As major retailers like CompUsa, Mervyn’s, Linens and Things, Circuit City, fold one after another, leaving vacant spaces in major malls across the country, occupancy rates continue a downward trend, which eventually leads to decreasing rents and values.

Real Estate investors with the most leverage (i.e. the least amount of their own money), will be the hardest hit, but even lower leverage institutions are taking a hammering in their overall valuations.

What’s going on?

It has to do more with the capital markets than the dynamics of the real estate economy. According to a recent Wall Street Journal article, over $530 Billion dollars of loans are coming due in the next 3 years, including $160 Billion in 2009. Real Estate investors that counted on excess liquidity (or even some liquidity) in the marketplace, are now seeing their valuations hammered as the stock market’s perception is that many of these companies will be unwilling to renew their financing.

Some of this country’s largest owners, are

Real Estate Investment Trusts, or REIT’s are a special type of corporation (that is not double taxed) which allows passive investors to hedge their risk by investing in a large number of markets around the country (thus avoiding having all of their eggs stuck in one city).

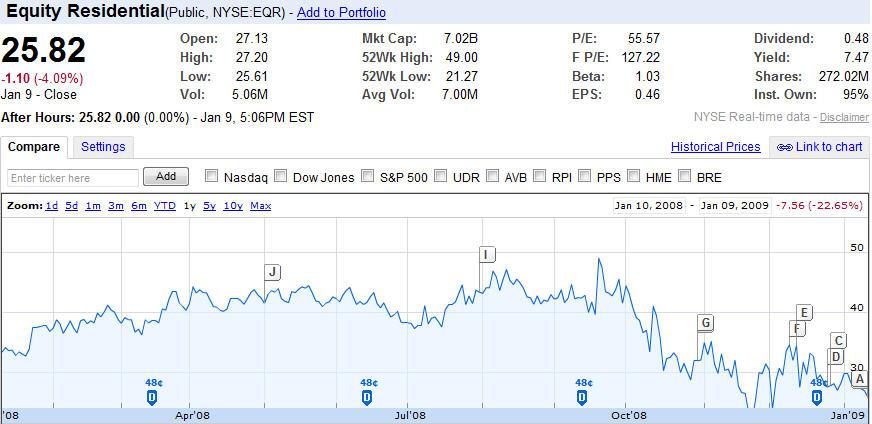

As an indication of where Wall Street pessimism in the marketplace, take a look at the stock value of some of the largest and most well known REITS:

A Co-Star article indicates that REIT’s values have seen decreases of more than 40% and that many of them are likely to run into a liquidity crisis.

It certainly is an interesting time to be in the business – the recent meltdown of the subprime crisis had led to a crisis of trust between lender’s – so much so that the SEC was recently quoted as saying

“The trust and confidence that counterparties require in one another in order to lend, trade, or engage in similar risk-based transactions evaporated to varying degrees for each firm very quickly. What would have been more than sufficient in previous stressful periods was insufficient in more extreme times.”

From a bystander’s viewpoint, it has been interesting to witness the country’s politicians mickey mouse with the free market, then run from the issues, then hold hearings to find blame, and now they believe they can solve it?

Unfortunately, they’ve avoided discussing the root causes of the capital crisis – public policy initiatives to get every American into a home (whether they could afford it or not), government interference in the free market by offering home ownership preferential tax treatment, and a lack of oversight when Wall Street started going bezerk creating complex financial instruments that neither them, the rating agencies, the buyers or the sellers understood.

The original plan for Troubled Assets Relief Program T.A.R.P was to allow lender’s to clear their slate clean of these bad debts, thus opening the market for future financing.

And guess what?

We still don’t understand them, and until we do, no one knows who has the hot potatoes (the bad debts), and until due-diligence is done to uncover those assets, those same lender’s don’t know what to convey to T.A.R.P. and their assets remain frozen as there isn’t market to buy and convey what you can’t quantify.

Unfortunately, the market doesn’t wait for solutions, it just keeps rolling, and its rolling off the precipice if the real estate investors and developers can’t renew their loans on existing, performing, assets.

Right now, solutions are most likely to come from the following arenas:

1. The capital markets start to thaw and we see financing return to the marketplace

2. a seperate financing vehicle is created, possibly under the T.A.R.P. program

3. Lender’s convert their debt positions into equity (which would require government approval).

4. The property owners start to liquidate other holdings (Prologis just announced a large sale of their Asian holdings

Until then? Look for continue decreases in real estate equity and the possibility that the canary may die, before one of these solutions are expedited.