Please note that the deadline to file a protest is 30 days after the date on the notice of value.

Author: Todd Clarke

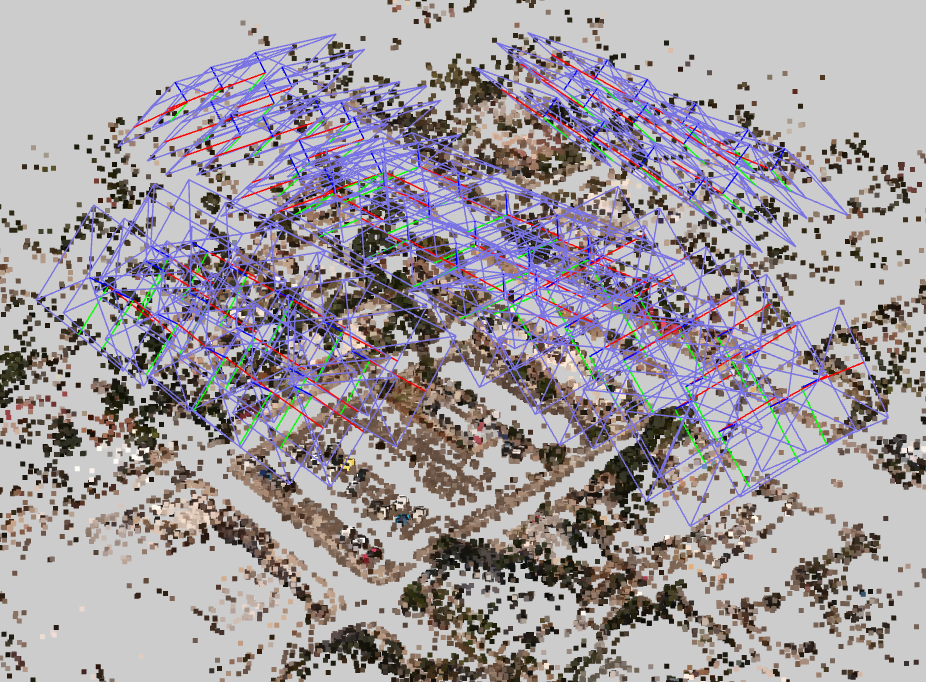

AtliZure – 3D models from your drone photography

This was taken today with our DJI Phantom 4 Drone and the Altizure software.

The drone made 5 paths (or passes) around the property, taking a total of 78 images that you then upload to Altizure and it formulates this 3D model.

This is what the background computer processing (called camera poses) of that image looks like:

Polish Resume

Thanks to my friends at the Polish Real Estate Federation for promoting myself and fellow CCIM instructors, Steve Price, Mark Cypert and Joe Fisher and our resumes:

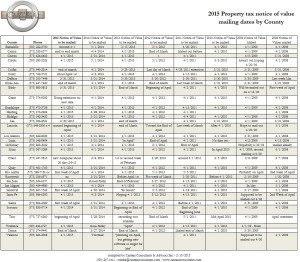

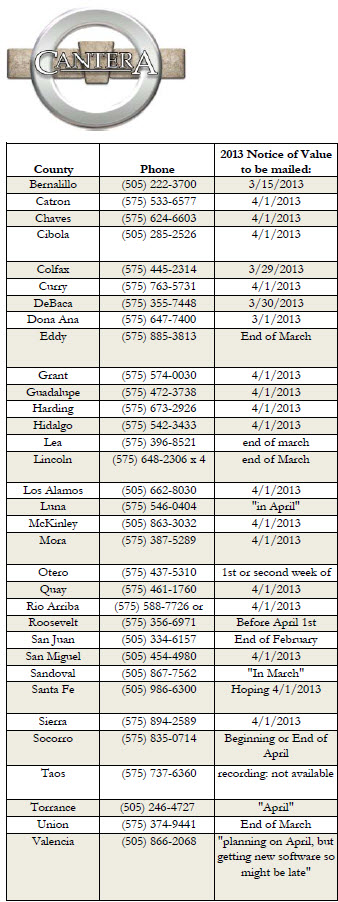

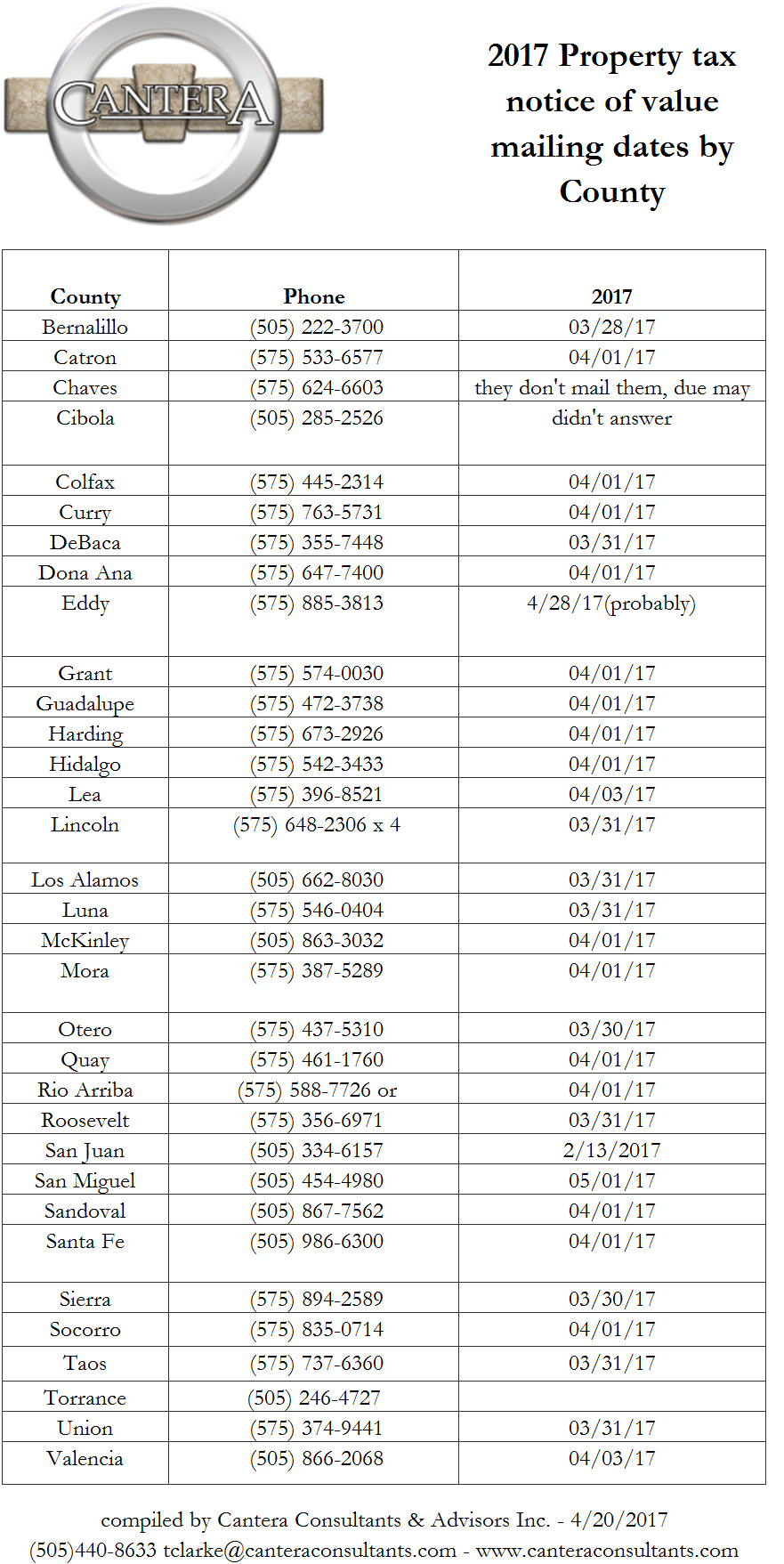

Property Taxes – notice of values update for 2015

Cantera Consulants & Advisors has just updated its notice of value dates from each of the county assessors.

Please remember that you only have 30 days from the date of the notice of value to protest your property taxes.

A PDF version of this table can be found here.

Bernalillo County Property Tax Protest board rules on LLC/refinancing issue at formal hearings

The Apartment Association of NM in the form of Attorney Gene Vance and property tax consultant Todd Clarke, represented apartment portfolio owner, Richard Fox, in the handling of his property tax protest case.

In the case, the property owner held title in a series of related Limited Liability Corporations (LLCs) for estate purposes. He and his wife had refinanced their properties in 2007 and again in 2013. In both cases the lender(s) required the property owner to move the ownership of the property from the LLCs, to his personal name before moving them back to the LLC.

In 2007, this related party transfer did not trigger a removal of the 3% cap on property value increases.

In 2014, the assessors office, based on a legal opinion obtained from the State of NM on a related property tax issues, removed the 3% cap and increased property values.

The formal boards ruling for this landmark case can be found here:

FinalDecision-Order-FoxPortfolio-10202014

The opening narrative for the case is as follows:

Attorney Gene Vance and I are here today not just representing our client, Richard Fox, but also the apartment industry through the Apartment Association of NM who has taken a keen interest the number of their members who have experienced a sharp increase in the property tax from the removal of the 3% Cap. These removals did not occur because the owner of the property sold their property, added on to their property or even rezoned their property. These removals were done solely because the property owner took advantage of historically low interest rates to refinance their property. In a post economic meltdown economy, many of the lenders required these owners to handle these refinances through related entity limited liability corporations or LLCs.

Before we lay out our case, I wanted to share with you a story. When House Bill 366 was approved and passed in 2001 and implemented in 2002, its intent was to protect the elderly widowed single family home owner in Santa Fe who risked losing her property due to a sudden and swift property tax increase caused by out of state, Hollywood moguls, purchasing properties around her.

Now, a dozen years later, our case focuses on a similar individual, our clients, Richard and Linda Fox, who have built up a small nest egg of rental investments over decades of ownership, tending to their residents and keeping their properties in good condition.

As part of their estate planning, to ensure continued uninterrupted management of their properties, and to plan for their future, they created a series of related party LLC’s. The need for this estate planning tool became more obvious when both Richard and Linda suffered from cancer in the last few years. Unfortunately, Linda did not survive, and she passed away earlier this year. Richard, who is in his 70s, and is like the elderly widow this law was created for, has had his protection removed by this assessor’s administration in a manner that is not consistent with previous administrations or other county assessors and in direct conflict with state law and a number of legal precedents.

Today, our evidence will show that Under the New Mexico Limited Liability Company Act, there was no change of ownership from substituting the owner’s name on the deed for that of the company. There was no beneficial interest transferred to a separate entity. Interpreting the law to cover these transactions is contrary to the policy behind the 3 per cent cap.

While we all are aware of the inequities created by the property tax lightning law and various follow-up Band-Aid approaches to fixing these, it is ironic the aged population this law was intended to protect is now being used as a weapon to raise their property taxes.

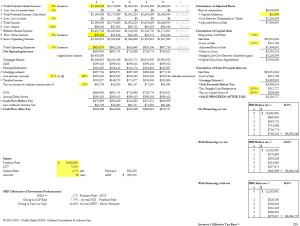

A to Z of investment basics course

To be held at GAAR offices on Thursday, October 2nd, 2014

Spreadsheet tools:

DTC-IRR-Model-v15-comm-blank-Citadelapartments

Tech Fiesta 2014 – ABQ

Come listen to the latest trends in recruiting millennials with housing to our market.

Guest Speakers: Todd Clarke CCIM and Dale Dekker

http://www.techfiestaabq.com/

State of the apartment market – 2014

NMREC mandatory course findings and update

Cantera Consultants and Advisors has just finished its analysis of the NM Real Estate Commissions mandatory course and E&O programs.

The findings and recommendations can be found here –

2-CCA2NMREC-UpdateandFindings-v9-

07202014

Santa Fe Course – 7/18/2014

The following are links and documents from todays presentation.

Complete the 2014 ULI Value / CAP rate survey here

Prezi from today – Ethical use of social networking Prezi-CCA-EthicalUseofSocialMedia-072014

List of iOS apps – click here

Today’s powerpoint presentation can be found by clicking here- SantaFe-Tech-SocialNetworkingWebinar-07182014-v5

CCIM 2013 annual seminar – 97 apps in 90 minutes

Click here for the technology blog

Course: A to Z of Investment Basics – 4 CE hours

If you are feeling a bit rusty on measures of investment performance, the Investment Basics course will provide a sound foundation in the basic tools to analyze income producing real estate.

If you are feeling a bit rusty on measures of investment performance, the Investment Basics course will provide a sound foundation in the basic tools to analyze income producing real estate.

This hands on course includes simple to use spreadsheet tools to help you in analyzing investments using the basic measures of investment performance including:

– GRM

– Cap Rate

– Cash on cash

– IRR

and you will walk away with a sound understanding of the major investment benchmarks and tax benefits of owning real estate.

Both courses are hands on and its strongly encouraged that you bring your excel or numbers based laptop, tablet, smart device, etc.

Example of the financial analysis tool used in this course:

Register for this or any other course at www.canteraconsultants.com/cca2015 .

Additional information about your international award winning instructor can be found at www.toddclarke.com

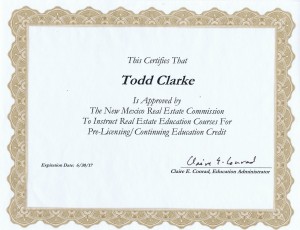

Thanks to the NMREC

Property Tax update – 03/24/2014

The following is a quick update on property tax issues from 2013 and a preview of what we can expect in 2014 and 2015.

2013 protests

As you may recall, I did not expect 2013 to be a year that we would see much in the way of reductions. I did encourage some of my clients to file protests, because we had a new assessor and the top commercial appraiser had moved from Sandoval to Bernalillo. Unfortunately for us, that top commercial appraiser moved back to Bernalillo county mid 2013.

The reductions we were able to get in 2013 were a result of squeezing a bit more from the stone, rather than a new approach or philosophy.

Bernalillo and Sandoval county are aggressively reappraising right now – in fact, you can monitor Bernalillo countys progress here -http://www.bernco.gov/Assessor_Canvass . Remember, they are required to obtain the most accurate and correct information, and its been my experience if you are helpful on the front end (i.e. let them into your building, hold the other end of the measuring tape), they are more inclined to help you when it comes to the revaluation. Residential reappraisals are occurring on a map basis (i.e zone atlas page by zone atlas page)

As it relates to commercial properties, the only major increase I expect for 2014 will be for mini storage, assisted living and banks as they have completed their new valuations for these properties types. I’ve been told that the balance of commercial will show up in the 2015 notices of value.

Legislative update:

Our various trade associations like AANM and RANM were very busy this year tracking bills, responding to our legislators, and pushing back on bills that would have a drastic impact.

House Bill 178 (attached) was probably the most problematic of the bunch as it restored the increase of property taxes at time of sale starting in 2015. (a fuller update on this and other bills can be found below my signature line. Thanks to RANM for the update).

The Apartment Association of NM is working on raising funds and partnering with other associations to have a white paper completed this year that can be used to create new legislation to address the property tax lightning mess in the long 2015 session. Email me if you want more info on this process.

Property tax course

If you have an interest in learning how the property tax system works in NM, I will be teaching an 8 hour course a week from today (March 31st) at the Apartment Association – registration is mandatory (so we know how many books to print and bring and because we have limited seating – you can register at – www.canteraconsultants.com/cca2014 . Those of you in the real estate business should know that the course is approved for 8 CE credits. If you have an interest in learning how the property tax system works in NM, I will be teaching an 8 hour course a week from today (March 31st) at the Apartment Association – registration is mandatory (so we know how many books to print and bring and because we have limited seating – you can register at – http://www.canteraconsultants.com/cca2014 . Those of you in the real estate business should know that the course is approved for 8 CE credits. The course is $99 if you want a electronic (PDF) version of the book and $149 for a printed copy of the 300+ page textbook.

Notices of value for 2014

I will be updating our notices of value spreadsheet (2013 notice of value dates can be found here – http://www.toddclarke.net/?p=1656)

NOTE: The Bernalillo County assessor has sent out a notice to all property tax consultants that they need to update their client authorization signature pages. They have had issues in previous years with consultants “slamming” clients and filing without their approval. What does this mean for you? Just send me your notices of value (as they arrive) and I will send you a new contract for 2014.

While I am not expecting increases this year, I do expect previous properties that we have protested may have corrections in info that may lead to increases.

Thanks,

Todd

RANM update

2014 New Mexico Legislature Update []

From David Oakeley, RANM Government Affairs Director

February 21, 2014

The thirty day New Mexico legislative session is over and RANM was successful in getting three bills passed, two of them sponsored by RANM. House Bill 185 (HB185), the Commercial Real Estate Broker Lien Act and Senate Bill 124 (SB124), the Real Estate Foreign Broker Bill, passed in both the Senate and the House. SB110, the Real Estate Appraisers Act, was another high priority bill supported by RANM, also passed.

The bills will be sent to Governor Susanna Martinez for action.

THE 2014 SESSION

The whirlwind thirty day session had a less contentious feel due in part to a much narrower Democrat majority in the House of Representatives and with upcoming elections, neither side appeared anxious to engage in hostile partisan politics.

Some of the bigger issues were the budget, minimum wage, capital outlay and the Navajo Nation gaming compact. The $6.2 billion budget—dubbed a compromise—passed both Houses with apparent input from the Governor’s office. It includes a minimum 3 percent raise for State employees and teachers. The fear was that the budget battle would derail the session and result in the need for a Special Session.

A bill that would have increased the minimum wage in New Mexico narrowly passed in the Senate but failed in the House. It was the other way around for the Navajo Nation gaming compact that would have opened the door for two more Indian Casinos. The bill narrowly passed in the House but was defeated in the Senate.

HB55, the $232.6 million capital outlay bill, which funds projects throughout the state, also passed. $184.8 million of the projects will be funded with severance tax bonds, the remainder from other state funds.

THE RANM BILLS

One of the RANM-introduced bills that awaits the Governor’s signature—HB185—passed the House and was on the Senate calendar when time ran out. The Real Estate Appraiser Act was signed into law last year but amendments were introduced and passed this year to clear up some of the language.

HB 185, the Commercial Real Estate Broker Lien Act sponsored by Representative Antonio “Moe” Maestas, allows Real Estate Brokers to file a lien against commercial (not residential) property for leasing commissions owed by the owner of property if the property owner had a written agreement with the real estate broker to pay leasing commissions. You can download a copy of the bill by going to this link: http://www.nmlegis.gov/Sessions/14%20Regular/bills/house/HB0185.pdf

The other bill on the Governor’s desk is SB124,which amends the Real Estate Foreign Broker Bill, was introduced by Senator Phil Griego. The act was amended to add a definition of Commercial Real Estate and to allow out-of-state brokers to practice real estate in New Mexico with respect to commercial real estate only, provided they enter into a transaction-specific written agreement with a New Mexico real estate broker. For a full copy of this bill go to:

http://www.nmlegis.gov/Sessions/14%20Regular/bills/senate/SB0124.pdf

SB110 is the Real Estate Appraisers Act sponsored by Sen. Sander Rue, proposes to amend the Real Estate Appraisers Act in order to comply with federal law and to provide for appraisal management companies, trainees, an appraisal subcommittee, uniform standards or professional appraisal practice, automated valuation models, broker price opinions and criminal background checks.

OTHER HIGH PRIORITY RANM BILLS OF INTEREST

A “tax lightning bill” opposed by RANM, HB178 introduced by Representative Brian Egolf, never made it out of committee and died. RANM sent out a “Call to Action” on this piece of legislation. RANM members responded, many contacted their representatives, and it helped narrow the vote. It did narrowly pass in the House, 32-30. RANM considered this bill unconstitutional and deemed the caps on property evaluation would have the opposite effect and negatively impact real estate sales.

Another bill that addressed tax lightning, SB260 introduced by Senator Steven Neville, died in committee. This bill attempted to fix the tax lightning problem with the valuation and taxation of residential property. This bill transitions valuation to a percentage of the “current and correct” standard set in the Property Tax Code.

THE RANM LEGISLATIVE PROCESS

A total of 1,082 bills were introduced this thirty day session—549 in the House of Representatives and 533 in the Senate. Of all these bills only 126 of them survived; a success rate of a little over 11.6 percent.

Each bill usually gets one or more committee referrals, and if the bill survives all committee votes (some never even get a committee vote and thus fail to advance), they then face debate on the floor of the chamber in which they were introduced. If it passes it then goes to the other chamber where the process starts again. If the bill survives the second floor vote without amendment, then and only then, will it get consideration by the Governor who has 20 days after the session adjourns to take action which would be either to sign the bill, veto the bill, or not sign it (called a pocket veto).

RANM’s staff reviewed every bill and made recommendations to RANM’s Legislative Committee as to which pieces of legislation had a direct or indirect impact on the membership. A total of 104 bills—about 10% of those introduced—were so identified. They were categorized (taxes, water, regulatory, economic development, commercial, mortgage/lending, etc.), assigned the level of interest (high, medium, low), and whether they should be supported, opposed or simply monitored.

OTHER BILLS OF INTEREST TO RANM

The bills previously mentioned were high priority bills. Some other bills of interest included:

SB89, introduced by Sen. Peter Wirth, this bill would have affected the Gila River basin in southwest New Mexico, but never made it out of the Senate Conservation Committee. It would have required the Interstate Stream Commission to divert flood waters.

HB51, introduced by Representative Yvette Herrell and passed in both chambers, amends the Right to Farm Act, a pro-agriculture bill, passed both houses. It amends the Right to Farm Act to provide that no agricultural operation may be deemed a nuisance unless it is operated negligently. The New Mexico Department of Agriculture said about this bill, “Across the United States, nuisance law suits are being filed based on the encroachment of urban presence adjacent to agriculture activities. The consequence of nuisance or negligent lawsuits provides the potential to impair the state’s industry and the state’s economy and provides a negative impact on the ability for the industry to operate.”

HB273, introduced by Representative Ken Martinez and Senator Mary Kay Papen, is an economic development bill that passed both house and senate. It Proposes the Economic Development Grant Act, with a stated purpose to provide matching state grants to local and regional economic development agencies to expand their economic development and job-creation capacities through employment of economic development professionals. This bill appropriates $3 million for matching grants.

HJR8, this joint resolution introduced by Representative Jim Trujillo, authorizes the Energy, Minerals and Natural Resources Department to sell surplus property on East De Vargas Street in Santa Fe. The property was formerly used by the State Parks Division for administrative offices.

SM11, introduced by Senator Michael Padilla, (Identical to HM15), requests the United South Broadway Corporation’s Fair Lending Center, a nonprofit community development corporation that provides housing and foreclosure legal defense statewide, to convene a task force to study the foreclosure process and make recommendations to protect neighborhood and community stability, prevent unnecessary or improper foreclosures, and preserve the rights of families.

Albuquerque Hot for Rentals

In in Albuquerque Journal article dated October 8th, 2013, Albuquerque was rated the 3rd best market in the country for rent growth.

ULI now has an App for that

The Urban Land Institute now has an app that lets you read their industry leading magazine on your iOS device.

Click here to see to be taking to iTunes store for the app

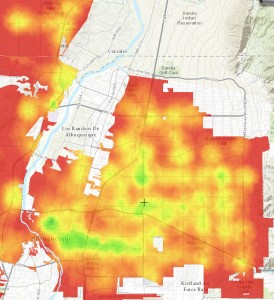

What is your city’s walkability map?

This is Albuquerque’s walkability map – the green areas are the most walkable, the red areas the least (walkable in the sense of close proximity to grocery stores, coffee shops, schools, etc.)

What is your walkscore?

2 great tools to study cities with

This week, the Smithsonian institute released a tool that overlays aerials of major American cities with windows of how they were a hundred years ago. Click here for more.

The second tool comes from Rural Data and it provides quick snapshots and economic overviews of any county in the country. Click here for more info on Bernalillo County.

If some of the results look familiar – they should -they are modeled after BLS.gov ‘s LQ calculator,

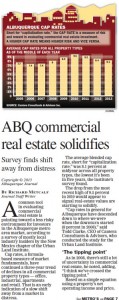

ULI NM – 2013 Commercial Real Estate Value Survey

The NM Chapter of the Urban Land Institute released its 2013 Commercial Real Estate and Value survey last week at the joint Apartment Association of NM and Urban Land Institute Market forum luncheon.

Previous value and cap rate surveys performed by Cantera Consultants & Advisors Inc. can be found here for 2011 and here for 2010.

Read the full article from the ABQ Journal here

Read the full article from the ABQ Journal here

The complete 11 x 17 version of the survey can be found by clicking here.

ABQ Biz 1st – Boomers, Millennials power apartment biz

At the annual Apartment Association market update last week, Todd Clarke discussed the latest generational drivers of apartment demand. View the complete article by clicking here.

DeJa Vu an update to multifamily in CCIM’s Journal

This month’s CCIM magazine has an update article on the multifamily industry.

“In some markets, demand is up and the existing multifamily properties are simply obsolete. “We need to replace our inventory,” says Todd D. Clarke, CCIM, chief operating officer of NM Apartment Advisors in Albuquerque, N.M. “The average apartment was built in 1965, is red brick, pitched roof, master metered, and built furnished — none of which is what the baby boomers and Generation Y are looking for.” Developers are expected to deliver 560 units in Albuquerque this year — up from 158 in 2012, according to Marcus & Millichap.

Generation Y, in particular, is expected to be key to multifamily leasing and development. A significant portion of this 87.3 million-strong population segment will form new households as they leave their parents’ homes during the next two years, Marcus & Millichap notes.”

Attend the next CCIM conference in Denver and see the 2 T’s of technology

Tech guru’s Todd Kuhlman and Todd Clarke will be hosting 60 apps in 60 minutes on 10/26/2013.

The video of the session can be found – here as Todd Kuhlman and I provided info on 97 apps in 90 minutes.

Albuquerque Realtor has connection to Japanese CCIM’s

The Albuquerque Business News covered Todd’s recent class and pinning ceremony for the newly minted CCIM’s in Japan:

Todd Clarke named as commissioner to Albuquerque Housing Authority

Property Tax Update

Spring is almost here, and that means its time to start looking in the mail for our notice of value property tax forms.

First on a macro level – the legislature is 12 days away from completing its 60 day session, and they are working on a couple of bills that could impact property owners.

House Bill 117 – appears to be DOA, and would have allowed a some disclosure to go into place – http://www.toddclarke.net/?p=1651

House Bill 521 – is working its way through various committees and currently has the support of RANM and the county assessors, but is being opposed by Apartment Association of NM which is attempting to make modifications to the bill – http://openstates.org/nm/bills/2013/HB521/documents/NMD00012252/

In it’s current form, HB 521 would not go into effect until 2014.

I recently taught the property tax course for a Santa Fe brokerage firm and they had invited two of the better county appraisers to attend. They were kind enough to share an interesting bit of info that should make tracking our notices of value easier – in 2014, notices of value should have a side by side comparison this years value vs. last years – an example can be found here – http://www.toddclarke.net/?p=1661

Notice of value dates

On a micro level – we have contacted all 33 assessors across the state as to their likely release dates for notices of value. A complete list can be found here – http://www.toddclarke.net/?p=1656 . Please note that their is an update for Bernalillo County (see below).

Changes at Bernalillo County

Although notices of value were prepared to go out earlier this year, Bernalillo County has a new assessor who has requested an extension until May 1st, 2013. For those of us who own commercial properties, their current valuation is in limbo as the commercial team is looking to hire a new commercial manager to provide direction for this years notices of value, all of which has led to a great deal of uncertainty as to what this means for values this year.

Class

If you need Continuing Education (CE) hours, or you think you would like to handle your own cases, we are offering our 8 hour “Understanding NM’s property tax system course” on 4/2/2013. The course is $99 if you use a PDF version of the textbook, or $149 if you need a printed one – seating is limited and registrations can be taken here – http://www.canteraconsultants.com/registration

As always, if you have any questions, please do not hesitate to contact me.

Thanks,

Todd

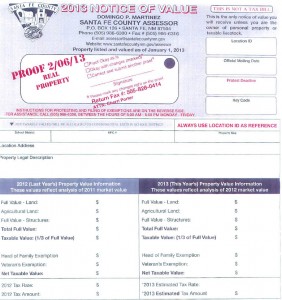

New Notices of value in 2014

Thanks to Gus in the Santa Fe County Assessor’s office for sharing the format of the new notices of value that should be standard in most counties in NM starting in 2014.

The major change is that these new notices of value now show your prior year valuation next to the current year, which allows the property owner to quickly identify an increase in property taxes due to value change.

A sample form can be found here.

SantaFeCounty-NewNoticeofValueForms-for2014-022013

The Santa Fe paper, the New Mexican, has reported this is part of a change in the law.

Notice of value dates for NM County Assessor’s

Our most recent survey of county assesor’s shows that most intend to send out notices of value on or before April 1st, 2013.

If you would like to compare these results with previous year – click here for our PDF version NM-CountyAssesorsNOVDates-2013-01242013 .

New Sim City coming

Although this might seem like a shameless plug for my brother Scott who is a programmer at Maxis working on the new Sim City game, I wanted to share that its an amazing piece of virtual real estate.

The Urban Land Institute recently featured the game in its magazine – the article can be found here.

My kiddos and I were fortunate enough to try a beta, and I’ve got to admit the realism is amazing and the game play is addictive.

Pre-orders are being taken for a March 2013 release date for $59 for Mac or PC.

Cool Shape Shifting Home – your next cabin retreat?

Thanks to Gizmodo.com for finding this amazing shape shifting home.

As the roof rises, your ceiling becomes the heavens!

Now this is the way to view the stars!

The full video can be found here:

Legaslative update – NM Property taxes

Proposed Senate Bill 117 has been introduced (see attached) as a possible solution for property tax lightning.

The following represent my thoughts about this bill:

Currently this part of the state statues reads as follows:

PROPERTY TRANSFERS–COPIES OF DOCUMENTS TO BE FURNISHED TO ASSESSOR–PENALTY FOR VIOLATION

Whenever a deed or real estate contract transferring an interest in real property is received by a county clerk for recording, a copy of the deed or real estate contract shall be

given to the county assessor by the clerk.

A county clerk who willfully fails to comply with this section is guilty of a petty misdemeanor, punishable in accordance with the Criminal Code.

This was later updated for residential properties in 2004 (see bottom of this email for the gist of that change)

Although I would support a disclosure bill for all real estate in NM, this bill doesn’t do that, AND it creates less transparency that we currently have.

It also has a number of issues:

1. It conflicts with the current law for residential disclosure, which in itself has had a number of historical problems and issues (from the assessors and the property owners perspectives). A new bill should address those issues.

2. Limited use bill – for those that thought this bill might create a fairer system of values, it won’t, because it limits the assessors use to creating an summary index of value. My assumption is that the bills author hopes to use this to force the assessors to hit the “reset” button on all values by showing that their total portfolio is less than 85% of market value. That isn’t a bad idea, but it will lead to all values being increased. (removing the 3% cap on residential).

3. Most assessors lack resources (i.e. computer/GIS system) to comply with this bill. That in itself is a whole ‘nother box of pandoras as Former Govenor King would say.

4. Creates information that is not public information (what is the point of transparency if we allow the government to hide information) – this is a major problem as we have cases where the assessors has used an affidavit to support values in a formal hearing, but redacted the relevant information (because its not public), thus denying the property owner their right to correct bad information and the formal board has allowed the evidence to be used to force a higher value. Although I am sure it would never happen, a “lazy” appraiser could create an affidavit that has their target value, redacting everything else and the property owner would be defenseless to challenge that comparable sale.

5. The value language is a problem – I have a large 2012 apartment sale, where an escrow has been set aside for increased property taxes (same owner had the property for 25 years) – the language would require that escrow to be included in the calculation of value, even though it didn’t add value at all, but was rather a self financed insurance policy.

6. If we disclose price, we should also disclose size as that is relevant to value. And Zoning. and Use and Tenant info. and Financing. it takes the entire bundle to create value.

7. The bill lacks teeth for enforcement – what happens if we don’t file the affidavit? current law makes it a misdemeanor and $1,000 fine for each party (seller, buyer, title company). This net will capture the small property owner, but miss the larger institutional owners (as it does now).

8. It lacks verification – the bill should require that the affidavit be notarized as I’ve had several cases where a value affidavit has been presented, and no one has knowledge as to who actually signed it.

9. It creates unnecessary red tape and bureaucracy – what if the parties can’t agree on how to fill it out? Whose obligation is it really?

10. It requires the buyer and seller to agree on the allocation between real and personal property. This might seem like a small issue, but I’ve had buyers and sellers argue over whether 200 refrigerators are part of the real or seperate personal property. Currently, the system allows each party to make its own allocation.

11. Ultimately, what is the goal for this bill? I think if we knew that, we might know how to support them (or not).

Finally, if we decide to support it, I would recommend removing the emergency portion of the language. I have too many multifamily and commercial clients that could be impacted by this and they need to be able to plan for it in 2014, not be surprised as notice of values are being sent out in 2013. Along those lines, I’ve attached our latest survey of county by county and when notices of value are going out so we can see the impact it would have right now.

One more thought – I would run this by the title companies, to see if they would be willing to record deeds based on this (it increases their liability).

I’ve finally come around that transparency is key to a fairer property tax system, and if others are on the same band wagon, we would be better suited to draft our own bill and make sure it prohibits transfer taxes (NM had disclosure until 1970 and it was removed as part of the constitution rewrite to eliminate transfer taxes).

Thats all for today,

Todd Clarke CCIM

After January 1, 2004, New Mexico’s status as a “non-disclosure state” as relates to property sales data changed. Beginning in 2004 any person “presenting a deed, real estate contract,…” for recording with the county clerk is required to also file with the county assessor within thirty days of filing with the county clerk, an affidavit relating to the transfer. It is required that the affidavit contain the following information:

1. The names of the transferors and transferees

2. The current mailing address of both

3. The legal description of the parcel

4. The full consideration paid for the parcel

5. The value and a description of any personal property contained in the sale.

The law states that the assessor shall “…index the affidavits in a manner that permits cross-referencing to other records in the assessor’s office pertaining to the specific property” and “The affidavit and its contents are not part of the valuation record of the assessor”. This indicates, and some county assessors have stated, that the affidavit should not be used to increase the value of the subject property. The correct use of the affidavit then is as verified comparable sales data.

There are a number of exceptions to the requirement to provide the affidavit. In general these are for transfers that don’t represent what we think of as an actual, market conveyance of property. These exceptions include:

1. A deed that results from payment of a real estate contract

2. A lease or easement

3. A deed wherein the grantor is a government entity

4. A quitclaim deed to clear boundary disputes

5. A conveyance executed pursuant to a court order

6. A deed for am unpatented mining claims

7. An instrument solely to provide or release security for a debt

8. An instrument that confirms or corrects a previously recorded deed

9. An instrument between husband and wife or parent and child with only nominal consideration.

10. An instrument arising out of a tax sale

There are several others exceptions along these lines, including the conveyance of a property to a trust with the same ownership. A person who fails to file the affidavit in the required time frame, or who provides false information, is guilty of a misdemeanor and can be fined up to $1,000. As well, any employee, or former employee of the assessor who willfully releases this information is guilty of a misdemeanor and can be fined up to $1,000 per occurrence. An exemption is make for release of data as part of the formal protest process.

What is Residential?

Per the tax code, “residential property” means property consisting of one or more dwellings together with appurtenant structures, the land underlying both the dwellings and the appurtenant structures and a quantity of land reasonably necessary for parking and other uses that facilitate the use of the dwellings and appurtenant structures; as used in this subsection, “dwellings” includes both manufactured homes and other structures when used primarily for permanent human habitation, but the term does not include structures when used primarily for temporary or transient human habitation such as hotels, motels and similar structures;

That is clear for a single-family but what about a 20 unit apartment complex? What about a 200 unit complex?

THANKS TO NAIOP for getting the word out about this bill.

This is the kind of person I want looking after my states finances…

Yesterday’s Wall Street Journal reported that Susan Combs, Treasurer for the State of Texas is pushing for new legislation that would require local governments to add up their total debt obligations and disclose it to their constituents, the tax payer.

GREAT IDEA SUSAN!

Her office has also signed the light on Texas with a “Texas its your money” website that shares a ton of financial information about the states budgets.

New Mexican’s shouldn’t we demand the same?

Recent update on apartment property tax lightning

Both the Albuquerque Journal and  Channel 13 tv news have run recent overviews on the latest on apartment property tax lightning.

Channel 13 tv news have run recent overviews on the latest on apartment property tax lightning.

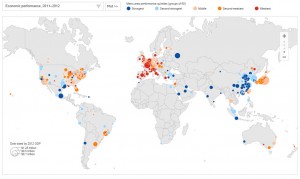

Global competitive indicators

Global Capital Markets> JLL Global Markets

Jones Lang Lassale – https://www.joneslanglasalle.com/Pages/Research.aspx

AND

most of them will be left behind by the top 50 cities in china

Presentations from Oregeon Association of Realtors Commercial Summit

Thanks to the Oregon Association of Realtors for hosting Views from the future of commercial real estate.””

PDFs of the presentations can be found here

Introduction – Todd Clarke CCIM – OAR-Intro-ViewsfromtheFrontier-10222012-v4

Office – Patricia Lynn CCIM NotesfromtheEdge Office-PatriciaLynn6c

Industrial – Sam Foster CCIM ViewsFromTheEdge-Industrial-SamFoster-v04302012-v2dtc

Residential/Multifamily – Todd Clarke CCIM – ViewsFromTheEdge-Residential-ToddClarke-v10252012-v6dtc

Latest and greatest apps – can be found here.

Confessions of a Commercial Real Estate consultant can be found here.

OAR-CCA-ConfessionsofaConsultant-10242012

CCIM Live!

Session on using technology in marketing was well attended – thanks again to the CCIM Institute for doing such a great job!

RANM course – 9/14/2012

This file is for the IRR course at the RANM conference 9/14/2012.

This is the file – filled out for a sample deal – IRR-Model-v12-FilledOutSampleDeal

And this is the file as a blank work sheet DTC-IRR-Model-v12-blank

Full agenda can be found here.

Tech course in Ft. Lauderdale

Thanks to the fine folks at the Greater Ft. Lauderdale Association of Realtors and NAR’s Commercial/RCA for hosting our tech course on 9/11/2012.

A PDF of the courses powerpoint can be found here.

Office of the future – excerpt from 2012 NAR presentation

The following is Todd Clarke’s excerpts from the Office of the future presentation – given first at NAR in 2012, with a Seattle update in 2013

MFA Keynote presentation

NMMFA-HousingSummit-ResidentialUpdate-08222012-v2NMMFA’s keynote presentation for August 22nd, 2012 (4.5 meg PDF) “Matching Global Trends with Local Values”.