial appraiser, one residential appraiser, the head of the residential department, as well as the county assessor.

We framed ourside of that case that this was not a not a decision of “value”, but rather implementation of the law and that the assessor’s office had not been executing the current laws consistently for all apartments. The assessor’s office framed their case as one of “value”, and we stipulated to the assessor’s updated value if the board found in favor of the assessors (this means that your property will receive a reduction either way, the only question is how much of a reduction).

Since we had close to a dozen apartment property tax lightning cases that had the same issue, we respectfully requested that the board here the arguments for all property’s and implement them individually on each property (this allowed the board to hear a dozen cases in 2.5 hours vs. 30 hours).

The outline document that is attached served as our narrative as we walked the formal property tax board through the following steps:

– demonstrate that your property is classified as residential

– demonstrate that your property had experienced more than a 3% increase

– demonstrate that other counties have been executing the law with no more than a 3% increase

– demonstrate that the Bernalillo County assessor’s office lost apartment tax lighting cases in 2010

– pull apart the logic underlying the assessor’s case as to why apartments should be treated different than single family homes

– pull apart the logic underlying the assessor’s case as to why apartments should be treated the same whether they are owner occupied or not

– share with the board the stipulated agreement we negotiated with the county in 2010

– remind the board of former board decisions that have found in favor of the apartment owner

– remind the board of former district court decisions that have found in favor of the apartment owner

Finally, we were able to get one of the appraisers to testify that the assessor’s office had a policy of rolling back apartments to the 3% over previous years value, but only in cases that had been previously protested, which demonstrated an uneven application of the law.

The assessor’s office presentation was focused entirely on how they had arrived at the value for the protest.

Unofficially, we have been informed from 3 different sources (including the assessor’s office) that we have prevailed in these cases, but as of this date, have not received written confirmation. As soon as we do, I will forward a copy for your files as well as an invoice showing the new value. The treasurer should then have their records updated prior to the May 2012 payment window.

If you would like a refresher on how our county got to where we are on apartment values – you can find a series of updates on our website at http://www.toddclarke.net/?s=property+tax, with the most detailed explanation at http://www.toddclarke.net/?p=969 .

Please email me if you would like to receive copies of the outline and/or the exhibits presented.

Tearing it up from the top down

Yes your eyes are not deceiving you – there is an excavactor on top of this high rise, demolishing it.

Only in China would we see something like this. More on the story at the link below.

Thanks to Gizmodo.com and its sister blog Jalopnik.com

Building a 30 story building in 15 days

Surpassing a previous record of building a 15 story hotel building in 6 days, the Chinese company, the Broad Group has constructed a 30 story building in only 15 days.

It would appear a majority of the building was built off site in panels that were lifted into place, a practice that is likely to become much more common in the near future. A 6 minute time lapsed video can be viewed here.

Thanks to Gizmodo.com for the original article.

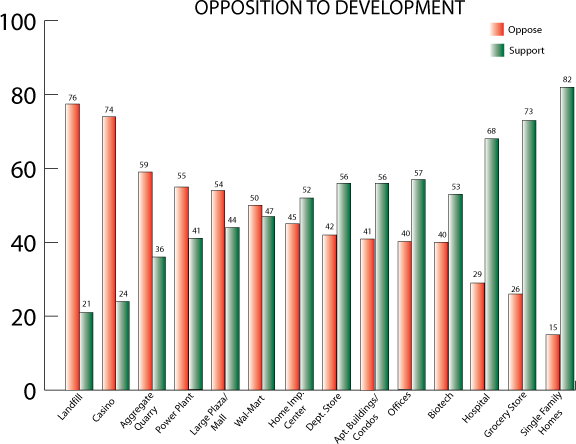

Who opposes development?

As always, I am astounded at the amount of information available on the internet. Recent case and point – fellow Twitter, Patrick Fox @pffox send me a link to the New Saint Index , which tracks opposition to real estate projects.

What an amazing resource!

While landfills and casinos continue to be unpopular with neighborhoods, the opposition to WalMart has reached a tipping point where those in favor and against are almost even. (As an interesting aside, one of my favorite authors, Marc Levinson has just released a new book titled “the Great A&P and the Struggle for Small Business in America” which covers the opposition to A&P markets which was the largest retailer in the early 1900’s)

I also appreciate how the index breaks down the demographics of each product type – like supporters for grocery stores (mostly male 21 to 45, who rent and have some college and a lower income) vs. opponents (mostly female 45 to 55, own their home, high income).

QR Codes in Real Estate – around the world!

As reported in our sister blog, Todd’s technology Corner,

Having long written about the benefits of using QR Codes, imagine my surprise when I came across this real estate sign in Kyoto that included a QR code!

CCIM Live and Frank Lloyd Wright!

CCIM Live update – Aerotropolis webinar now online!

Last week I had the pleasure of introducing and interviewing Greg Lindsay, author of Aerotropolis. CCIM has just posted his webinar live.

Tapping into people’s memories as part of your social networking strategy

OR, using Groups effectively on Facebook.

As someone who has covered, spoken and taught courses on social networking, I can tell you this the fastest evolving part of the internet today. Facebook membership is rumored to be over 750 million people, or 20% of all of the business people on the internet today.

During the last few years I have seen mildly ineffective to downright disastrous uses of social networking, and the successful uses are fewer and far between.

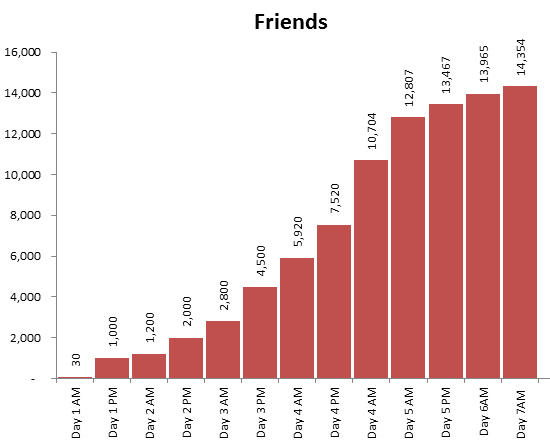

Today I would like to focus on one of that success by focusing on a local Facebook group page that grew its membership from 30 to 15,000 and experienced over 40,000 posts in one weeks time.

The group Remember when in Albuquerque… had a simple concept – encourage local Albuquerque’s to share their memories of by gone places, people, and events.

The original idea came from Laura Reynolds, a Realtor in Las Cruces, who came across a Facebook group that allowed people who grew up in Ft. Worth to share memories. Laura suggested to her husband that he start a group about Albuquerque.

Steve started the group, Remember when in Albuquerque and quickly had 30 members. As those members started to tell their friends, and started posting their Albuquerque, memories, growth started to accumulate exponentially, and Steve requested a handful of us help administer (myself included).

I kept track twice a day of the growth of the group:

While the occasional commercial does popup on the group and there has been some sniping about deleted posts, the group has continued to grow as more people share their memories about Albuquerque.

Although many people know that four generations of my family has lived and worked in Albuquerque, many don’t know that I am an Albuquerque history buff and have a large collection of old photos, postcards and books. What better venue to share these? As I shared, others chimed in, and my “friends” counter increased by another 15% or so. (No, I don’t know all of them, but if they love Albuquerque history as much as I do, why would I tell them no?)

The group has received recent coverage from the local to TV new on KRQE as

As well as a front page article in the Albuquerque Journal:

Is this a short term fad, or a long term trend?

For now, I would say long term trend. Although Facebook doesn’t share average time spent on any one group, a common expression from group members is how much fun they’ve had strolling down memory lane, and how much of their day has flown by.

Even after growth in the group stabilized at 15,000 (or so members), the media coverage has exposed the group to new people who are asking to join, creating that ever increasing spiral of increasing exposure, which is truly any marketers dream.

All in all, I’d label this a “sticky” success.

Book review: Best read for 2011: Aerotropolis

Aerotropolis, the way we’ll live next

Authors: Greg Lindsay & John D. Kasarda,

Publishing Info: Farrar, Straus and Giroux, Nonfiction, First edition published March 1st, 2011

As an international instructor for the CCIM institute I discovered that the book, Aerotropolis: the way we’ll live next dovetails nicely with what the just-in-time delivery model as a primary driver of demand for industrial space that we teach in the CCIM 102 course, I would highly recommend it to anyone in commercial real estate.

As a rabid book consumer, I will easily digest about 100+ books a year, and without a doubt, Aerotroplis: the way we’ll live next has become not only my favorite book of this year, but one of my all time favorite business books. It is one of those rare books that I thoroughly enjoyed reading that I found myself moderating how much I could read daily so I can push the ending of the book out as long as possible.

My favorite magazine, The Economist recently offered a glowing review of Aereotroplis, stating “In Aerotropolis, John Kasarda of the University of North Carolina and his co-author, Greg Lindsay, convincingly put the airport at the centre of modern urban life.”

The theme of the book is that successful cities of the future will be wrapped around successful airports and those cities that can’t adapt may be passed by. Its authors state the books hypothesis as an equation related to time “The aerotropolis is a time machine. Time is the ultimately finite commodity setting the exchange rates for all the choices we make.”

Author and reporter, Greg Lindsay, expands and expounds on the John Kasarda’s original idea that airports are the highways of the future. As a former Fast Company and Wired magazine reporter, Mr. Lindsay racks up the frequent flyer miles talking with civic leaders, CEO’s and company logicians as he interviews them on their home turf about the importance of air transit to their communities, companies or supply chains future.

As a fellow traveler, I reminisced about Mr. Lindsay’s travels to well-known airports like Chicago’s O’Hare, Atlanta’s Hartsfield, Amsterdam’s Schiphol, or even Hong Kong’s International, but I was green with envy over his trips to Dubai’s Al Maktoum International Airport or South Korea’s Incheon airport and adjoining master planned Songdo International Business District. One story of Mr. Lindsay tracking his gift of flowers from the Aalsmeer flower auction in Amsterdam to his mother’s front porch will endear Mr. Lindsay to the reader as an extremely diligent reporter and respectful son. Even more surprising than his few thousand mile journey for flowers was his mother’s reaction.

Some of the books concepts in the book are eye opening such as “The world’s urban population is poised to nearly double by 2050, adding another three billion people to places like Chongqing. We will build more cities (and slums) in the next forty years than we did in the first nine thousand years of civilized existence. The United Nations predicts the vast majority will flood cities in Africa and Asia, especially China.”

Or this quote about South Korea “South Korea’s capital is the archetypal twentieth-century megacity, doubling in size every decade or so since 1950 to twenty-four million inhabitants—the second most populous on earth after greater Tokyo.”

Or my favorite quote about a Chinese based manufacturer: “We had barely crossed the border before he opened his laptop and began walking me through the true costs of those shipments. He’d built a widget calculating every conceivable variable: the weight, volume, value, and quantity of the products in question; the lead times for sourcing and building them; time spent in transit; their shelf life; the spread between paying his vendors and being paid himself; the cost of money in the meantime; and the cost of returns. An entire calculus, in other words, underlies the pivotal question of our era: What is the price of speed? The widget’s answer: slow is more expensive. The only thing faster than a FedEx 777 Freighter out of Hong Kong is the velocity of money, and the last thing Casey wants to pay for are the days his parcels are stuck on a boat. Obsolescence sets in the moment they leave the factory. “Revenue evaporation,” he calls it. “Air freight is key,” he muttered while running the numbers. “We like to work with products that can go by air. We build them in Shenzhen, and they’re in New York two days later. Time is often our number one currency, and the dollar is second.” ”

And this quote summarized the breath taking feelings I experienced in my many visits to China for CCIM’s education program: “China is placing the single biggest bet on aviation of any country, ever. Even before the crisis and China’s subsequent stimulus, the central government announced as part of its Eleventh Five-Year Plan that it would build a hundred new airports by 2020, at a cost of $62 billion. The first forty were ready last year. The vast majority lie inland, hugging provincial capitals and secondary cities bigger than any in the States. Full-scale aerotropoli are planned for China’s western hubs, Chongqing and Chengdu, and its ancient capital. Besides airports, China laid as many miles of high-speed railroad track in the last five years as Europe did in the last two decades. The trains, in turn, are meant to keep people off the highways, to which China’s adding thirty thousand miles—enough to eclipse the American interstate highway system. China’s planners have internalized the lessons of America’s Eisenhower-era infrastructure boom, designing a world-class system for moving people and goods quickly, cheaply, and reliably across any distance, whether locally by highway, regionally by rail, or globally by air. The plan is to pick up and move large swaths of the Delta hundreds or even thousands of miles inland. There is nothing to stop them.

And this quote on where the future global cities will be “Finding another five hundred million passengers 7should be easy. China has anywhere between 125 and 150 cities with populations greater than a million. The United States has nine; Europe, thirty-six. When the first phase of China’s airport-building boom is complete, the number of hubs handling thirty million passengers annually—more than Boston’s Logan or Washington’s Dulles—will have risen from three to thirteen, all of which will be the host of aerotropoli. By the time they’re finished in 2020, 82 percent of the population—1.5 billion people—will live within a ninety-minute drive of an airport, nearly twice the number today.”

The book dovetails nicely with some of my other favorite business reads like Marc Levinson’s “The Box: How the Shipping Container Made the World Smaller and the World Economy Bigger” and Sasha Issenberg’s “The Sushi Economy: Globalization and the Making of a Modern Delicacy” both of which deal with just in time delivery and creating new markets.

Additional topics addressed in Aerotroplis include Peak Oil vs. Peak Food, globalization as a tool to pull the poor into the middle class vs. the carbon footprint of globalization via air travel, and the true cost of air travel in both economic and environmental terms.

If you enjoy Aerotroplis as much as I did, you might also read the June edition of Southwest Airline’s Spirit magazine as Mr. Lindsay has recently penned an article titled “Corporate Latter”. In this article he builds on the concepts discussed in Aerotroplis and discusses how technology has allowed us to shift away from being tied to an office, setting up shop at any location (http://www.spiritmag.com/click_this/article/the_corporate_latter/) . One economic development guru and author, Mark Lautman, is pushing this idea as the next evolution of cutting edge business recruitment – to scale down the benefits big corporations receive so communities can chase the highly mobile, quality of life comes first businessperson/consultant who eventually expands their business and hires staff. According to “When the Boomers Bail: A Community Economic Survival Guide”, this segment of our economic businesses is one of the fastest growing.

Not only would I highly recommend you read Aerotroplis, I would encourage you to purchase copies to share with your family, friends and clients as the conversations started from the concepts in the book are engaging, enlightening and very relevant to anyone with commercial real estate.

Todd Clarke CCIM

Aerotropolis can be purchased at: http://www.amazon.com/Aerotropolis-Way-Well-Live-Next/dp/0374100195/ref=sr_1_1?ie=UTF8&qid=1306590616&sr=8-1

Mother nature’s wrath

This photo shows a before and after of a neighborhood in Joplin, MO that was demolished from the recent the toronado storms.

The image on the top is from Google Map’s street view.

The image on the botton was taken by Aaron Fuhrman

While all American’s pray for the fine people in Joplin who have seen the mother nature first hand, it will be interesting to see how redevelopment occurs for this area.

Thanks to one of my favorite techblogs, Gizmodo, for sharing this (via DailyWhat).

Notice of value dates for property tax bills

A new form of advertising – your house

Thanks to Gizmodo.com for sharing from Adzookie.com which is a UK based company that is offering to pay homeowners mortgages if they let them paint their house with advertisements.

Although the Gizmodo posting indicates the advertisement is only in UK, when I went to their website it looks like they are up and running in the USA as well!

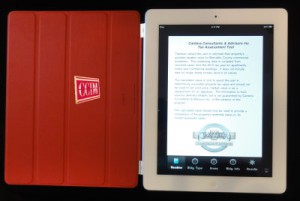

Announcing our Social Networking scavenger hunt

Would you like to win a new iPad2 with red leather cover (notice the CCIM logo?)

Correctly answers the first 10 questions on our social networking quiz and give us some feedback on the next 4 questions at:

www.canteraconsultants.com/scavengerhunt

Good luck!

This marketing effort will be used to gauge the effectiveness of social networking in the marketing of the CCIM Technology and Social Networking course http://www.ccim.com/education/course/TSN/TSN0001 .

The world’s smallest trailer

is made for the babyboomers…and their hoverarounds.

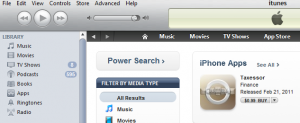

my first iPhone app help client’s calculate their property taxes

Very excited – as of 5 minutes ago, our iPhone app to help client’s calculate their property taxes for commercial properties in Bernalillo County went “live” in the iTunes store! It is only 99 cents, and if you provide us feedback to improve version 2 and leave feedback, I’ll gladly send you a buck!

If you own a commercial property in Bernalillo County and you would like to compare your property’s value against the resolved cases from 2010, click here – http://itunes.apple.com/us/app/taxessor/id419811562?mt=8 to try it out.

The App is only $.99 and if you leave us a review and email me feedback at tclarke@nmapartment.com so we can improve version 2, I’ll gladly refund you a buck.

Thanks to Mark and Jamii at SWCP for making this happen.

Support for the app can be found here – http://www.taxessor.com .

More bricks and mortar fall to clicks

In a Wall Street Journal article dated today, Borders Group has indicated that they are making preperations to file bankruptcy in the forthcoming days.

Similar to the fallout of music stores after iTunes, Amazon website and digital readers has encouraged many readers to abandon physical stores. Companies that have figured out how to the digital frontier continue to thrive, while those that haven’t die. Interestingly , the same articles mentions that Borders tried going dot com a while back, threw in the towel and sold their initiative to Amazon.

“I think that there will be a 50% reduction in bricks-and-mortar shelf space for books within five years, and 90% within 10 years,” says Mike Shatzkin, chief executive of Idea Logical Co., a New York consulting firm. “Book stores are going away.””

—wsj.com 2/12/2011

Borders Group currently has over 600 locations, less than 1/2 of what it had in its peak at 2005.

In our market, Borders has a prominent location in the ABQ Uptown lifestyle center. I will be curious to see what the new highest and best use of that store will be.

Property Tax protests update for 2010

2010 Bernalillo County Multi-family Property tax rollback – the rest of the story.

The following is a summary of an email sent to clients after our December 15th, 2010 hearing:

As I was working through a review and update of the apartment property tax lightning cases of 2010, I was reminded of the ancient Chinese blessing (or curse depending on your viewpoint):

“May you live in interesting times”

Many people are not aware that this blessing has two follow-up lines:

“May you come to the attention of the authorities” and

“May you come to find what you are looking for”

Unfortunately, 2010 was a year where all three of these came true for many of us. With that in mind, The following is an update on the property tax protests for your property.

The short version of this update is simple: we were able to get your property the lowest value we believe was possible in 2010, that value is final, and is not subject to any further litigation or appeals.

The long version as follows:

In my 22 years of handling property tax protests, 2010 was a unique year. State statutes indicate that the “value” year was 2007, which represent the tail end of the peak in the real estate market, and yet here in 2010, values in many cases had plummeted. We can add to that mix a county assessor who had recently been told by two different judges in district court that parts of a law passed by the legislature in 2002, and enforced by 33 county assessors was unconstitutional. As these recent changes in the law have had a big impact on how properties are valued, and it would be a safe to say this was a “perfect storm” that could wipe many property owners out.

Why we believe our client’s hire us at Cantera Consultants & Advisors Inc.

As it relates to handling property tax protests for our clients, we have found that successful protests involve more than knowing valuation technique and state statutes, it is also about knowing the people and having a strategy.

Our strategy this year was as follows:

– To use time to the advantage of our clients

– To research, develop, or create market information for the foundation of value negotiations

– To provide our clients with the risk/return analysis of the values that were negotiated with the assessor’s appraisers

– To meet with our local politicians, keep abreast of the recent changes in law, and provide an continual education on our property tax system

– To keep our clients and the public informed as to the changes in the property tax arena

– To align ourselves with other professionals who have experience in the property tax protest arena and litigation (i.e. find a good attorney)

Market information

For the first time ever, our firm, Cantera Consultants and Advisor Inc., compiled a 5 year survey of occupancy, rental rates, CAP rates and value changes. This market information was published in the Albuquerque Journal earlier this year and was used to help our client’s in obtaining lower property tax values.

A bit of history about recent changes in the law

The law, known as the “property tax lighting” or “3% maximum increase” or “3% Cap on values” law limited the increase in values for residential properties by no more than 3%. What many people forget is that the law had other components, such as requiring all assessor’s to bring their entire portfolio to “current and correct values, which are to be no lower than 85% of market value” prior to implementing the cap.

The intention of this law was to minimize the impact of a property tax bill increase on the little old lady in Santa Fe whose neighborhood was being overrun by Hollywood types that were paying outlandish in prices for housing. The value of the little old lady’s house would rise to the recent sales, which would lead to an increase in her property tax bill to an amount she might not be able to afford.

While the intention of the law might have been noble, the thought process about how to implement it was poorly executed. If we as citizens of New Mexico have decided that the little old lady deserved protection, then the legislature could have granted her an exemption on her actual property tax bill. Instead, the law limited the increase of her assessed value by no more than 3% a year, or 6.1% every 2 years.

Anyone who has analyzed our property tax system knows that there are three variables that impact your final property tax bill. Your assessed value, the percentage of your property that is assessed, and the mill levy. In New Mexico, your assessed value should be close to “market value”, most properties are assessed at 1/3 of their market value, and the mill levy floats as a ratio between the county’s total property portfolio value and the budgets of those entities that tap into property taxes.

By limiting only the value of the property, the law did not limit the increases on the property tax bill. By requiring disclosure of all single family residential property sales, the law ensured the assessor had a ready pool of comparable sales, AND, many of us believed it opened the door for the legislature to consider a property transfer tax.

The law had some exemptions that allowed increases of more than 3%, including new construction, changes in zoning, and the sale of the property. If your property had experienced any of these, its value could be increased by more than 3%.

As property buyers came into title in their new property, they experienced a large increase in values, larger than the 3% of previous years, which led to the term of “property tax lightning” for the zapped feeling many of these owners experienced as their property tax bills shot through the roof.

From 2002 to 2009, residential property owners were repeatedly zapped with this unfair law. Typically, case law, or interpretation of laws in the court room allows our legal system to provide a balance against our legislature. Amazingly, it took a few years before a case was filed that impacted the interpretation of this law.

In 2009, a handful of property tax cases were brought against the Bernalillo County challenging the implementation of the exceptions to increasing values more than 3%. Two different judges ruled that the law was unconstitutional, and those cases have since been appealed, and now, on the eve of 2011, have still not been resolved.

Resolution or not, the message was clear – the legislature created a law that treated property tax owners differently based on the date of their purchase of a property.

At the end of 2009, and after these court rulings, the county assessor “rolled back” all single family home values that had been increased by more than 3% to their 3% limits.

As a side note – it is interesting to note that a legal opinion written about the same time as the law was being considered by the New Mexico Attorney general indicated that the while this new law may not be unconstitutional, “its application could be unconstitutional”.

Fast forward to spring of 2010, where the Bernalillo County assessor has two rulings that the 3% cap on increase law is unconstitutional. She decides to rolls back the value on some 45,000 single family homes that had experienced property tax lightning in former years.

As the overall value of the county’s portfolio is decreased by these roll backs, she also interprets that the law on limiting increase does not apply to apartment buildings based on their occupancy status and then she proceeds to raise the value on thousands of apartments across the county.

Although the decrease in single family values was not entirely offset by the increase in multifamily values, the timing of the two cannot be entirely coincidental.

Through out the summer, fall and winter of 2010, our office met with the county assessor’s appraisers and reviewed each of our client’s properties. In many cases, we were able to get a value reduction to the 2009 value plus 3%, or lower.

In some cases, we were able to get the value’s negotiated down close to the 2009 level +3%, and we signed off on those cases. Working with our client’s we performed a risk/return analysis that balanced an additional smaller decrease in value vs. the possibility of paying a property tax bill on the original assessed amount for many years as the cases worked their way through the property tax protest process and possible appeals into the legal system (keep in mind, those owners who prevailed in the 2009 single family property tax lightning cases are still paying higher property tax bills in 2009 and 2010 as their cases are still under appeal).

The balance of the property cases we had, totaling 30 in number, proceeded to formal hearings on December 15th, 2010. These were the most hard core cases, where none of the standard value techniques indicated a value remotely close to the 2009 plus 3%. In one particular case, while we able to reduce a property’s value by 50% from its 2010 assessment, the 2009 value plus 3% was another 50% lower. Each of these owner’s (including myself) indicated an ability to pay the higher property tax bill and a desire to continue their protest based solely on the legality of the removal of the 3% increase in values.

Assessor’s deposition

On November 19th, 2010, the Bernalillo County assessor was deposed by a handful of attorneys, including ours. I attended a majority of the deposition and I can tell you my summary at the time was that the most repeated answer in the 167 pages of the deposition, was “I don’t know”. Part of that consistent answer relates to the questions that some of the other attorneys asked – questions that showed a limited understanding of the assessor’s job duties, but the balance of the questions related to the assessor’s execution of the changes in values to apartments as it related to the removal of the 3% increase cap on values.

As you may know, there is a state statute that gives any county assessor a large advantage in formal hearings:

7-38-6. PRESUMPTION OF CORRECTNESS

Values of property for property taxation purposes determined by the department or the county assessor are presumed to be correct. Determinations of tax rates, classification, allocations of net taxable values of property to governmental units and the computation and determination of property taxes made by the officer or agency responsible there for under the Property Tax Code are presumed to be correct.Our belief was that the assessor’s deposition demonstrated that this presumption of correctness should not be applied by the formal tax board in these apartment cases.

Timing

Based on last year’s single family property tax lightning cases, and our experience from previous years, we believe the longer we can wait to resolve our cases, the more our client’s benefit. For example, last year, some of our clients benefitted from recent court rulings that came late in the year. Said succinctly, each year the aggregate protests carry with them a body of knowledge, and by being last or close to last in the protest process, we benefit from that knowledge base.

The unfortunate side effect of waiting until the end is that the assessor was successful in getting an extension of their cases until after the December 10, 2010 property tax bills were due, so many of our clients received a bill for full value.

Our formal hearings for unresolved cases were scheduled for December 15th, 2010.

Ostrowski Decision

On November 30th of 2010, the formal property tax board found in favor of a property owner who owned a single family residential property that was rented out. The property in this case had sold in 2004, and had been hit with tax lighting, but its value was not rolled back as it was believed to be a “non-owner occupant” property. The board ruled that irrespective of the property’s occupancy status, it was not being treated uniformly with other similar properties. The board ruled that the value be rolled back.

Owings Star decision

On December 3rd, 2010, the formal property tax board found in favor of the county assessor in a case where an apartment owner believed that their property had been discriminated against based on its increase value of 25%. Unfortunately, the owner presented little in evidence to demonstrate said discrimination, and the formal property tax board, citing the case Hahn, Inc. vs. County Assessor that “the bar is set very high for a property owner claiming discrimination. What must be proven is an intentional scheme of discrimination, for which there is no evidence here”, and the formal board found in favor of the assessor.

Unresolved Decision

On December 9th, 2010, the formal tax board convened to hear the 40+ cases of another tax consultant and his attorney. Although the assessor had been subpoenaed to appear, the county attorney informed the board that she would not be appearing, and that the consultant, and their respective property tax owners, did not have the authority to subpoena an assessor to appear. Both sides tendered their briefs and this case should be ruled on by January 8th, 2011.

Clarke Stipulation

About a week before the hearing, our attorney, Stephanie Dzur (who prevailed in the single family residential property tax lightning cases in 2009), extended an offer to the county attorney’s office. The offer was an agreement that indicated we understood that the county assessor has been making decisions based on the information available at the time, and while we respected the difficult position she was in, we believed we would prevail at formal hearings, and as such, the county should agree to rolling back all of our pending protests to the 2009 values plus a 3% increase. As part of this offer, Mrs. Dzur shared with the county assessor our case, which we believed to be very strong.

Wednesday, December 15th, was our formal hearing for all remaining property tax protests for Bernalillo County. By Tuesday afternoon, we had been able to negotiate all of our pending cases down to the lowest values, subject only to the apartment cases that has experienced “tax lightning” or an increase of more than 3%.

Wednesday morning, I received a call from the assessor and she indicated that she wanted to meet with myself, the county attorney, and our attorney, Stephanie Dzur. The assessor indicated that based on how the formal board was ruling, she believed that apartments should not be treated differently, and although she intended to appeal some of the formal rulings, she was willing to resolve and sign off on the balance of cases if we could come to terms on a stipulated agreement.

Over the course of the morning, we modified the language of our original stipulation presented in our offer the week before.

Although we had an intellectual interest in pursuing the case through formal boards and a passion to put on our case, foremost in our minds was the issue of an appeal. The assessor had indicated that she was going to appeal the decision of the formal tax board, and similar to the property tax lighting cases of 2009, we were concerned that our client’s would be exposed to many years of property tax bills based on much higher amounts, until the legal system could provide a final and complete ruling.

By working through the stipulated agreement, you and our other clients would benefit from a lower property tax bill and a final decision that was not appealable. For each property that was subject to this agreement, I have already forwarded to you the stipulated agreement. The gist of it is that we agreed that the assessor interpreted the law based on the best information she had at the time, that the information was changing over time, and that we wanted our clients to benefit from that updated information by being treated the same as other the residential properties in 2010.

In the end, we believe we had the better hand, the better case, and that it led to the best possible outcome.

2011 and beyond

Many of our client have asked us what 2011 will hold, and to be candid, while I have many ideas as to what might come about with a new governor, a “refreshed” legislature, and an reelected assessor, I remain hopeful that they will have the courage to deal with this pressing issue head-on.

My largest concern for future years is the creeping of politics in the property tax system. In his autobiography, Former Governor King indicated that one of the many reasons he wanted the state constitution rewritten in the 1970’s was to push politics out of the property tax system. The laws that came out of that constitutional congress served our state well for over three decades, but all of that effort has been undone by recent laws. Until we repeal those laws, or modify our property tax system I remain concerned that politics and politicians will continue to provide uncertainty in our property tax system. That uncertainty translates to an opaque property tax system that will have an impact on all of our property values.

Fortunately, organizations like the Apartment Association of New Mexico and NAIOP are staying on top of these issues by meeting with our elected leaders to provide a better outcome. If you are not currently a member of both of these organizations, I would highly recommend signing up in 2011.

My apologies for the lengthy update, but I thought you might have an interest in the rest of the story. If you have an interest in copies of any of the above mentioned documents, don’t hesitate to let me know.

Thanks,

Todd

————————-

Todd Clarke CCIM

Cantera Consultants & Advisors Inc.

715 8th NW Albuquerque NM 87102

O 505-247-1411

M 505-440-TODD

F 800-791-4047

tclarke@nmapartment.com

www.nmapartment.com

Read Confessions of a Commercial Real Estate Consultant – www.toddclarke.com

————————-

This decade’s population growth is the slowest in the USA since the depression

According to CNN.com – which is covering the release of the Census data sets today. There is just under 309 million Americans today.

10 years of tenants, toilets and trash

Imagine being the landlord of this multinational facility – and while its only some 286 miles away, the average round trip cost to service it is $750,000,000.

Today, the International Space Station (ISS) celebrates its 10th anniversary as an occupied structure.

To date, ISS has been visited by 200 visitors on some 36 space shuttle launches and/or 9 Russian Launches. The ISS represents the largest manmade structure outside of Earth, contains 29,561 cubic feet and is estimated to have cost $150,000,000,000 to design, launch, assemble, maintain and service. That works out to be about $5,074,253 per cubic foot.

Regardless of how you feel about the space station, it is amazing to think that over 100,000 people from 15 different nations have been able to work well enough together to allow this project to continue.

Other interesting facts: as of today, the International Space Station has made over 46,000 orbits around the earth – along a path that is visible to over 90% of the world’s population.

Thanks to Gizmodo for the 10th anniversary alert!

Honey, where did we park the house?

I could have sworn we left it right here on the corner of Sinkhole Avenue and Dropoff Blvd…

This first appeared on one of my favorite gadget blogs, Gizmodo, and then was followed by a posting with more photos on the National Geographic website.

Before my friends in Albuquerque chuckle too much about those crazy places (like California) that seem to suffer from too many of these natural disasters, a few years ago, an Albuquerque sink hole swallowed up a Albuquerque Fire Department truck.

Latest update – we now have video.

Too my friends in the development business, how would you value a site like this?

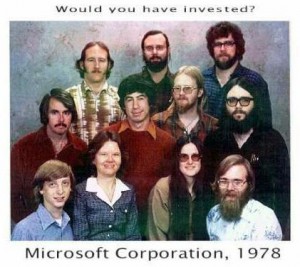

The passing of an era

Posted in our sister blog, Todd Clarke’s Technology Corner, is an obituary of the man who developed the hardware for the first personal computer.

His fulltime job was as a scientist at Sandia National Labratories, but his interests were in developing computers that the public could use.

His company, MITS, developed the hardware, but he needed a software operating system to make the machine more accesible, and he and heard of a bright young programmer in the Seattle Area, Bill Gates, who might be able to write what he needed. Bill and his partner, Paul Allen worked around the clock from some down and out Route 66 motels to write the first operating system under their new corpoorate name, Microsoft.

This corporate photo, taken in 1978, shows the original Microsoft staff.

Thank you Dr. Edwards for cementing Albuquerque’s role in computer history.

Apartments and Property tax lighting

Cantera Consultants & Advisors Inc. recently completed a thorough analysis of all apartments in Bernalillo County.

The following graph is a summary of that analysis.

The graph illustrates that duplexes, triplexes and fourplexes are assessed at a much higher rate than their bigger peers.

If you feel this is counter intuitive, you would be correct – generally, the newest nicest apartments with swimming pools, clubhouses and movie theaters are the larger apartments.

So whats going on in the details?

Simple – our property tax code is too complicated, and skewed towards the larger owner who can afford to higher a property tax consultant such as Cantera and the smaller owners are less likely to pay attention when their notice of values come out.

What can you do about this? Join advocacy groups like the Apartment Association of NM and work with there government affairs committee to help our legislature change our laws.

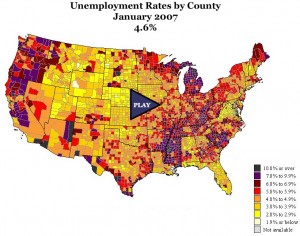

Unemployment trends across the country – good or bad for your area?

Click on this link for an animated video showing county by county unemployment levels and watch as most of the country turns purple in unemployment.

Now you really can have an office anywhere!

Possible solution for zoning issuess?

This make look like any ordinary residential area in California, but would you believe it if I told you it was actually a factory? Click here for more. I wonder why developer’s haven’t used this for industrial parks?

This make look like any ordinary residential area in California, but would you believe it if I told you it was actually a factory? Click here for more. I wonder why developer’s haven’t used this for industrial parks?

Mega development near Vegas…

The Hoover dam by-pass is under construction – Gizmodo (and my father-in-law) have forwarded some amazing photos of the construction of this bridge.

Spaceport NM update

Thanks to Richard David for turning me on to this article about the spaceports status…

Thanks to Richard David for turning me on to this article about the spaceports status…

Small housing… now portable?

My friends and family will tell you that I’ve recently become a bit obssessed with Teardrop trailers – an offshoot of our family’s fabulous cross-country summer adventure.

My continual search for this perfect Teardrop trailer has yielded this trailer –

.

.

I made a dozen or so trips to China, and can recall many amazing sites and feats that people were able to do on their bikes – from carryring a loady of 2x4s (on his shoulders) to more than one person on a bike – but nothing like the photo above. What do you suppose he does in that trailer? live? rent it out? store his mother in law?

(thanks to Kevin Cyr for taking the photo)

How cars have shaped modern society…

A good friend, developer, proffesor and author friend of mine, Chris Lienberger, wrote a fabulous book titled “Option of Urbanism” a couple of years ago. One of the items I was stunned to learn is that GM designed and presented their vision of a future metropolis – centered around cars.

Some sixty years later, many of our cities resemble that comment.

It is interesting to see how some communities are dealing with this issue by designing parking structures that don’t resemble parking lots…

Thanks to Gizmodo.com for sharing with us this lot from VW and this automated lot in Russia complete with a photo gallery.

Those of you interested in Chris’s book can purchase it here:

Now this is my kind of apartment

from the Cool Hunter website comes a possible design for a new W hotel…

The website features several perspectives and layouts on this apartment, which looks like a cross between BladeRunner and Space 1999.

Hey – who is that in my shower?

APS’s dismal graduation rate

In a copyright story by the Albuquerque Journal, the headline read “State: Almost Half of Class of 2008 Didn’t Graduate” and was followed by “Roughly half the students who should have graduated with the class of 2008 failed to do so, prompting a call to action by the state’s education secretary.”

While the headline is alarming, the data underneath it is suspicious.

How do I know? I worked as a consultant a couple of years ago on an education study for a developer to understand what was gonig on with APS enrollment.

In meeting wiht APS staff demographers, it came out that they didn’t track APS students once they left the system. So if you move to Los Lunas, you didn’t graduate, if you change schools to St. Pius, you didn’t graduate, if you move to Boston, attended and graduate from M.I.T., negotiate world peace, and win the Nobel Peace Prize, yes, you guessed it, APS believes you “didn’t graduate”.

Assuming 5% of all American’s move in any given year, and a four year high school attendance, fully 20% of the APS students could have “not graduated”.

Maybe its time for APS to spend some time and money and track its most precious resource, its students…

Albuquerque loses a stately historic apartment community

Fire last night destroyed one of Albuquerque’s best loved medium sized apartment communities- the Castle Apartments. Located between downtown and old town at 1410 Central SW, the 20 unit apartment community caught fire around 8pm and continued to burn in the Wednesday morning.

Built in 1922, the 15,150 square foot apartments featured amazing built-ins and was considered by many of its former residents, some of the nicest apartments in the Duke City.

Located just east of former mayor, Franz Huning’s estate, affectionally known as Huning Castle. The old Huning Castle estate was replaced in the a few years ago with the

As smoke blanketed downtown Albuquerque, News reports last night mistakenly indicated the newwer Huning Castle apartments were on fire, but later corrections indicated that residents from the Huning Castle apartments called in to the fire department about the fire at the Castle apartments.

Fortunatley no lives were lost, and our condolences go out to the families that own this historic gem and the residents who called it home.

Teaching an old building new tricks…

This doesn’t look so good…

Thanks to Gizmodo.com for the headsup on this diaster in Turkey!

From one extreme to another in housing

[/caption]

[/caption]

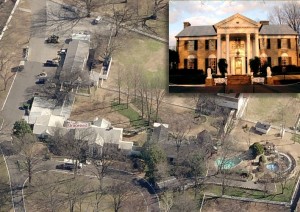

Having visisted Graceland right before driving to Asheville, NC to see the Biltmore Estate, it was very clear this house was and still commands the status of an “estate”.

And I must admit that as a destination/tourist magnet, the property is one of the best run venues I’ve been to – on part with how well Disney runs their entertainment venues.

Changes in real estate

Our family was at Elvis former mansion and last resting place this week, Graceland , and I was struck by the fact that housing has changed a lot since Elvis’s hey day.

In 1970 the average house size was 1,100 sf. Today it’s over 2,200 sf. Elvis’s big amenities were 3 TV’s, and a hundred disc record player.

The style, size and even taste of the house might be something any of our neighbors might have and besides the large lot it sat on, the house itself hardly seemed to qualify as a “mansion” by today’s standards.

(images courtesy wikipedia.org and bing maps)

How global demographics and technology are changing the face of our planet

The video does a nice job of summarizing the acceleration of technolgy and its innovation. Couple that with changing demographics (for example, did you know there are more people who speak english in China, than there are people in the United States?